On 15 August 2019, the S&P/ASX 200 Health Care Index is down 2.48% to 34,883, while the benchmark index S&P/ASX 200 was down by 2.65% and trading at 6,425.5 (as at AEST: 2:08 PM). In this article, we will discuss four stocks that are directly and indirectly serving the health care industry and are listed and traded on the Australian Securities Exchange. Let us look at their recent updates and stock performances.

Regeneus Ltd

A regenerative medicine provider, Regeneus Ltd (ASX: RGS) is headquartered in New South Wales, Australia. The company focuses on treatment for diseases like osteoarthritis and musculoskeletal disorders, in addition to the areas of oncology and dermatology. The company uses stem cell technologies to develop a portfolio of novel cell-based therapies. RGS was established in 2007 and got listed on ASX in 2013.

Completion of Operations Restructuring:

In a press release dated 13 August 2019, the company unveiled the completion of restructuring and implementation of a range of cost-saving initiatives, which resulted in a 50% reduction in recurring operating costs to $ 250,000 each month. As reported, the initiatives ensure that the companyâs operations are in line with its revised strategy, aimed at the development of therapies for the global pain market.

In order to support the ongoing R&D of Progenza and Sygenus technologies via a model that is cost effective, the company plans to use its collaborations with leading universities and contract research organisations for the development and commercialisation of additional therapies, designed to address several indications in pain.

Revised Booklet Despatched:

On the same date, RGS also updated the market regrading the despatch of an offer booklet and personalised entitlement and acceptance form, concerning the pro-rata non-renounceable entitlement offer to all eligible shareholders (registered address in Australia or New Zealand).

The company intends to raise approximately $ 3.2 million (before costs) by offering approximately 39,689,190 new fully paid ordinary shares in the company based on 1 new share for each 6 existing shares held by eligible shareholders. The shares would be issued at a price of $ 0.08 per new share. The record date is 8 August 2019, while the offer opens on 13 August 2019 and closes on 27 August 2019.

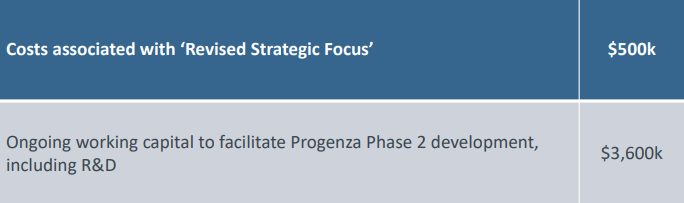

Proceeds from the offer would be directed towards costs related to the companyâs revised strategic focus, in addition to working capital purposes.

Source: Companyâs Report

Source: Companyâs Report

Stock Information:

On 15 August 2019, RGS was trading at $ 0.086, with a market capitalisation of $ 20.48 million and approximately 238.14 million outstanding shares. The stock has corrected by 12.01 % and 34.82% during the last three and six months, respectively. The stock made a 52-week high of $ 0.230 (as at AEST: 1:50 PM).

Bionomics Limited

Integrated clinical stage biopharmaceutical company, Bionomics Limited (ASX: BNO) is focused on the development of several drug candidates. BNO has created proprietary technology platforms for each step in the drug discovery and development process. The company is based in Australia with headquarters in Thebarton.

Quarterly Cash Flow Report:

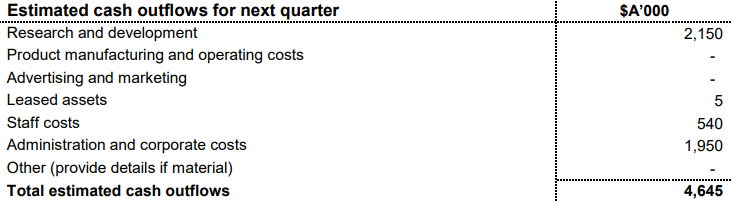

On 31 July 2019, BNO announced its quarterly cash flow statement as on 30 June 2019. As per the release, cash balance of BNO was $ 13.98 million at the end of the June quarter against $ 22.1 million on 31 March 2019. Net operating cash outflow of the company reached $ 6.18 million for the quarter ended 30 June 2019. Total cash receipts during the quarter came at $ 1.92 million against $ 1.94 million as on 31 March 2019. Research & development costs increased by 33% on a q-o-q basis. The management stated surge in R&D was due to the completion of the BNC210 clinical trial. The drug is being tested for the treatment of agitation. For the next quarter, the company expects cash outflows worth $ 4.65 million.

