Dividends are an important source of cash for many elderly Australians who didn’t have superannuation systems in their times. Given the precipitate shock due to COVID-19 to the cash flow streams of many businesses, dividends by Corporate Australia have been evicted and deferred, thereby causing concern for dividend income seekers.

At the same time, the pandemic is posing threats to the potential dividends of companies over the future course, as a recession is being embraced by the world. Economic recovery across the globe is likely to deliver improving outlook for dividends by Corporate Australia. However, the uncertainty attached to the COVID-19 crisis has been paramount.

At this juncture, blue-chip companies are likely to deliver satisfactory outcomes with respect to dividends, and some listed investment companies with a decent track record.

We discuss how these names have fared amid COVID-19 and February earnings season.

BHP Group Limited (ASX:BHP)

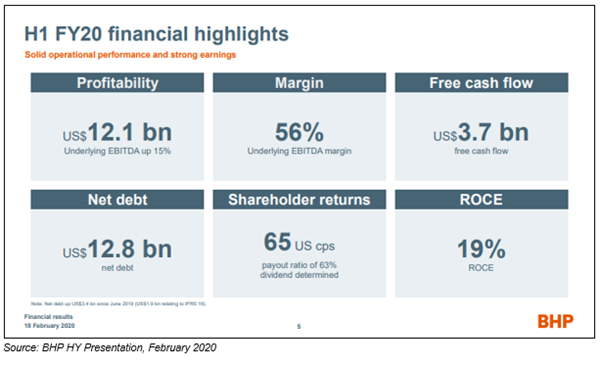

BHP Group announced an interim dividend of USD 65 cents per share for the period ended 31 December 2019. Its underlying EBITDA for the half year was USD 12.1 billion, while underlying EBIT was noted at USD 9 billion.

Attributable profit for the period stood at USD 4.9 billion, while underlying attributable profit was USD 5.2 billion. Iron ore contributed 60% to the underlying EBITDA at USD 7.1 billion with ROCE of 49%.

Copper’s contribution to underlying EBITDA was 20% at USD 2.4 billion, metallurgical coal accounted for 9% of the underlying EBITDA at USD 1.1 billion and petroleum’s contribution was noted at 13% at USD 1.6 billion.

Net debt in the business was USD 12.8 billion, which was at the lower end of USD 12-17 billion target range. The Company expects full-year (FY20) capital expenditure within USD 8 billion and approximately USD 8 billion in the next year (FY21).

On 15 April 2020, BHP last traded at $31.430, down by 0.726% from the previous close.

Telstra Corporation Limited (ASX:TLS)

Telstra announced an interim dividend of 8 cents per share for the period ended 31 December 2019. During results’ release, the Company also reaffirmed its FY20 guidance of total income in the range of $25.3 billion to $27.3 billion, underlying EBITDA of $7.4 billion to $7.9 billion, restructuring costs of ~$300 million, capex between $2.9 billion and $3.3 billion, and free cash flow (FCF) after operating leases between $3.3 billion and $3.8 billion.

In response to COVID-19, the Company has reported to hold additional job reductions, and it is focused on delivering an underlying fixed cost reduction of $2.5 billion annually by end-FY22. It would recruit additional 1k temporary contractors to manage call centre volumes.

The Company has brought forward the $500 million capex to current calendar year from the second half of FY21, which would be deployed in increasing network capacity and fast-tracking 5G rollout. TLS now expects FCF to be at the lower end of the guidance.

On 15 April 2020, TLS last traded at $3.120, down by 1.266% from the previous close.

WAM Capital Limited (ASX:WAM)

WAM invests in most undervalued growth opportunities in the Australian market. In the March 2020 investment update, Chairman & Chief Investment Officer Geoff Wilson talked about all major equity market indexes entering bear markets at record pace, owing to a self-induced recession set in for investors, globally, during March 2020.

At the end of March, WAM portfolio size was $1.26 billion, with listed equities of $1.02 billion. The current cash weighting of the Company’s investment portfolio was noted at 32.6%. The increased portfolio liquidity, high cash weighting and flexible mandate position the Company well.

WAM has announced a fully franked dividend of 7.75 cents per share, which is due for payment on 28 April 2020 to the shareholders in records on 21 April 2020.

Earlier in the February 2020 investment update, Chairman & Chief Investment Officer Geoff Wilson had talked about the large falls experienced in the month across global markets and Australia. Mr Wilson had stated that COVID-19 caused sharp adjustments in recent market euphoria, reflected by the steep falls in asset prices.

