The Telecom Service providers have revolutionised the way Australians communicate by delivering boosted wireless connectivity. Fifth generation (5G) superfast wireless networks have practically dwarfed the traditional businesses of telecom operators across the globe. The ever-increasing significance of 5G connectivity is a global trend and provides the main impetus for growth to the telecom industry.

So far, this year, dynamic market conditions and growing consumer choices have given numerous opportunities for telecom companies to augment their revenue sources. In order to enhance data speeds and higher connectivity for customers, telecom carriers are quickly implementing the latest 4G LTE Advanced technologies. At the same time, these companies are developing fibre optic networks to help growth in 4G LTE and 5G wireless standards.

In the present time, communications service providers, video and bandwidth applications companies, are spending more on LTE, broadband and fibre to meet the growing demand of internet and wireless networks.

Robust 5G Network: Lifeline of The World

The success of 5G depends on the actions taken by the operators to transform the joined or multiple-use network structures and data communications, combining voice and video into a single network. Consequently, this helps to develop solutions to boost the convergence of wireless networks. Notably, 5G wireless technology has plenty of scope to expand the total addressable market for wireless carriers and introduce them to different digital ecosystems.

Let have a look at 3 telecom stocks- TPM, TLS and VOC with their recent updates.

TPG Telecom Limited (ASX: TPM)

TPG Telecom Limited is a telecommunications company. It is based in Australia. The company focuses on consumer telecommunications and business internet services. The company has more than 1.9 million group customers and approximately 600,000 live NBN customers.

Recent Updates

On 4th December 2019, the company announced the results of its 2019 Annual General Meeting. All the resolutions were put to vote and were passed. These pertained to the adoption of the FY19 Remuneration Report and the re-election of Joseph Pang, one of the directors of the company.

Will Regulatory Troubles Give TPG Telecom a Tough Financial Year?

Recently, the Australian Government has prohibited the use of equipment from Chinese telecom goods manufacturer Huawei on national security interest in 5G networks. This is likely to inflict a severe blow on the company to deliver its long-term strategies as it was a key element of the companyâs pioneering mobile network design.

Secondly, the ACCC delivered its verdict to disagree with the companyâs proposed amalgamation with Vodafone Hutchison Australia.

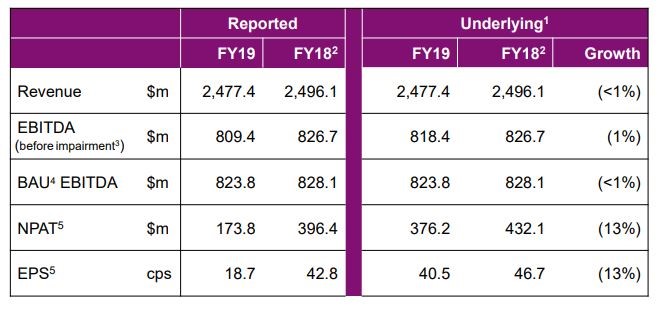

Analysing FY19 Results:

The company has recently provided the financial results for the FY19:

- Revenues in the FY19, came in at $2.477 billion, down approximately 0.7% on a year over year basis.

- Underlying EBITDA during the same time period came in at $818.4 million, a decrease of 1% on a year over year basis.

- Net profit after tax came in at $175 million, a decline of 56% year over year.

- EPS in FY19 stood at 18.7 cents, a decline of 56.2% year over year.

- On a segmental basis, Data/Internet revenue increased by $29.5 million to $592.2 million. However, Voice and Legacy iiNet segment revenue slumped by $15 million and $9.9 million to $115 million and $50.8 million, respectively.

- The net operating cash flow came in at $707.7 million as compared to $673.8 million in FY18.

Financial Summary (Source: Company Report)

What to Expect? The company expects significant margin pressure in the subsequent two years from the NBN rollout plan. However, TPG Telecom Limited is well placed for growth post the end of the NBN rollout.

- BAU EBITDA for FY20 is estimated to be within $735 million -$750 million.

- The company expects FY20 BAU capex to be in the range of $200 million-240 million.

Stock Performance

TPG Telecom Limited has a market cap of $6.4 billion with ~ 927.81 million outstanding shares as on 9th December 2019. The stock was trading at $6.895, down by 0.072 percent ( as on 9 December, at AEST 2:28 PM).

Telstra Corporation Limited (ASX: TLS)

Australiaâs leading technology and telecommunications company, Telstra Corporation Limited offers a wide range of telecommunication and information services like internet and pay television, and mobile telephony. The company in Australia caters to around 18.3 million retail mobile customers, 1.4 million fixed separate voice customers and provides 3.7 million fixed bundled and individual data services.

Focal Points of Investor Day 2019

On 27 November 2019, the company held its Investor Day and following are the highlights:

- The company considers itself as a leader in telecommunications technology. Telstra is one of the first companies to unveil 5G in Australia. The company has more than 10,000 consumers using its 5G technology.

- This year is of vital importance for the company as it started T22 strategy to reinvent the company for the future. Under this strategy, the company is building on the abilities and competencies required to attain its long-term goals.

