With the Australian Housing sector consistently declining in value, investors are eyeing the real estate market closely as investment has become cheaper. Sydney and Melbourne, two major cities of the country went through a housing price slump in the past few months. However, the situation eased post the federal election. Toppled with the consecutive rate cuts which would aid businesses to acquire capital, there have been multiple interventions by the federal government towards bettering the housing scenario in Australia.

In the light of the promising real estate sector, let us have a look at one of Australiaâs vital international property and infrastructure group, Lendlease Group (ASX: LLC), and contemplate if it would interest the investors:

Company Profile: Operational across Asia, Europe, Australia and the Americas, Lendlease Group (ASX:LLC) is a global infrastructure and property group with infrastructure, design, development, investments and management expertise. The company aims to build innovative and sustainable property and infrastructure solutions for the next generation. Few of the companyâs projects include- the Athletesâ Village in London, Petronas Towers in Kuala Lumpur, Sydney Opera House and the September 11 Memorial & Museum in NYC.

The companyâs strategy is focused on three realms â Development, Construction and Investments. Also, 2018 marked the 60th year of the company. The company got listed on ASX in 1962 and has its headquarters in Sydney.

LLCâs Approach (Source: LLCâs Presentation)

Stock Performance: On 29 July 2019, LLCâs stock was trading at A$15.15 on ASX, up by 0.598 per cent (at AEST 2:00 PM). With a market capitalisation of A$8.5 billion and ~564.13 million outstanding shares, the annual dividend yield of the stock is 3.12 per cent while the P/E ratio stands at 22.68x. In the last one, three and six months, LLCâs stock has generated returns of 12.39 per cent, 13.75 per cent and 24.26 per cent, respectively.

Agreement with Google: On 18 July 2019, LLC pleasingly announced that it had signed an agreement with Google in the US, with the intention to develop its landholdings in three prime areas in the San Francisco Bay - San Jose, Mountain View and Sunnyvale into mixed-use communities, for the next 10 to 15 years.

While LLC would develop up to 15 million square feet of community uses in the region, Google would aim to develop its office space within the communities. The anticipated end development value is ~USD15 billion and would most likely begin in 2021.

Proceeding filed against LLC: On 18 April 2019, LLC notified the market that Maurice Blackburn had filed a proceeding against Lendlease Corporation Limited and Lendlease Responsible Entity Limited. This case was on behalf of shareholders who had acquired an interest in the companyâs stapled securities during 17 November 2017 till 8 November 2018. LLC denied any liability and had announced that it would defend the proceeding as required.

Presentation for the Credit Suisse Asian Investment Conference: On 28 March 2019, LLCâs Chief Financial Officer, Tarun Gupta presented at the Credit Suisse Asian Investment Conference in Hong Kong, stating that as a leadership motive, $59.3 billion worth urbanisation strategy was in pipeline, with 20 projects across 10 entry cities. The company had posted a 17.8 per cent annual growth in funds under management since FY14.

LLCâs managed Australian Prime Property Fund Commercial was ranked first out of the total 874 respondents in the 2018 Global Real Estate Sustainability Benchmark, and for a second year in a row, the APPF Commercial fund had been rated as the worldâs best for Sustainability by GRESB.

LLC was doing its bit towards the retirement space of Australia and was operating one of the biggest Retirement Living businesses in the country, aspiring to build a scale platform in China. The company had successfully secured the first senior living project in Shanghai in 2018.

LLC was pacing at par with the worldâs advancement towards technology. The cross Laminated Timber, digital design, pre-fab and an online sales channels are amongst few of the initiatives undertaken by the company.

LLCâs Targets: The company had reduced construction contribution to EBITDA mix on the Engineering and Services end and the Construction segment EBITDA margin target was 2-3 per cent. Besides this, on the internal Construction margin end, the Construction contribution to EBITDA mix had been reduced too, with the Development segment ROIC increased (10-13 per cent). 50-70 per cent of the capital was allocated in Australia, with 20 per cent max per international region. Under its distribution policy, the Pay-out would be 40-60 per cent of the earnings. The capital structure gearing was 10-20 per cent.

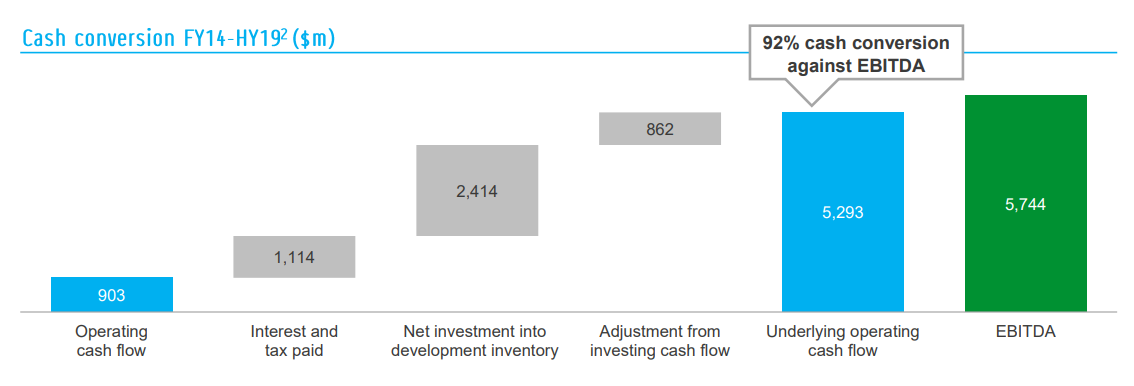

LLCâs underlying operating cash flow is depicted in the image below:

LLCâs cash conversion (Source: LLCâs Presentation)

In its presentation, the Revised target for FY19 was projected, with the ROIC target of 10-13 per cent. On the development towards urbanisation, a total of 2,600 apartments for rent across six urbanisation projects are expected to launch in H2FY19 â FY23. 16 buildings across six urbanisation projects were expected launch in the same time frame of H2FY19 â FY23. Apartments for rent across nine urbanisation projects are expected to launch post FY23. Besides this, the launch date for Apartments for sale across 17 major urbanisation projects is subject to the market conditions.

Outlook: As guidance, LLC has a Development pipeline of $74.5 billion and a Construction backlog revenue of $14.8 billion. Investments segment had $3.6 billion of investments and $34.1 billion in FUM and $26.6 billion in AUM.

HY19 Results: In February 2019, LLC had released its HY19 Results and Engineering and Services update, posting a PAT of $ 15.7 million and earnings per stapled security of 2.8 cents, amid a challenging period. Development pipeline was up 31 per cent at $74.5 billion. Funds Under Management was up by 20 per cent to $34.1 billion. The Group had $2.1 billion of available liquidity, after underperformance of its Engineering sphere.

In HY19, the company had added two new major urbanisation projects to its pipeline â Victoria Cross in Sydney, and Lakeshore East in Chicago. It was named as a preferred partner on London Thamesmead Waterfront and Birmingham Smithfield projects in the UK, who jointly have an estimated end development value of $17.2 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.