Identitii Limited and PointsBet Holdings Limited, the two ASX-listed companies, have made significant developments in the past couple of days. Letâs have a detailed look at their recent developments.

Identitii Limited

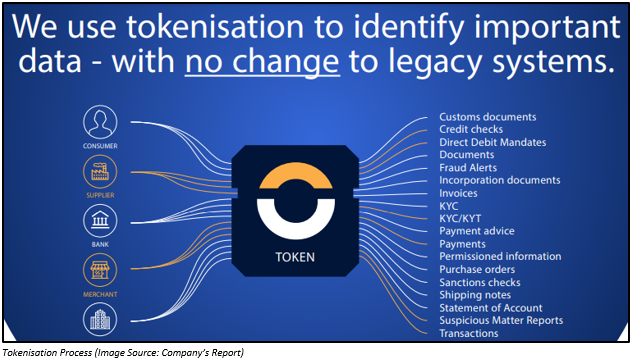

Identitii Limited (ASX: ID8) is a financial technology company that helps banks as well as enterprises in exchanging information related to the purpose, origin and beneficiaries of financial transactions via a private blockchain network and existing technology infrastructure.

New Licence Agreement with HSBC

On 20 August 2019, Identitii Limited announced to have entered into a new licence agreement with HSBC Bank Australia Limited to provide its Overlay+ platform to the bank.

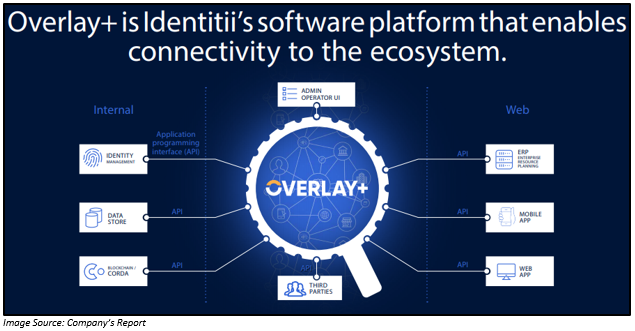

The Overlay+ platform allows the exchange of information through blockchain and tokenisation. It helps banks as well as corporates in improving their technology infrastructure in order to exchange documents and information within and outside the organisation in a secure manner.

This is the second licence agreement for the technology of the company under its existing global framework agreement with HSBC Global Services UK Limited. The new agreement is for an initial period of five years, and there is a provision for further extension. The minimum contract value is of $ 511.6k. The criteria for terminating the agreement remains the same as the existing global framework agreement between ID8 and HSBC.

The new license agreement, which represents a new use case for the platform, would be a source of material revenue for the company via a combination of professional service fees for the implementation of the technology along with a monthly licence fee (ongoing). The implementation work is anticipated to conclude by the second quarter of 2020. Post the completion of the implementation, the Overlay+ platform is anticipated to go live with HSBC Australia.

Non-Exclusive Perpetual Licence Agreement with Loot

Recently on 30 July 2019, ID8 entered into a non-exclusive, perpetual licence agreement with Loot Financial Services Limited, under which the former would be able to utilise the fully developed user-facing mobile and web applications of the latter for A$ 62,150 in cash.

The mobile application iOS & Android versions as well as web applications would be combined with the Overlay+ platform and white-labelled to develop a component of ID8âs offering for medium sized banks. It would allow customers, corporates as well as SMEs to interact with the Overlay+ platform through a personalised user interface.

The licence would not only result in cost and time savings for Identitii Limited, it would also help the company in accelerating its strategy to market its platform to over 900 medium sized banks in the APAC region that would prefer to leverage personalised white-labelled user interface instead of creating their personal proprietary apps.

Stock Performance

On 22 August 2019, the stock of ID8 closed the dayâs trading at A$ 0.340. ID8 has a market cap of A$ 18.54 million and ~ 54.52 million outstanding shares. The stock has given negative returns of 2.86% and 32.67% in the last one month and three months, respectively.

PointsBet Holdings Limited

A wagering services operator, PointsBet Holdings Limited (ASX: PBH) is a consumer discretionary sector player, listed on the ASX in June 2019. It is the best new online bookmaker in Australia. The company offers innovative sports & racing wagering products along with the most exciting sports betting format in the world. It has operations in the markets of Australia and the United States. Through its cloud-based wagering platform, it provides its customers with innovative sports and racing wagering items like Fixed Odds Sports, Fixed Odds Racing and PointsBetting.

Licence from Iowa Racing and Gaming Commission

On 20 August 2019, PointsBet Holdings Limited announced that its 100% owned subsidiary, PointsBet Iowa, LLC has been granted a licence from the Iowa Racing and Gaming Commission (IRGC). Moreover, the subsidiary has taken first bets at Catfish Bend Casino.

Catfish Bend Casino focuses on offering a memorable gaming experience to its clients along with the access to state-of-the-art slot machines, twenty-five table games and expensive live poker room as well as a VIP lounge.

Digital Sports Betting and Gaming Services Deal

Recently on 1 August 2019, the company announced that its wholly owned subsidiary, PointsBet USA Inc. and Penn National Gaming Inc. have signed an online gaming services framework agreement for digital sports betting as well as gaming services in the United States.

Under the agreement, Penn National Gaming Inc. (PNG) has provided PointsBet USA with the authority to build, own, market and operate under the formerâs operating licences. As a result, PointsBet USA can build, own, market as well as operate its branded online sportsbook along with gaming operations in locations like Indiana, Louisiana, Missouri, Ohio and West Virginia. Apart from this, PointsBet was also given permission from PNG of 1st offer for any new market access points.

Key Features of Partnership:

- The duration of the market access agreement for each market access state is 20 years. The period will be counted from the date when the PointsBet branded service is first provided to the players of PointsBet in the applicable state.

- The footprint of PointsBet in the US can grow to ten states as part of the partnership; however, this feature depends on the clearance of enabling legislation as well as licensure.

- PointsBet would be paying PNG with a portion of the revenue from net gaming secured from each market access state.

- PointsBet would also make a market access fee payment to PNG, which would be paid by the funds generated through an equity placement and issue of options. Another US$2.5 million would be paid in cash or equity after the clearance of legislation in the US state of Ohio.

Meanwhile, PointsBet has reached a subscription agreement with PNG, as part of which the latterâs wholly owned subsidiary Penn Interactive Ventures, LLC would be issued 6.13 million new fully paid ordinary shares in the company, in addition to 10.37 million options.

Stock Performance

On 22 August 2019, the opening price of the shares of PBH was A$ 3.010. By the end of dayâs trading on 22 August 2019, the price of the shares of PBH was A$ 3.000, up 0.334% as compared to its previous closing price. PBH has a market cap of A$ 347.37 million and ~ 116.21 million outstanding shares. It has delivered a negative return of 0.33% in the last one month.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.