This article will try to shed light on the popular WAAAX stocks including tech players namely WiseTech (ASX: WTC), Appen (ASX: APX), Altium (ASX: ALU), Afterpay Touch (ASX: APT), and Xero (ASX: XRO).

According to media reports, the median PE of the high growth firms in Australia is the highest in any market in the world. It means that high growth firms in the country are relatively expensive as compared to such firms in other jurisdictions.

In the short-term, the markets are often priced on sentiments & emotions rather than fundamentals. Long-term investors have an appetite to remain patient and unemotional amid short-term disruptions in the market.

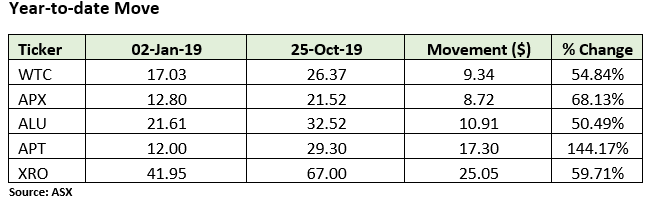

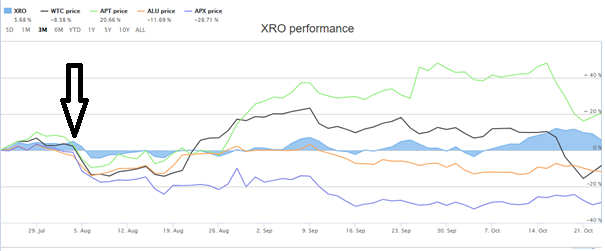

All the above stocks have delivered a return of over 50% on a year-to-date basis. However, these stocks get beaten up amid a wider sell-off in the market, as seen during August 2019 (below figure).

Source: ASX

Moreover, on a three-month period to 24 October 2019, the return of most of the WAAAX stocks has been in the red territory, excluding Xero & Afterpay.

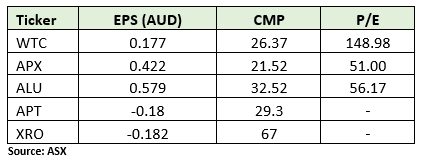

On 25 October 2019, WTC last traded at a price more than ~149 times of its annual earnings, representing the expensiveness of the stock. Whereas, APX & ALU were valued at less than half of the WTC. APT & XRO have not depicted profitability, according to latest numbers available at ASX.

WiseTech Global Limited (ASX: WTC)

WTC has been under pressure since the accusations made by a short activist â J Capital Research. The short activist also launched a second attack, following the denial of accusations made in the initial report by the company.

In the initial report, the accusations included overstating profit and the acquisition made by the company. J Capital said that the company has been fabricating its revenue growth, since its public market debut, highlighting the increase in net profits to $54.1 million in FY 2019 from $4.6 million in FY 2016.

In response to the initial report, the company said there had been no manipulation to profits, revenue growth, and the accounting numbers were never overstated through acquisition accounting.

Further, the company said that the revenue derived from CargoWise is almost fully-recurring with monthly invoicing. The EMEA (Europe Middle East & Africa) revenue is dependent on the invoicing location of the customer, which was adopted in FY 2019 as the companyâs billing model.

In the second report, the short activist criticised the companyâs acquisitions of similar software companies. It was also said that the company overpaid for some transactions. In addition, the company was also accused of falling revenue, customer attrition, organic growth, and unsatisfied customers.

In response to the second report, the company provided the number of organisations using its software and said customer attrition in FY2019 was less 1%. It was said that the companyâs commercial model helps to drive the transaction & revenue growth. Moreover, the company rejected key claims contained in the report by J Capital.

Appen Limited (ASX: APX)

The stock was quoting around $31 in July this year. In the past five days, the stock was trading inside $21-23 range. Previously, the prominent brokerages in the country have upgraded the stock to buy, following the heavy sell-off in August, according to sources.

Consolidated Financials

In the half-year ended 30 June 2019, the company had posted a revenue of $244.8 million, an increase from $152.74 million in the previous corresponding period. Profit after income tax expense was $18.6 million compared to $14.03 million in the previous corresponding period.

Outlook & Integration

In its outlook, the company said that it is stemming its footprint in the high growth markets through investments in technology, sales & marketing, government markets and China.

Further, the integration of Leapforce was completed, and efficiency savings of $6 million were expected in 2019, contributing to margin expansion. It was said that the company conducted a deep review and redesigning all operational processes.

In addition, the full-scale integration of Figure Eight would start by the new year 2020, and Figure Eight is operating like previously in 2019. The companyâs management is focusing on sales and technology acceleration.

Altium Limited (ASX: ALU)

Recently, the company reported on extending its line-up with the addition of the newest version of Altium Designer. It has been reported that the company launched its new product at the Altium Live Conference on October 9th.

Further, the new product â Altium Designer 20 provides better user experience, world-class PCB design capabilities, and upgraded to a unified design environment. More importantly, the upgrades included over 200 users suggested upgrades.

Consolidated Financials

In the full-year ended 30 June 2019, the revenues from ordinary activities were $172.75 million, depicting an increase of 23% from $140.37 million in the previous corresponding period. Further, the profit after income tax was $52.9 million, increasing 41.1% over the previous year from $37.48 million.

Outlook

Reportedly, the company intends to become the leader in the PCB design software market leader. It has a target to achieve $200 million in revenue by 2020, and a commitment to achieve a dominant market position with 100k subscribers by 2025.

Afterpay Touch Group Limited (ASX: APT)

Recently, the company responded to media commentary that highlighted the development related to regulatory oversight by the Reserve Bank of Australiaâs 2020 review of payment regulations.

According to the release, presently, APT is not subject to an enquiry or review process, and it intends to be involved with RBA in a wider periodic review of the payments systems industry next year.

Commenting on the status quo of the Australian payments system, it was said that the company believes that legislative change would be required to cover the âBuy Now Pay Later (BNPL)â sector in the payment system regulation.

It was highlighted that the BNPL accounts for below 2% of all transactions in the economy, while over 40% transactions are credit based. BNPL sector has multiple players, offering a range of services, leading to a competitive market.

The company also shed light on the surcharging fees wherein it was said that Australia is one of the few OECD countries, having permission for surcharge fees, subject to regulation. However, the surcharging fees are negatively perceived by the customers, and very few organisations choose to do so.

Xero Limited (ASX: XRO)

In August 2019, the company held its 2019 Annual Meeting. The chairman said that the company had delivered an impressive set of results for the period ended 31 March 2019. The business achieved excellent progress in financial & strategic objectives and continued expanding the services to small businesses and partner across the world.

In the year, the company delivered its first free cash flow, improving financial and operating metrics, while emphasising investment in growth. The company completed USD 300 million convertible note issue, allowing the company for financial flexibility, extension of platform, and acquisitions.

Further, the CEO said that Annualised Monthly Recurring Revenue (AMRR) grew by 32% to $638 million, depicting an increase of $154 million in AMRR over the prior year. The company added 432k subscribers in FY 2019, resulting in overall subscriber numbers to over 1.8 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.