Australia is counted amongst one of the healthiest economies in the world. Over the last 40 years, the government undertook several initiatives aimed towards transforming the country into a global export-leader and high-tech steamroller. As a result, the economy is characterised by higher growth rates of GDP, averaging over 3 per cent compared with the average of 2.5 per cent of gross domestic product growth rates of OEDC during 1992-2007.

The Australian Stock Exchange is also ranked amongst the leading financial markets across the globe, with a total capitalisation value of around A$2 trillion.

Benefits of Investing in Australia

- Political Stability - Australia is considered to have stable politics and economy, with the government providing its support through corporate tax benefits, free trade agreements and support reforms in the labour market, thereby making Australia an attractive and dynamic destination for investors.

- Strong Corporate Governance - Australia is believed to have robust legal frameworks, targeted towards ensuring effective legalisation and intellectual property protection.

- Mineral Rich Nation â Australia boasts the strong presence of iron ore, gold, coal and other minerals. The abundance of resources makes the country an attractive investment hub for investors.

On 8 October 2019, the benchmark index S&P/ASX 200 closed the dayâs trading at 6,593.4, up 0.45 per cent from its previous close, while S&P/ASX 200 Consumer Discretionary (Sector) traded upward by 0.95 per cent to settle at 2,611.6 and S&P/ASX 200 Communication Services (Sector) inched up by 0.06 per cent to close at 1,247.4.

Below discussed are two stocks from consumer discretionary and communication services sectors â namely Pointsbet Holding Limited and Speedcast International Limited, respectively.

PointsBet Holdings Limited

PointsBet Holdings Limited (ASX: PBH) is an Australia based company, which is a corporate bookmaker, engaged in offering innovative sports and racing betting products and services direct to clients through its scalable tech platform. The company, with operations in Australia and the United States, was officially listed on the Australian Stock Exchange on 12 June 2019. Recently, PBH announced that it would hold the Annual General Meeting on 24 October 2019.

In a market update on 7 October 2019, the company unveiled that 2,639,654 ordinary shares are scheduled for release from mandatory escrow on 31 October 2019, for the purpose of Listing Rule 3.10A. According to another market update, one of the companyâs director, Nicholas Fahey, boosted direct and indirect interest in the company with the acquisition of 3,544 fully paid ordinary shares. Moreover, Brett Paton, another director in the company, acquired 200,000 fully paid ordinary shares.

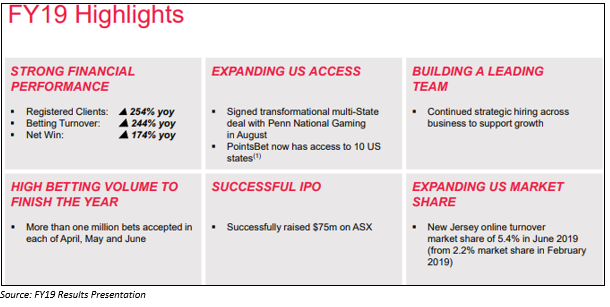

Betting Turnover up 244 Per Cent in FY19

On 29 August 2019, the company released financial results for the year ended 30 June 2019 or FY19, highlighting

- On a normalised basis, total revenue surged by 173 per cent to A$25.6 million compared to the previous corresponding period

- Gross profit of the company increased by approx. 50 per cent to A$10.9 million

- Total operating expenses grew to A$44.0 million from A$11.6 million in FY18

- Loss before income tax of the company stood at A$34.4 million

- PBH reported increased headcount across all business areas in Australia and the United States

- The company achieved a 244 per cent year-on-year growth in betting turnover

- Cash and cash equivalents at the end of the reported year reached $75.9 million

The company is well-positioned for growth in FY20, backed by a significant market opportunity in the US. PointsBet Holdings is hoping to launch its products and services in numerous states in FY2020 and beyond.

