What is the meaning of Blue-Chip Stocks?

Blue-chip stocks are generally held at a highest value. When it comes to a companyâs perspective, the blue-chip companies have excellent reputation in the industry. These types of companies have their market capitalisation in the billions, are large sized, as well as financially sound.

Advantages of Investing in Blue-Chip companies:

- In the time of economic recession or turndown, these companies have more stability as compared to others;

- Due to being big in size, they pay a steady dividend to retain their investors.

National Australia Bank Limited

National Australia Bank Limited (ASX: NAB) provides banking, financial and the related services. The bank was listed on Australian Securities Exchange in 1974.

Ross McEwan commences work as NABâs CEO

- The bank through a release dated 20th September 2019, announced that Mr Ross McEwan would start with the National Australia Bank as its Chief Executive Officer and Managing Director on Monday, 2 December 2019.

- It further added that the start date would follow the announcement of his appointment made by the bank on 19th July 2019, when the bank advised that Mr McEwanâs start date at NAB was subject to him fulfilling his obligations as CEO of Royal Bank of Scotland.

Ceasing to be a Substantial Holder

The bank recently published a series of announcement, wherein it has ceased to become a substantial holder:

- National Australia Bank Limited recently announced that its associated entities and the company have ceased to become a substantial holder in Magellan Global Trust from 16th September 2019.

- The bank has made a change to its substantial holdings in Metro Performance Glass Limited on 5th September 2019 and the current voting power stands at 6.557% as compared to the previous voting power of 5.163%.

- In another release, NAB announced that it has ceased to be a substantial holder in Link Administration Holdings Limited from 2nd September 2019.

A look at the Third Quarter of Financial year 2019

The company recently updated the market with the operational and financial performance for the third quarter of financial year 2019:

- The company stated that its Q3 FY19 performance compared with the 1H FY19 quarterly average is solid, with revenue increasing and costs flat against challenging operating environment, including subdued home lending growth.

- The cash earnings witnessed a rise of 1% in comparison to 1H FY19 quarterly average.

- In 1H FY19, the Board of the bank declared interim dividend of 83 cps.

When it comes to the performance of the stock, National Australia Bank Limited last traded at a price of $29.83 per share, with a dip of 0.134% on 27th September 2019. It witnessed a rise of 19.86% in the time frame of six months. On year to date basis, the stock produced a return of 26.41%.

Australia And New Zealand Banking Group (ASX: NAB)

It offers banking and finance related products and services to business and individuals both. The market capitalisation of the company stood at $80.5 billion as on 27th September 2019.

Institutional and Large Corporate banking in PNG

- The company through a release dated 23rd September 2019 announced that it has wrapped up the sale to Kina Bank including its - Retail, Commercial and Small-Medium Sized Enterprise banking businesses in Papua New Guinea. It enables ANZ to focus solely on its Institutional and large corporate banking business in country.

- The key personnel of the bank stated that in accordance, with its strategy of simplifying its business, as well as focusing on customers fueled by trade and capital flows, it is committed to run a world-class Institutional bank throughout its International network.

The acquisition by Kina Bank primarily includes:

- Retail customer deposits and loans.

- Commercial/SME customer loans and deposits.

- ANZ PNGâs 15 retail branch premises.

Pillar 3 Disclosure Statement

ANZ through a release dated 16th August 2019 updated the market with the Pillar 3 disclosure statement for quarter ending 30 June 2019, wherein, following key points were mentioned:

- For the June quarter, the total provision charge amounted to $209 million, which remained broadly flat in comparison to quarterly average of 1H FY19.

- However, the individual provision witnessed a rise of $68 million and the figure stood at $258 million.

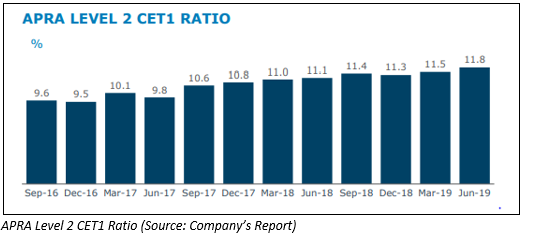

- The group CET1 ratio (APRA Level 2) stood at 11.8% for the same period, reflected a rise of around 30 basis points for the June quarter.

- With respect to housing portfolio, there was a decline of 0.7% in Q3 FY19. There was also decrease of 0.2% and 1.8% in occupied loans and investor loans, respectively.

- In 1H FY19, the bank declared fully franked interim dividend of 80 cents per share.

When it comes to the performance of the stock, Australia And New Zealand Banking Group Limited last traded at a price of $28.68 per share with a rise of 0.986% on 27th September 2019. It witnessed a rise of 9.91% in the time frame of six months. On Year to date basis, the stock produced a return of 19.03%.

