Iron ore prices are slipping into the red amidst speculation over the long-term impact of U.S.-China trade tussle. The roll-over in the iron ore futures contract from September 2019 to January 2020 on the Dalian Commodity Exchange witnessed a sharp build-up of short-sellers.

Iron ore prices dropped on DCE (China) from the level of RMB 918.00 (Dayâs high on 19 July 2019) to the present low of RMB 628.00 (Dayâs low on 9 August 2019), a drop of over 31 per cent since CISA (or China Iron and Steel Association) decided to end the supplierâs monopoly.

The market pessimism over the global macroeconomics instigated a speculative sell in the market, and the iron ore prices in China (DCE) dropped despite lower supply and fall in inventories across 35 crucial ports in China.

As per the data, the overall inventory across the 35 Chinese ports stood at 107.84 million tonnes for the week ended 9 August 2019, down by 1.30 million tonnes or 1.19 per cent against the previous corresponding week inventory level.

The higher upcoming tariffs on Chinese goods exerted pressure on steel prices in the international as well as in the domestic market of China. The prices of LME Rebar 1-month contract plunged from the level of US$477.5 a tonne (Dayâs close on 1 July 2019) to the level of US$452.0 a tonne (Dayâs close on 9 August 2019), which in turn, narrowed the profit margins of the steel mills, and exerted the pressure on iron ore prices.

Costly Steel Scarp slowed EAF:

However, despite a fall in steel prices, the easer curbs across various steelmaking provinces in China Coupled with an expensive steel scrap, which reduced the operating efficiency of the Electric Arc Furnace (Or EAF) steelmakers, increased the daily average deliveries from the Chinese ports.

As per the data, the daily average delivery from the 35 significant ports in China stood at 2.69 million tonnes at the beginning of August 2019, up by 212,000 metric tonnes on a weekly basis and 158,800 metric tonnes on a yearly basis.

For now, the falling inventory coupled with loose curbs over the steel production in China and increased delivery rates could support the iron ore prices in China; however, the gloomy picture over the global macroeconomic conditions remains a potential risk for the future prices of the commodity.

The Australian Miners:

The Australian behemoths such as Rio Tinto (ASX: RIO), BHP Billiton (ASX: BHP), and Fortescue Metals Group (ASX: FMG) are in the red-zone amid falling iron ore prices along with other potential reasons.

Rio Tinto (ASX: RIO)

The stock of the company nosedived approx. 21 per cent (as per the current levels) from its A$107.935 high on 3 July 2019. The fall in iron ore prices after the formation of a potential double top pattern contributed substantially towards the fall.

Also Read: Commodity Market In A Nutshell; Iron Ore Shows Potential Double Top

Apart from that, the ballooning cost at Rioâs Mongolian copper project seems to be causing some problems for the company.

Rio and the Mongolian Project:

The Mongolian copper project of the company- Oyu Tolgoi, in which Rio controls interest through its 51 per cent owned Turquoise Hill Resources (66 per cent interest in Oyu Tolgoi) is anticipated by the company to witness an increase in cost.

The open-pit mining, which dwells the surface produced significant concentrate, which the company mined and shipped; however, 80 per cent potential of the prospect is underground. Rio is now seeking clarification from the Mongolian government for their stance on the project, in which the Mongolian government controls 34 per cent interest.

As per the company, the final cost of the redesign work is scheduled for the second half of 2020, but for now the company expects the cost of the development excluding a power station would be in the range of A$6.5 to A$7.2 billion, which in turn, marks an increase of over A$1.2 to A$1.9 billion from the previous estimation of A$5.3 billion.

Rio and Copper:

Rio remains optimistic over the future perspective on copper and aluminium, and as per the company the longer-term fundamentals remain positive for copper, and Rio allocated additional A$0.3 billion for its Resolution copper mine in 1H 2019.

Rio is moving forward with its FY2019 copper production guidance of 550-600kt, and the company produced 281kt of copper, and 131kt of refined copper for which the FY2019 guidance is in the range of 220-250kt, in 1H 2019.

How the additional investment in copper project paying off?

