Australian biopharmaceutical company,Immuron Limited (ASX:IMC), headquartered in Carlton, is engaged in developing and commercialising orally delivered targeted polyclonal antibodies for the treatment of inflammatory mediated and infectious diseases.

Immuron has a novel, safe and validated proprietary platform, Oral Immune Technology Platformwith one flagship commercial product, Travelan®, currently generating revenue.

The Technology Platform develops and produces an orally stable therapeutic(antibodies)as a potential âoral targeted therapyâ for a wide range of immune mediated and infectious diseases as well as chronic diseases like inflammatory bowel diseases (IBD), non-alcoholic steatohepatitis (NASH) diabetes, irritable bowel syndrome (IBS), colitis andliver fibrosis.

The addressable market reflects a growing and unmet medical need, where oral targeted therapy drugs could benefit owing to the lack of absorption and the high safety profile.

Travelan® is a non-absorbable, safe product,which comprises of anti-bacterial antibodies that work on the gut immune system and gut microbiome. The product designed to prevent travellersâ diarrheais a listed medicine on the Australian Register for Therapeutic Goods and a licenced natural health product in Canada. Moreover, the product is available as a dietary supplement in the United States for digestive tract protection.

In early June 2019, the company updated the stakeholders that the US Department of Defense (US DoD)had reported final results from Travelan® Shigellosis Challenge Study in non-human primates.

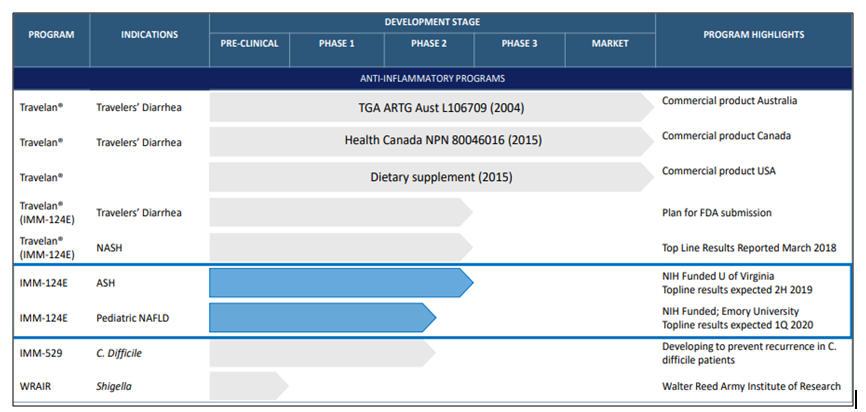

Product Pipeline

In addition to the current offerings, Immuron has a pipeline of products that are either under different stages of clinical trials or at early phase of development.

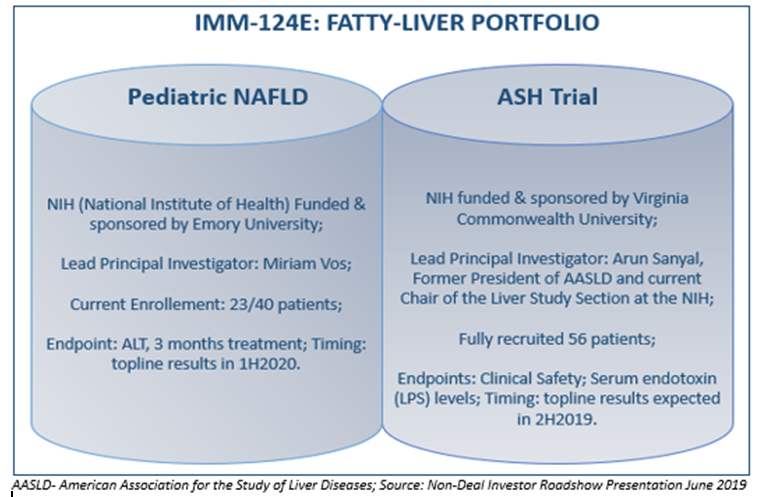

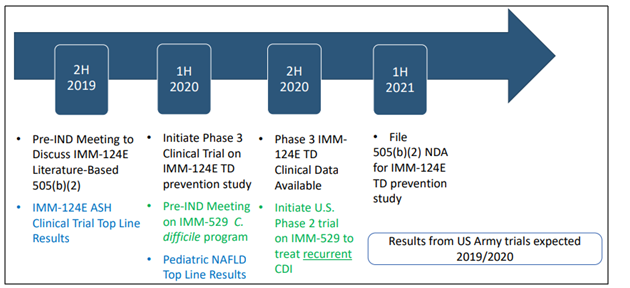

Thelead clinical drug candidate, IMM-124E is presentlyundergoingsecond phase trials for paediatric non-alcoholic fatty liver disease (NAFLD) and severe alcoholic hepatitis (SAH).

The company recently announced plans to accelerate the clinical development of IMM-124E as a drug to prevent travelersâ diarrhea via a formal registration with the Food and Drug Administration (FDA) in the US.