- The company estimates its FY20 restructuring costs to be roughly $300 million in association with the T22 strategy. By the end of the 2022, the company projects to reduce underlying fixed costs by a cumulative $2.5 billion.

Recent Board Changes

On 3rd October 2019, the company announced that Christian von Reventlow was replaced by Kim Krogh Andersen for the role of Group Executive of Product & Technology, making a major add-on to the companyâs management. Also, he will play an important role in executing the T22 strategy.

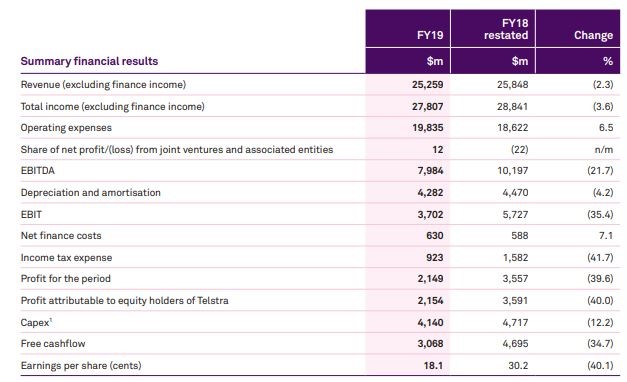

On 15th August 2019, the company announced its FY19 results. Focal points of the results were as follows:

(Source: Company Report)

Outlook for FY20:

The company also updated its outlook for FY20:

- Telstra predicts total income to be between $ 25.7 billion to $27.7 billion,

- Underlying EBITDA is projected to be between of $ 7.3 billion to $7.8 billion,

- Restructuring costs are expected to be around $300 million, whereas, the company expects capital expenditure to be lie between $ 2.9 billion to $3.3 billion.

- Additionally, free cash flow for the period is projected to be between $ 3.4 billion to $3.9 billion after operating lease payments.

- The FY20 underlying EBITDA is expected to increase by up to $ 500 million (excluding the recurring in-year headwind of the NBN).

Stock Performance

Telstra has a market cap of $44.01 billion with ~ 11.89 Billion outstanding shares as on 9th December 2019. The stock was trading at $3.715, up by 0.405 percent (as on 9 December 2019, at AEST 2:31 PM).

Vocus Group Limited (ASX: VOC)

Vocus Group Limited is a specialist fibre player, which provides network services. It links all mainland Australian capital cities with Asia. The company has around a spread of 30,000 km of fibre optic cable across Australia and New Zealand.

Shareholding Update

One of the companyâs directors, Julie Fahey, who holds an indirect interest in Vocus Groupâs ordinary shares, acquired of 7510 ordinary shares for $25,016.57 on 7 November 2019.

On 5 November 2019, the company issued an announcement pertaining to the notice of initial substantial holder. The Vanguard Group Inc became a substantial holder on 30 October 2019 holding 31,045,125 fully paid ordinary shares with 5.003% voting power.

Recently, Nitesh Naidoo has been appointed as Chief Financial Officer (CFO). It will be effective from January 2020. Nitesh has over 20 years of experience as a telco executive, and with this extensive experience and knowledge he is expected to take the company to newer heights and help attain its long-term growth.

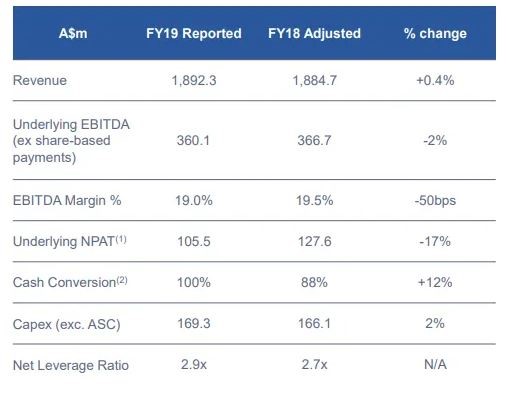

Analyzing FY19 Results:

The company has recently provided the financial results for the FY19:

- Revenues in the FY19, came in at $1892.3 million, up approximately 0.4% on a year over year basis.

- Underlying EBITDA during the same time period came in at $360.1 million, a decline of 2% on a year over year basis.

- Underlying Net profit after tax came in at $105.5 million, a decrease of 17% year over year.

- Capex for the period was $169.3 million, up 2% year over year.

Financial Performance (Source: Company Report)

What to Expect?

The company recently restated its outlook on FY2020:

The company continues to anticipate Underlying EBITDA to be between $359 to $379 million. It is estimated that EBITDA increase of $20 to $30 million in Vocus Network Services, will be offset by a subdued Retail business.

The company expects Vocus Network Services to positively impact EBITDA growth in FY2021. The company also expects stable growth in New Zealand during the same period.

Stock Performance

Vocus Group Limited has a market cap of $1.85 billion with ~ 620.57 million outstanding shares on 9th December 2019. The VOC stock was trading at $2.955, down by 0.839% (as on 9 December, at AEST 2:32 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)