Stock Performance

The stock of PBH closed the dayâs trading at A$3.690 on 8 October 2019, up 0.82 per cent from its previous closing price. The company has a market cap of A$425.89 million and approx. 116.36 million outstanding shares. The 52-week high and low value of the stock is at A$3.850 and A$2.170, respectively. The stock has delivered a return of 33.58 per cent in the last three months.

Speedcast International Limited

Headquartered in New South Wales, Australia, Speedcast International Limited (ASX: SDA) is a critical communications company offering remote communication and IT solutions, catering to industries including energy, telecom, mining, and cruise and ferries. The company provides professional services, network management solutions, connectivity solutions, and customer experience management solutions.

Recent Updates

- On 3 October 2019, the company announced a change in the substantial holding of Southeastern Asset Management, Inc. in SDA, with its voting power increasing from 6.370 per cent to 8.06 per cent.

- On 1 October 2019, Mitsubishi UFJ Financial Group, Inc. became a substantial holder of the company with 12,305,972 securities and a 5.13 per cent voting right.

- Additionally, on 1 October 2019, the company released a notice regarding the change in the directorâs (John Mackay) interest.

New INDs on Board

The company at the end of September 2019 unveiled that Peter Shaper and Joe Spytek have agreed to join the board as independent non-executive directors (INDs), effective from 27 September 2019. Previously, Caroline van Scheltinga had notified about her retirement from the board. Mr Spytek has more than twenty-five years of experience in leadership and international business.

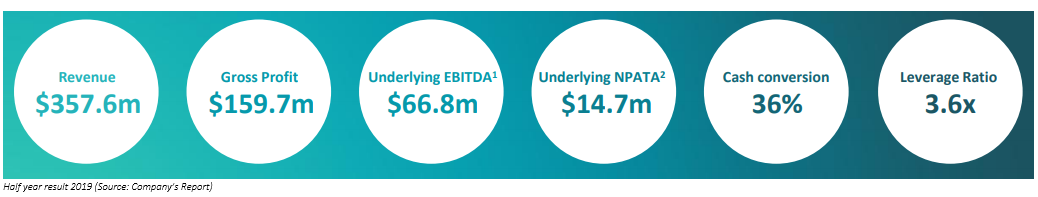

Revenue Up By 17.3 Per Cent in H119

On 27 August 2019, the company announced financial results for the half-year ended 30 June 2019, unveiling

- Total revenue surged by 17.3 per cent to US$357.6 million compared to the previous corresponding period

- EBITDA of the company increased by approx. 3.0 per cent to US$62.9 million

- Net profit after tax and amortisation decreased by 30.3 per cent to US$14.7 million

- Cash and cash equivalents stood at US$54.6 million at the end of the reported period

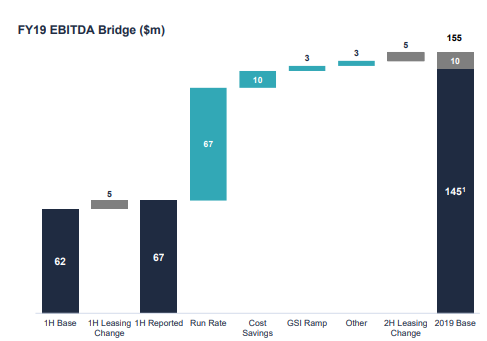

Moderate Organic Growth for H219

- The company is expecting to register moderate organic growth in the second half of 2019

- EBITDA is anticipated in the range of US$150 million to US$160 million

- Cost savings of approximately US$10 million in the second half of 2019

- Capex targeted at US$50 million in H219

- Leverage ratio of the company expected to be ~4x at the end of the year

Source: Companyâs Report

Stock Performance

The stock of SDA settled at A$1.040 on 8 October 2019, down 3.704 per cent from its last closing price. The company has a market cap of A$258.92 million and approx. 239.74 million outstanding shares. The 52-week high and low value of the stock is at A$4.150 and A$0.682, respectively. The stock has generated a negative return of 70.81 per cent in the last six months and a negative return of 60.73 per cent on a year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.