Global trends influencing Real estate

Several global trends, including urbanisation and technology, are reshaping the way people across the planet live. This is impacting various real estate firms all around the world. The global trends which are currently influencing Real estate Players Strategy include:

Urbanisation

- As per Australiaâs leading real-estate group, Lendlease, currently, around 55% of the worldâs population lives in urban areas, and this is expected to increase to 68% by 2050.

- The human shift from rural to urban regions along with the rampant population growth, could have additional 2.5 billion people in the urban zones by 2050.

Global infrastructure

- Lendlease believes that between the current times and 2035, the global infrastructure spending would be up by an average of $5.1 trillion p.a.

Funds growth

- Global assets under management would likely be up from $85 trillion in 2016 to $145 trillion by 2025.

Technology, digital and data

- The exponential growth of internet use has created a new society of hyper connected citizens;

- It is estimated that by the year 2025, on average, every connected person will have a digital data engagement over 4,800 times per day.

Ageing population

- As per Lendlease, on a global level, people aged 60 and above would grow thrice as fast than the overall population between 2015 and 2050.

Sustainability

- Climate shift and societyâs revert to it were the foundational catalysts of risk and opportunity across the globe.

In this context, let us look at few leading real estate stocks trading on ASX:

Lendlease Group

International property and infrastructure group Lendlease Group (ASX: LLC) has been entrusted with many projects of public, cultural and social significance. The group was involved in the constructing the Sydney Opera House, restoring and renovating historic buildings such as Londonâs Tate Britain and National Theatre and creating the National September 11 Memorial & Museum in New York.

Lendlease Group Integrated Model (Source: Company Reports)

In FY19, the company delivered 1,623 residential apartments for sale including in Sydney, Melbourne and London and reported a profit of $467 million over the period.

LLC FY19 Highlights

- $9.7 billion of construction activity;

- Construction backlog revenue $15.6 billion;

- $9.9 billion of new work secured.

Lendlease Group has a market capitalisation of $9.54 billion (as at 13 September 2019). In the past six months, the stock has provided a return of 36.15 per cent.

Charter Hall Group

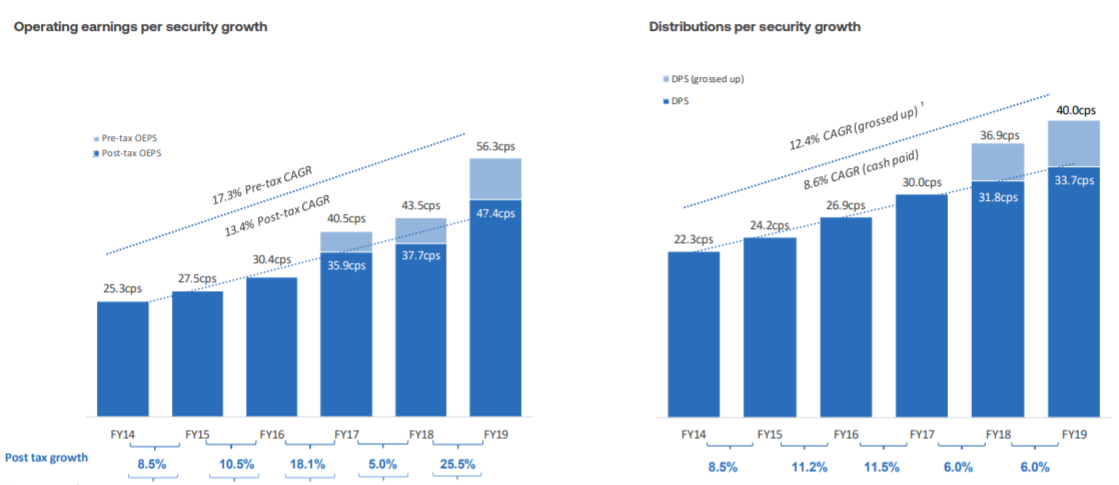

Australiaâs leading fully integrated property group Charter Hall Group (ASX: CHC) uses its property expertise to access, deploy, manage and invest equity in its core real estate sectors. In the last six years, the company has witnessed substantial growth in its earnings and distributions as depicted in the below graphs.

Strong growth in earnings underpinning distribution growth (Source: Company Reports)

CHC FY19 Highlights

- Operating earnings of $220.7 million, or OEPS post-tax of 47.4cps, up 25.5% on the prior corresponding period (pcp);

- Statutory profit of $235.3 million reported in FY19;

- Total Platform Return of 11.1% reported in FY19;

- Distributions of 33.7cps, up 6% on pcp;

- $3.4 billion of gross equity raised for the year;

- $5.0 billion of gross transactions reported for the year;

- $30.4 billion of FUM at year-end, with $4.2 billion of FUM growth post-balance date to take FUM to $34.6 billion;

- Property Investments up by $138 million to $1.8 billion, delivering a 9.1% return for the year.

In FY2020, the group is expecting 18-20% growth in post-tax operating earnings per security over FY19 and 6% growth in FY20 distribution per security.

In the past six months, CHCâs stock has provided a return of 19.68% as on 12 September 2019. CHCâs stock has a PE multiple of 22.040x and an annual dividend yield of 3.03%.

Goodman Group

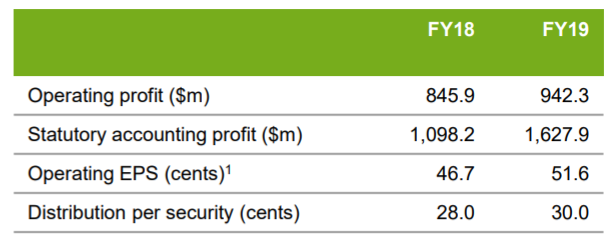

Integrated property group Goodman Group (ASX: GMG) is one of the largest listed specialist fund managers of industrial property and business space globally. In FY19, the group was able to deliver strong operating performance and financial performance.

