Investing in Small-Cap Stocks

Biotech is a dynamic and profitable sector for investors. Capital venture in biotech stocks provides great enthusiasm and diversification support to market fans. In general, before investing money in stocks, investors research about the company's fundamentals consisting of market cap, profits and the price at which the stock is available.

Multiplication of the share price, with the number of outstanding shares determines the market cap. Market cap gives an idea about the relative size of the company, its current assets and the scope of the company in future. Looking at the market cap, investors get a hint about the overvalued or undervalued stocks, stocks with better returns and the scope of the company in future.

Small-cap stocks are companies with lower market capitalisation. Some investors pour cash in popular blue-chip companies with fruitful commercialisation in the market, while others select picking up small-cap stocks that offer an attractive growth potential compared to the larger companies.

Let us go through the two small-cap stocks from the health care sector, and their latest updates.

Immuron Limited (ASX:IMC)

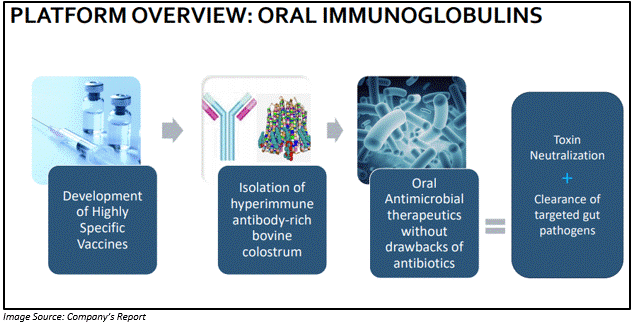

Commercial and clinical-stage biopharmaceutical company, Immuron Limited, targets infectious diseases with oral immunoglobulin-based therapies. Immuron's innovative, safe and validated technology platform comprises of one asset, Travelan®, which is registered for sale.

IMC's two lead drug candidates are - IMM-124E, first lead candidate, currently being developed as a drug to prevent Travelers' Diarrhea, IMM-529 which is IMC's second clinical-stage asset that targets Clostridium difficile Infections (CDI), and is presently in a clinical trial in CDI patients.

Change of Interest of Substantial Holder

On 25 September 2019, IMC released a notice regarding a change of interests of its substantial shareholder. As per the notification, the company's substantial shareholder, The Bank of New York Mellon Corporation (BNYMC) has reduced their voting power in the company from 21.55% to 20.39% on 23 September 2019, by disposing 20,479,60 shares. Post the change, BNYMC holds 36,054,000 shares of the Company as compared to previously held 38,101, 960 shares.

US Defense Reports Immuron's Travelan®

Immuron recently on 4 September 2019, announced the outcomes of a recent study on the immuno-reactivity of Travelan®, funded by U.S. Department of Defense (DoD), conducted by Department of Enteric Diseases, Armed Forces Research Institute of Medical Sciences (AFRIMS) in Bangkok, Thailand.

Travelan® is a commercially available over-the-counter gastrointestinal and digestive health supplement to infectious Vibrio cholera strains from Southeast Asia. The study aimed to investigate the extent of Travelan ®'s immunological reactivity to the pathogenic Vibrio cholera bacterial strains, isolated from infected workers deployed in Bangladesh, Cambodia and Thailand.

The outcome of the study revealed that Travelan® was able to bind and was reactive to all the 71 clinical isolates tested, compared to placebo control, highlighting the broad-spectrum recognition by Travelan® of surface antigens on potentially devastating and even deadly bacteria.

Stock performance

IMC's stock was trading at $0.14, down by 20% (as on 3 October 2019, AEST 12:41 PM). The market capitalisation of IMC stands at $30.94 million with 176.78 outstanding shares. IMC stock has given YTD return of - 16.67%.

REGENEUS LTD (ASX: RGS)

Headquartered in Sydney, a clinical-stage, regenerative medicine company, Regeneus Ltd is engaged in providing the treatment for osteoarthritis and musculoskeletal ailments, besides, the Company also has a focus in areas of neuropathic pain and dermatology. RGS has a robust product pipeline of novel cell-based therapies underpinned by stem cell technologies.

In a press release dated 26 September 2019, the company reported operational, financial and clinical & regulatory results for the fiscal year ended 30 June 2019 (FY2019).

