Healthcare

Healthcare sector comprises of the companies that offer medical services, producing medical equipment or medicines. These companies also give medical insurance to the patients.

In Australia, the funding of healthcare is taken care of by the Australian government, state and territory government, private sectors as well as NGOs. The Australian government fund the major part of expenditure via Medicare (accessible to the Aussies along with the permanent residents) and other programs.

Australian healthcare sectorâs progress is mostly propelled by its elderly populace. The other driving factors are rise in the chronic and degenerative diseases and variations in the lifestyle. These elements in turn, also give rise to the growing demand for better and innovative technologies which would help in improving the health care facility in Australian region.

In this piece of article, we would be looking at the four different health care stocks and highlight their recent updates.

AdAlta Limited

About the Company

AdAlta Limited (ASX: 1AD) is an innovative biotechnology company from the healthcare sector, focusing on utilizing its proprietary technology platform for generating i-bodies, which is a new class of protein therapeutics for the treatment of disease.

Recent Update/s

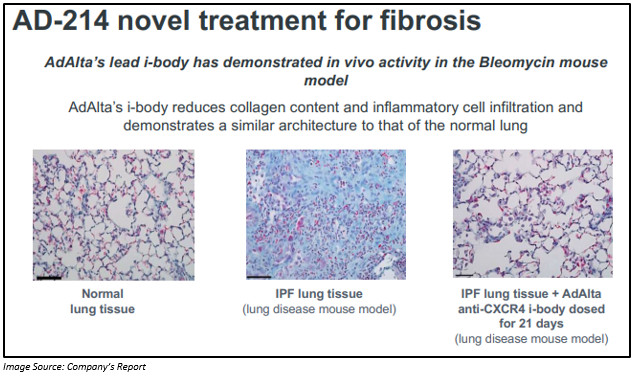

On 16 July 2019, AdAlta announced that it had started its key toxicology study with AD-214. This study is the last step before starting the human clinical trial for AD-214, developed for treating- Idiopathic Pulmonary Fibrosis.

The company started its four-week non-human primate study in order to assess the safety as well as toxicology of AD-214, which got concluded under Good Laboratory Practice (GLP) conditions. The data from this toxicology study is anticipated to arrive in the 2H 2019 and would inform the dosing regimen as well as safety details for the human clinical trial of the company. This result would also lead to IND (investigational new drug) submission to the US FDA. It would also be a matter of interest in potential partners assessing AD-214.

The four-week non-human primate study has been commenced by utilising the AD-214 materials based on a recently finalised demonstration run. The company would be concentrating on delivering material produced under Good Manufacturing Practice (GMP) situations, which are required for its phase 1 human study. Also, the study is expected to begin in January 2020.

Stock Performance:

In the previous six months, the 1AD stock has generated a negative return of 26.56%. The opening price of the shares of 1AD on 17 July 2019 was A$0.175. The shares of 1AD closed at A$0.175 (as on 17 July 2019), up by 6.061% as compared to its previous closing price. 1AD has a market cap of ~ A$27.93 million and ~ 164.3 million outstanding shares. Around 247,901 shares of 1AD have traded on ASX.

Immuron Limited

About the Company

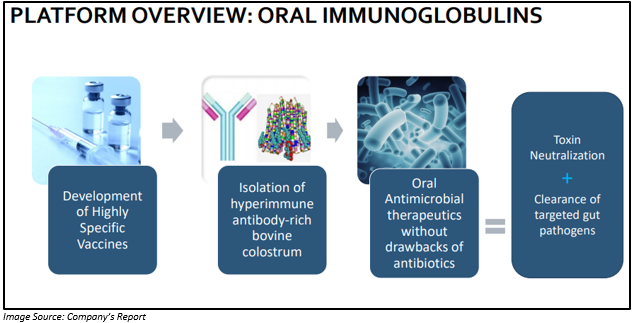

Immuron Limited (ASX: IMC) is a biopharmaceutical company from the healthcare sector. It focuses on developing as well as commercializing orally delivered targeted polyclonal antibodies that are used for the purpose of treating inflammatory mediated as well as contagious diseases.

Recent Update/s

On 17 July 2019, the company notified the pricing of 339,130 ADSs (American Depositary Shares) of an underwritten public offering. An individual ADS would be offered at a price of US$4.00. It was further mentioned that one ADS is equivalent to 40 ordinary shares of the company. Also, IMC has granted the underwriter a 45 days option to buy further 50,869 American Depositary Shares. The company anticipates the offering to be closed by 19 July 2019 conditional upon customary conditions.

The estimated gross proceeds to the IMC are anticipated to be around US$1,356,520 before subtracting discounts of underwriting, commissions as well as other anticipated offering expenditures.

The funds raised through the proposed offering would support the company for meeting the expenses related to the clinical development of its clinical candidates as well as fulfilling working capital requirements. Also, ThinkEquity, would represent the underwriters during the offering.