Rio along with its partner-BHP in the Resolution Copper Mining, in which Rio owns 55 per cent interest, and BHP owns 45 per cent interest, is keen to develop additional copper resources in Arizona, USA.

The additional allocation of A$0.3 billion for the permitting finally payed-off and Resolution Copper project advanced towards the U.S. permitting process.

Resolution started with the U.S. permitting process in 2013. The United States Forest Service, under the National Environmental Policy Act (or NEPA) conducted a comprehensive independent review.

The company earned a feather in its cap with the release of an independently prepared Draft Environmental Impact Statement for the Resolution copper prospect. The development of the Draft Environmental Impact Statement initiated a public consultation over the final Environmental Impact Statement (or EIS) for a 90-day period, which in turn, will inform Rio about the next step of the permitting process.

Is Copper an Additional Burden for Rio?

Despite decent progress over the permitting in the United States and progressive development for the underground operations at the Oyu Tolgoi, the share prices of the company are sliding.

The impact of the U.S-China trade tussle is dragging the prices of base-metals down, which, in turn, seems to be a problem for the company. Previously the higher iron ore prices used to nullify the impact of a drop in copper prices; however, the fall in both copper and iron ore prices are causing tough time for Rio.

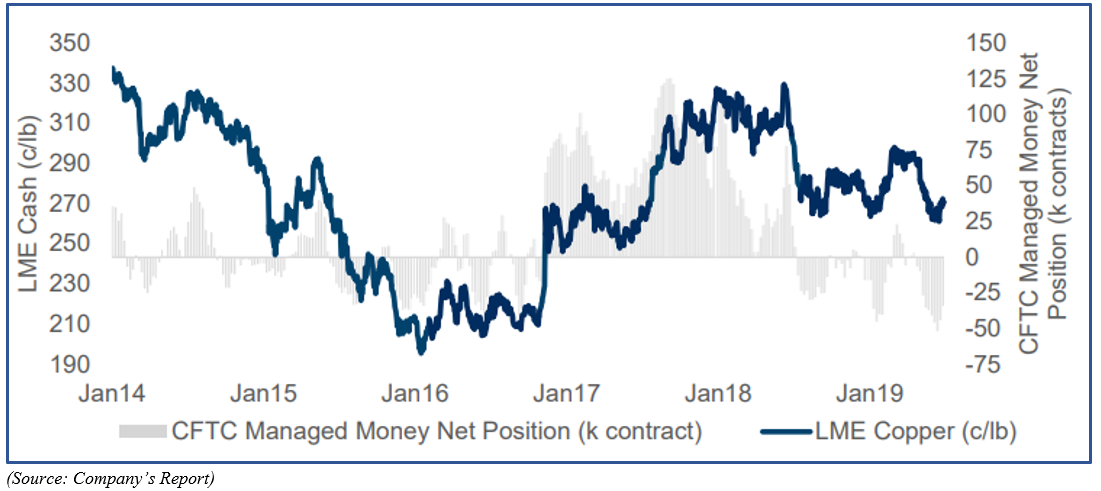

As per the company, the building of net shorts across the LME-Copper is contributing towards the weakness in copper; however, Rio remains positive on copper over the longer timeframe.

BHP Billiton-another giant Australian mines seem to be facing the somewhat same issue, and the share prices of the company have taken a jab on ASX.

BHP shares dropped from its recent high of A$41.980 on 24 July 2019 to the level of A$36.225 on 6 August 2019, which in turn, pens a drop of over 13.70 per cent. However, for now, BHP shares have reverted from the freefall mode and have recovered from the level of A$36.225 to the present level of A36.585 (as on 12 August 2019 03:05 PM AEST).

In a nutshell, the re-escalation in the U.S-China has dampened the sentiments of global growth, which is having a cascading effect and is building pressure across major commodities in the market, especially base-metals and steel.

The drop in the commodity prices along with particular cost-related issues and subdued expectations of realised prices for the miners by the market participants is dragging the Australian miners on ASX, and investors should monitor the development on a global scale to fathom the damage of rising trade tensions on the miners.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.