Operating Review

During FY2019, the company achieved significant clinical and regulatory milestones. RGS has also undergone management changes with the appointment of Leo Lee as CEO, who served as Non-executive Director previously and Dr John Chiplin and Dr Alan W. Dunton were appointed as two new Non-executive Directors.

This was followed by the initiation of a new strategic review in Q4 FY2019 focusing on the global pain market for the commercialisation of Progenza for osteoarthritis on priority, and to align these new strategic priorities, cost-containment initiatives were implemented in Q1 FY2020.

Financial Review

For FY2019, Regeneus generated R&D Tax Incentive of $2.4m operating cash inflow relative to FY2018. As on 30 June 2019, RGS' debt accounted to $3.8m, borrowed via loan funding of $1.3m from Paddington St Finance and funding of $2.5m loan provided by RGS Directors. The Company intends to cut down borrowings from $3.8m to $1.1m by mid-October 2019.

Further, it was reported that as a part of RGS' capital raising in August 2019, a part of RGS Directors' loan ($1.4m) was converted to ordinary equity capital. RGS anticipates receipt of R&D Tax Incentive by the end of the first quarter of 2020, which the company intends to utilise by paying off the Paddington St Finance loan and associated interest.

Company's expenditure from operating activities before the receiving of R&D tax incentive amounted to less than $500k per month compared to $571k per month for the year 2018.

Clinical & Regulatory Review

During the year 2019, RGS' research and development activities were focused on Progenza and Sygenus. The company received an intent to be granted European Patent, the notification for the same came from the patent office (Europe) for Progenza.

It was further reported that a Chinese patent has also been granted to Regeneus for the utilisation of Biomarkers in observing the development of the disease for mesenchymal stem cell (MSC) therapy for inflammatory ailment.

Stock performance

RGS' stock last traded at $0.069 on 1 October 2019. The market capitalisation of RGS stands at $18.52 million with 268.39 million outstanding shares. RGS stocks has given YTD return of -61.84%.

ADALTA LIMITED (ASX: 1AD)

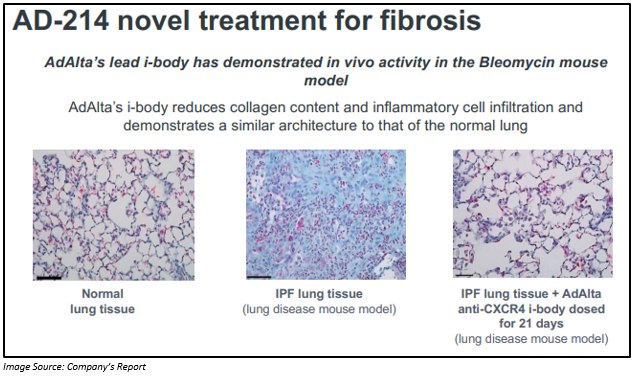

Biotechnology company, AdAlta Limited develops new class of protein therapeutics, i-bodies for disease treatment utilising its proprietary technology platform. AdAlta's lead i-body candidate, AD-214 could be utilised for curing IPF or idiopathic pulmonary fibrosis and other human fibrotic illnesses. Presently, the company is in the process to begin phase 1 clinical trial for AD-214, expected to start in early 2020.

Latest Updates

On 26 September 2019, AdAlta provided further update on the recently secured licensing deal with global medical technology and diagnostics firm, GE Healthcare for its i-body platform. The agreement is based on the future research aimed for the potential identification of a pre-clinical target for PET diagnostic applications. Following target selection, GE Healthcare would pay the research cost to AdAlta. An invoice of GBP100,000 of this first payment has been generated by AdAlta

In an announcement dated 18 September 2019, it was updated to the market that UBS Group AG and its related bodies corporate ceased to be a substantial holder of AdAlta Limited effective from 16 September 2019.

AdAlta has also been awarded a whopping $3.5 million Research and Development (R&D) Tax Incentive rebate for the financial year 2018-2019, as announced on 18 September 2018.

Paul MacLeman AdAlta's Executive Chairman was pleased to receive this non-dilutive funding under the Research & Development Tax Incentive, which would strengthen AdAlta's cash assets and will aid AD-214 on the road to the clinic.

Stock performance

1AD's stock was trading flat at $0.150 (as on 3 October 2019, AEST 12:57 PM). The market capitalisation of 1AD stands at $24.65 million with 164.3 outstanding shares. 1AD stock has provided YTD return of -35.20%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.