Source: Companyâs Report

Source: Companyâs Report

The company also unveiled upcoming milestones such as:

- Results of the companyâs solid dose formulation pharmacokinetic study are expected to arrive in early fourth quarter of 2019. During the same period, the company expects feedback from its Type C meeting with the FDA.

- The company is focusing on CNS programs and have strict R&D budget allocation. Bionomics continues limited activities to enhance the value of its legacy oncology programs through divestment and licensing both BNC101 and BNC105.

Stock Information:

BNO last traded on 14 Aug 2019 at $ 0.038. BNO has a market capitalisation of $ 20.7 million and approximately 544.69 million outstanding shares. The stock has slumped by 69.60% and 66.96% in the last three months and six months, respectively.

FarmaForce

FarmaForce (ASX:FFC) is a contract sales company, engaged in providing salesforce solutions to the pharmaceutical industry in Australia. Moreover, the company offers access to nurse teams and pharmacy merchandising teams in addition to solutions related to digital detailing. The headquarters of the company is situated in Sydney. It is engaged in promoting the products of clients to their customers like healthcare professionals, general practitioners, specialists and pharmacists.

Q4 FY19 Cash Flow Report:

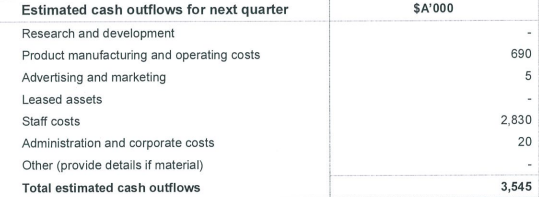

On 31 July 2019, FFC posted its cash flow report for the quarter ended 30 June 2019 via a press release. In FY19, the company reported a 48% y-o-y increase in customer receipts to $12,005k. Operating cash flow during Q4 FY19 stood at $ 637k. The company employed new staff during the quarter, resulting in an increase in costs compared to the previous quarter. As a result, cash balance stood at $ 173k at the end of the quarter, a decline of $ 675k compared to Q3 FY19. The company reported, accounts receivable of $ 806k was due on Q4 and are yet to be realised. As of June 2019, the company has an interest-free loan of $ 2000k, of which $ 806k has been utilised. The company would not be requiring further working capital assistance in the coming quarter. It expects cash outflows of $ 3.545 million in the quarter ending September 2019.

Source: Companyâs Report

On 22 July 2019, FFC announced a change of auditor. As per ASX Listing Rule 3.16.3, FarmaForce has replaced RSM Australia Partners, its previous auditor, with BDO East Coast Partnership (âBDOâ), with effective from 18 July 2019.

Stock Information:

On 15th August 2019, at 2.00 pm AEST, the stock price of FFC was quoting at $0.130 no change from its previous close. The company has a market capitalisation of $16.61 million and is available at a P/E multiple of 12.150x. The stock has given positive returns of 44.44% and 34.02% in last 6 months and 12 months, respectively.

Immuron Limited

Biopharmaceutical company, Immuron Limited (ASX: IMC), which is registered in Australia, is focused on the development and marketing oral immunotherapeutics. Its products are targeted towards gut mediated diseases. The companyâ medicine for diarrhea, Travelan® is listed with the Australian Register of Therapeutic Goods. Additionally, the drug helps in lowering the risk of minor disorders related to gastrointestinal.

Topline Results of Severe Alcoholic Hepatitis Clinical Trial:

A clinical trial to evaluate the safety and efficacy of IMM-124E was conducted by the TREAT Consortium, from which the company announced topline results on 8 August 2019. The study, which was carried out at three clinical sites across the United States, was aided by a UO1 grant from the e National Institute of Alcohol Abuse and Alcoholism.

As per the result, IMM-124E is safe to consume and can be used against severe alcoholic hepatitis disease. However, it does not help in lowering the levels of circulating lipopolysaccharide.

On 16 July 2019, Immuron unveiled its FY19 sales figures for the North American region, highlighting a 52% increase in revenue to $ 1.16 million. The results were related to commercially available products, including Travelan®, in addition to OTC gastrointestinal and digestive health supplement. Global sales of the company for the period were at $ 2.6 million, up by 29% y-o-y.

Stock Information:

At the current market price of $0.115, down by 8% from its previous day close. The market capitalisation for the stock stands at $22.1 million. The stock is currently trading towards its 52-week low of $0.100 and has declined ~63.77% and ~55.36% in last 1-year and 6 months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.