GMG FY19 Highlights

- Operating profit of $942 million, up 11.4% on FY18;

- Operating earnings per share (EPS) of 51.6 cents, up 10.5% on FY18;

- Distribution per security (DPS) of 30.0 cents, up 7% on FY18;

- Gearing at 9.7% (5.1% at FY18);

- Statutory profit of $1,628 million, includes $872 million valuation gains, contributing to 15% growth in net tangible assets from FY18 to $5.34 per security;

- $3.8 billion of revaluation gains across the Group and Partnerships;

- External assets under management (AUM) up 22% to $43 billion, with total AUM up 21% to $46 billion on FY18;

- Like for like net property income (NPI) growth of 3.3%;

- Maintained high occupancy at 98%.

FY19 Results Snapshot (Source: Company Reports)

Outlook

In FY20, the company is expecting to earn an operating profit of $1,040 million, representing 10.4% growth on pcp. Further, the company is expecting a 9% growth in its FY20 operating EPS.

On the stock performance front, on a year to date basis, GMGâs stock has provided a return of 25.84% as on 11 September 2019. GMGâs stock has a PE multiple of 15.280x and an annual dividend yield of 2.18%.

Mirvac Group

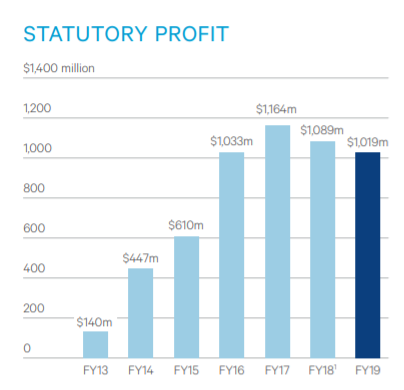

One of Australiaâs leading and most innovative property groups, Mirvac Group (ASX: MGR) is primarily involved in delivering innovative and exceptional workplace precincts, retail destinations, high-quality homes and connected communities for its customers. The group intends to add value to Australiaâs cities through innovative, visionary design, development, asset management and construction.

As per Mirvac Chairman, Mirvac Group is in exceptional shape, with a high-performing investment portfolio that will generate steadily growing income, all in the safe hands of a highly engaged and passionate workforce.

In FY19, the group delivered strong set of financial metrics. The group reported a statutory profit of $1.02 billion in FY19 achieved a strong operating cash flow of $518 million. During the year, the company paid distributions of 11.6 cents per stapled security, up 5% on pcp.

Statutory Profit Historic Graph (Source: Company Reports)

FY20 Outlook

- The group expect to achieve over 2,500 lot settlements in FY20;

- Gross margins to remain above through cycle target of 18-22%;

- 79% of FY20 EBIT secured.

The company is currently Australiaâs second largest office manager, with approximately $15 billion of office and industrial assets under management. It also believes that it is on track to deliver the expected ~$1 billion of active EBIT over FY19-21.

On the stock performance front, on a year to date basis, MGRâs stock has provided a return of 38.18% as on 12 September 2019. MGRâs stock has a PE multiple of 11.010x and an annual dividend yield of 3.82%.

Stockland

Australiaâs leading retail property owner, developer and manager, Stockland (ASX: SGP) recently updated the market that its previously announced on-market security buy-back will continue until 20 September 2020 or the date that it has bought-back $350 million of Stockland securities on issue, whichever is sooner.

- The group initially announced a buyback of up to $350 million on 6 September 2018;

- As at 4 September 2019, Stockland had bought-back and cancelled 50,117,773 securities for a total consideration of approximately $192.36 million;

Stockland Property Portfolio

Retail- At 30 June 2019 the portfolio comprises 35 retail centres with Stockland's ownership interests valued at $6.9 billion with gross book value of $7.2 billion;

Workplace- At 30 June 2019 the portfolio comprises 5 properties with Stocklandâs ownership interests valued at $0.8 billion with gross book value of $1.3 billion;

Logistics- At 30 June 2019 the portfolio comprises 29 properties encompassing over 1.4 million square metres of building area with Stocklandâs ownership interests valued at $2.5 billion with gross book value of $2.7 billion;

Residential Communities- Stockland has 56 communities and 76,000 lots remaining in its portfolio with a total end value of approximately $21.4 billion.

On the stock performance front, on a year to date basis, SGPâs stock has provided a return of 28.70% as on 12 September 2019. SGPâs stock has a PE multiple of 34.150x and an annual dividend yield of 6.22%.

Vicinity Centres

Australia's leading retail property group Vicinity Centres (ASX: VCX) was able to deliver strong results in FY19 despite facing challenging retail environment.

Financial Results Highlights

- Reported Statutory net profit of $346.1 million in FY19;

- Reported Funds from operations (FFO) of $689.3 million or 18.0 cps reflecting 2.0% comparable growth;

- Issued $400 million of six-year Australian medium-term notes at ~2.6% interest rate;

Strategic initiatives taken in FY19 includes:

- Acquired 100 milion securities at 12.3% discount to Jun-19 NTA

- Divested 12 assets for $670 million

- Commitment to Net Zero carbon emissions by 2030

On the stock performance front, on a year to date basis, VCXâs stock has provided a return of 4.37% as on 12 September 2019. VCXâs stock has a PE multiple of 29.090x and an annual dividend yield of 6.05%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.