Besides, the company released an announcement related to the trading halt of its securities. The shares of the company would be on trading halt pending a release on the capital raise before the trading on ASX begin on Friday, 19 July 2019.

IMC also notified that it would be a participant in an investor webinar and Q&A session, taking place on 18 July 2019, at 10: 30 AM EST (US time), which is being held by RedChip Companies.

On 16 July 2019, the company announced its sales results for the FY2019 period which ended on 30 June 2019 for its commercially available products.

In North America, the revenue during FY2019 period noted an increase of 52% and reached to $1.16 million. In the US, the sales of Travelan® surpassed the A$1 million and rose by more than 32% to A$1.02 million as compared to the previous corresponding period (pcp). In the month of May 2019, the company made a record USA Travelan® sales worth A$182,000. Besides, the international sales for Immuron in the FY2019 period increased by more than 29% on pcp to A$2.6 million.

Stock Performance

In the previous six months, the IMC stock has generated a negative return of 59.26%. As on 17 July 2019, the shares of IMC are on a trading halt. The shares of the company traded last on 12 July 2019 at a price of A$0.110. IMC has a market cap of A$17.95 million and approximately 163.22 million outstanding shares.

Neuren Pharmaceuticals Limited

About the Company

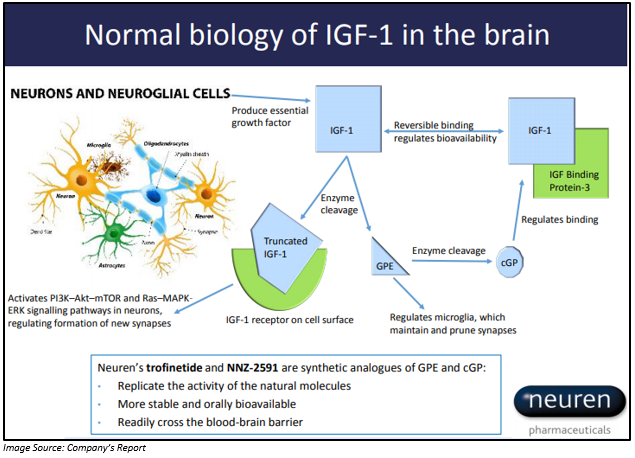

Neuren Pharmaceuticals Limited (ASX: NEU) is a biopharmaceutical company which is into the business of developing new therapies for patients with neurodevelopmental disorders. The companyâs strategy lays emphasis on product development opportunities. Its main product trofinetide is licensed to ACADIA Pharmaceuticals for North America and has completed Phase 2 development for Rett symptoms and has now entered into the Phase 2 development for Fragile X symptoms.

Recent Update/s

On 16 July 2019, the company announced that it received final payment from Lanstead Capital. With this, the Sharing Agreement signed between Neuren and Lanstead Capital as a part of Neurenâs capital raise in June 2017 has now come to an end. Previously, on 29 June 2017, NEU had notified that it had received funding, which would allow it to begin a few important activities related to Phase 3 trial in Rett syndrome. As notified by the company on 16 July 2019, the aggregate amount received from Lanstead Capital for the entire course of the funding arrangement stood at $12.2 million, which is in excess of the original commitment of $10 million.

Stock Performance:

In the previous six months, the NEU stocks have generated a negative return of 4.41%. The opening price of the shares of NEU on 17 July 2019 was A$1.425. The shares of NEU, last traded at A$1.33, (as on 17 July 2019), down by 6.993% as compared to its previous closing price. NEU has a market cap of ~ A$ 144.76 million and ~ 102.67 million outstanding shares. Around 134,788 shares of NEU have traded on ASX.

Stemcell United Limited

About the Company

Stemcell United Limited (ASX: SCU) is a biotechnology company belonging to the healthcare sector. The company focuses on growth, reproduction, culture as well as extraction of stem cells that are used for medicinal, health and beauty applications using its proprietary technology.

Recent Update/s

On 15 July 2019, the company announced that it has entered into a memorandum of understanding (MOU) with the University of Malaya, Malaysia (UM) on establishing collaborative research.

Under the MOU, both the parties would support in sharing the knowledge and expertise via the exchange of student, academic as well as administrative staff. They would also be organizing joint research tasks. MOU also allows both the parties to exchange publications, reports and other academic materials along with the information and sharing of other activities. MOU would further enable sharing of other activities and programmes in the regions of the joint benefit. The University of Malaya is one of the oldest and highest-ranking institutes of higher education in Malaysia.

On 2 July 2019, the company announced the appointment of a new advisor, Mr Theng Dar Teng who would be advising the company on matters that are related to business development in the Asia Pacific as well as Middle East regions.

Stock Performance

In the previous six months, the SCU stocks have generated a negative return of 26.09%. The shares of the company traded last on 11 July 2019 at a price of A$0.017. SCU has a market cap of A$10.91 million and approximately 641.61 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.