He noted the end of the longest bull market in equities after the WHO declared COVID-19 as a pandemic. Also, the existing low interest rate environment with additional monetary stimulus place the global economy at the risk of further shocks.

On 15 April 2020, WAM last traded at $2.010, down by 2.899% from the previous close.

MFF Capital Investments Limited (ASX:MFF)

MFF is a listed investment company that holds a minimum of 20 stocks from the international as well as domestic space. It aims to invest in quality businesses that are available at a discount to their intrinsic value.

The Company’s approximate weekly NTA per share as at 9 April 2020 stood at $3.078 pre-tax, compared with $3.225 at 30 June 2019. The post-tax NTA per share was noted at $2.556. Net cash demonstrated as a percentage of investment assets and net cash was ~ 30.1% at 9 April 2020.

Monthly NTA at the end of March 2020 was $2.971 pre-tax per share, which was $3.225 at the end of June 2019. Last month, MFF paid a fully franked special dividend of 20 cents per share.

Chris Mackay, Portfolio Manager, acknowledged the fall in the markets as well as in the MFF portfolio. MFF has increased cash weighting that stood at more than 25% of the portfolio, and the manager is ready to patiently deploy capital in well-priced opportunities having long-term business advantages.

In February, the manager noted significant selling this financial year that stood at $256.2 million, and it sold around $399.3 million in March. MFF invested a mere sum of $1.8 million and dividend receipts totalled ~$3.4 million in March.

On 15 April 2020, MFF last traded at $2.800, down by 0.709% from the previous close.

Woolworths Group Limited (ASX:WOW)

Recently, Woolworths Group released a letter to shareholders by Chairman Gordon Cairns, who highlighted that the business is taking necessary precautions while providing the essential services to Australian households.

He noted that the group has created new roles to contribute towards keeping Australians in jobs, enabling WOW to support scaling-up operations and changing needs of households as the health crisis filters deeper into the country.

The merger of drinks and hotels businesses was completed in February, but the Board deferred the separation of Endeavour Group until the calendar year 2021 due to the temporary closure of hotels and current financial market conditions.

Woolworths Group is progressing with the payments to the team member that were not paid adequately and remains committed to complete the review and rectifying payments as soon as possible.

For the half-year ended 5 January 2020, the group’s normalised NPAT from continuing operations was up 15.7%, and it announced fully franked interim dividend of 46 cents per share.

On 15 April 2020, WOW last traded at $36.210, up by 0.194% from the previous close.

Coles Group Limited (ASX:COL)

Recently, the group announced that Wesfarmers Limited (ASX:WES) sold a 5.2% stake in COL. Now the stake of Wesfarmers in the Company is 4.9%, which WES will retain for 60 days from the sale completion and restricts Wesfarmers to nominate a director to the Coles Board.

David Cheesewright sits on the Coles Board as nominated by Wesfarmers. Coles noted that Mr Cheesewright would continue to serve in the Board, but he would no longer be a nominee of Wesfarmers.

Chairman of Coles, James Graham stated that Mr Cheesewright is a valued member of the Board, who brings extensive board experience, including the international retail experience.

Besides, Coles and Wesfarmers would continue to operate Flybys JV with both entities having equal stakes in the business, enabling strategic cooperation between the companies.

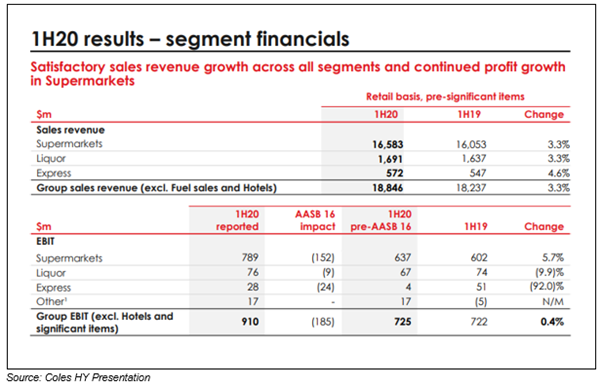

For the half-year ended 5 January 2020, Coles Group announced a fully franked interim dividend of 30 cents per share. Its total sales revenue for the period was $18.8 billion and operating cash flow was $607 million with 87% cash realisation.

On 15 April 2020, COL last traded at $16.200, down by 0.796% from the previous close.