The second in line fordevelopment is IMM-529, designed to treat Clostridium difficile infections (CDI). The clinical asset is undera clinical trial with CDI patients. Immuron intends to apply for an Investigational New Drug application with the US FDA to advance its development further, especially for the recurrent CDI patients.

The companyâs commercial and product development pipeline is briefed as below.

Source: Non-Deal Investor Roadshow Presentation June 2019

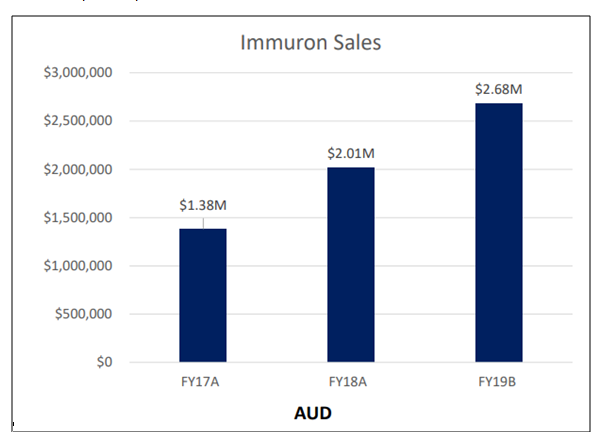

Sales Growth

Recently on 16 July 2019, Immuron disclosed its sales results for the financial year ended 30 June 2019 (FY19) for its commercially available products, including Travelan®, the over-the-counter gastrointestinal and digestive health supplement.

Immuronâsglobalrevenue touched a record-breaking AUD 2.68 million (unaudited), expanding by a robust 29% year-on-year in FY19.

Source: Corporate Presentation

North America- According to the figures posted, Travelan® sales delivered a stellar performance in North America in FY19, as the revenue climbed up by 52% and reached an impressive AUD 1.16 million (unaudited).

In the United States,Travelan® FY19 revenue crossed the $ 1 million milestone for the first time, as sales grew strongly year-on-year by 32% to AUD 1.02 million (unaudited). The upswing in sales may be partly credited to the consistent sales growth of 37% in the Passport Health Travel Clinic network (270 branches in the US).

Moreover, during FY19, Immuron also got aired on two podcasts on the US-based âNot Old, Betterâ channel. Of these, one was an interview with Dr Hailey Weertzfrom the US DoD, where she commented on the ground-breaking research conducted by the Walter Reed Army Institute of Research (WRAIR) for Travelan®. Both podcasts triggered an immediate upsurge in sales of Travelan® on Amazonby ~80% through the year.

May 2019, in particular, proved to be a historic month for US Travelan® sales revenue that climbed up to AUD 182K (unaudited).

Also, in Q3 FY19, Travelan® was launched into the Canadian market and subsequently generated sales of over AUD 100K in Q4 FY19, marking a decent start. Shoppers Drug Mart, a major Canadian pharmacy chain, was the first banner to range the product.

Australia - In Australia, FY19 total sales before rebates were recorded at AUD 1.44 million, demonstrating continued growth and a 15% increase year-on-year. The sales momentum improved on the back of enhanced initiatives in the pharmacy sector such as stronger merchandising in-store and TV advertising with Chemist Warehouse.

Way Ahead

Going into the new fiscal year 2020, Immuron aims to further ramp-up initiatives in the very important geographic area of North America. These would include the expansion of distribution channels and stimulating consumer demand via pull-through marketing campaigns and other sorts of advertising.

Moving forward, some of the key milestones expected to drive value for the company are-

Source: Non-Deal Investor Roadshow Presentation June 2019

Underwritten Public Offer

On 17 July 2019, Immuron announced its intent to offer and sell 339,130 American Depositary Shares (ADSs) in a fully Underwritten Public Offering. Each ADS represents 40 fully paid ordinary shares of Immuron at a price of USD 4.00 per ADS. Besides, the underwriter has an option of forty-five days to acquire further 50,869 ADSs for covering overallotments in connection, if any.

ThinkEquity, a division of Fordham Financial Management, Inc., will act as the underwritersâ representative in the offering, whichwas scheduled to close, subject to closing conditions, on 19 July 2019.

The company intends to issue the securities under its 10% capacity under Listing Rule 7.1A with a fee of up to 6% is payable to the underwriter.

The estimated gross proceeds to the company, from the proposed offering, are expected to be approximately USD 1,356,520 prior to deducting underwriting discounts, commissions and other estimated offering expenses. These proceeds are intended to be directed towards funding the expenses related to the clinical development of its drug candidates and alsoas working capital.

Stock Performance

Immuron has a market capitalisation of around AUD 22.85 million and approximately 163.22 million outstandingshares. On 19 July 2019, the IMC stock last traded at AUD 0.130 with ~ 186,907 shares traded.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)