Commonwealth Bank of Australia

Commonwealth Bank of Australia (ASX: CBA) provides banking and finance related services. The market capitalisation of the bank stood at $143.71billion as on 27th September 2019.

CBA Instalments

As per the release dated 25th September 2019, the bank provided an update to the market regarding its instalments, wherein the following key points were mentioned:

- As the issuer of instalment warrants over ordinary shares in SPDR S&P/ASX 200 FUND with ASX Codes STWIYE and STWIYF, Commonwealth Bank of Australia Equity Products Group declared the record date for entitlements to the estimated at $0.838779, 0% franked dividend for the STW Commonwealth Bank Instalments to be 30 September 2019.

- It was also mentioned in the release that the trustee would cause payment of the dividend to holders of STW Commonwealth Bank instalments to coincide with receipt of the dividend from STW on 11 October 2019.

Ceasing to Be a Substantial Holder

- The bank recently announced that it has ceased to become a substantial holder in Data#3 Limited from 24th September 2019.

- In another update, CBA announced that in the entity Maca Limited, it has ceased to be a substantial holder from 23rd September 2019.

Issue of Subordinated Notes

- As per the release dated 23rd September 2019, the bank made an announcement that it would issue subordinated notes amounting to $100 million. It added that the $100 million 3.66% subordinated notes due 2034 would be issued subject to its U.S.$70,000,000,000 Euro Medium Term Note Programme.

- It was also mentioned in the release that there would be no material impact on financial position by the issue of subordinated notes.

Financial Performance

- The statutory and cash NPAT of the bank stood at $8,571 million and $8,492 million, respectively.

- The CET1 ratio stood at 10.7%, reflecting a rise of 60 basis points.

- As per the release of FY19 results, the Board of the bank has determined a final dividend of $2.31 per share.

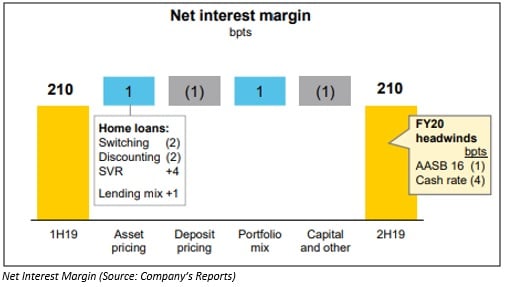

The following picture provides an idea of net interest margin:

When it comes to the performance of the stock, Commonwealth Bank of Australia last traded at a price of $81.54 per share, with a rise of 0.443% on 27th September 2019. It witnessed a rise of 14.81% in the time frame of six months. On year to date basis, the stock produced a return of 14.39%.

Ramsay Health Care Limited (ASX: RHC)

It is a well-known hospital group, which generally owns and runs numerous healthcare facilities.

A brief on Substantial Holdings

Recently, the company has released a series of announcements, wherein it communicated about the change in the substantial holdings:

- RHC stated that UBS Group AG and its related bodies corporate ceased to become a substantial holder in the company on 19th September 2019.

- JPMorgan Chase & Co, and its affiliates ceased to be a substantial holder in RHC on 19th September 2019.

Reduction in Holdings by Paul Ramsay

- As per the released dated 17th September 2019, the company announced that the underwritten block trade sale of 22 million shares in the company to institutional investors at $61.80 per share has been completed by Paul Ramsay Holdings Pty Limited.

- It was mentioned in the release that the settlement was expected to occur on 19th September 2019.

- After the sale of shares by Paul Ramsay, their current voting power stood at 21.3% as compared to the previous voting power of 32.16%.

Financial Performance

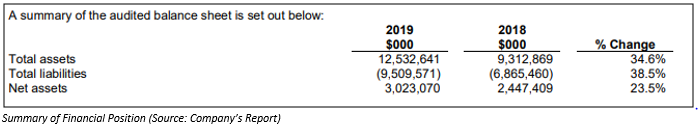

- For the financial year ended 30th June 2019, the company reported statutory net profit, which was attributable to the owners of the parent amounted to $545,473,000, reflecting a rise of 40.5% on the pcp.

- The diluted statutory earnings per share stood at 263.3 cps for the period with a rise of 41.9%.

- The Australian operations of the company reported overall EBITDA growth of 6.0% against pcp.

- The Group consolidated leverage ratio stood at 3.1x as at 30th June 2019.

When it comes to the performance of the stock, Ramsay Health Care Limited last traded at a price of $64.67 per share, with a rise of 1% on 27th September 2019. It witnessed a rise of 0.51% in the time frame of six months. On year to date basis, the stock produced a return of 12.08%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.