The benchmark index S&P/ASX 200 was trading in green at 6,757.9, up by 40.4 points or 0.6%, with S&P/ASX 200 Information Technology (Sector) trading upward by 10.4 points (0.75%) to 1,393.6 and S&P/ASX 200 Consumer Discretionary (Sector) trading at 2,612.5, up 23.3 points (0.89%), on 20 September 2019 (AEST 01:54 PM).

Below discussed are three companies from information technology and consumer discretionary sectors. All these companies have delivered positive returns to their investors for the last six months and on a year-to-date basis. Let us have a look at their recent updates and stock performance on the ASX.

Afterpay Touch Group Limited

Afterpay Touch Group Limited (ASX: APT) is an ASX-listed payment service provider that has two main products and businesses- Afterpay and Pay Now (Touch). The company has its presence in Australia, New Zealand, Europe, and the United States. The company is listed on the Australian Stock Exchange under the ticker APT.

FY2019 Highlights

On 28 August 2019, the company declared its financial results for FY2019. Few highlights of the results are as below:

- Global underlying sales increased by 140% to $5.2 billion from $2.2 billion in the last year (FY2018).

- Active customer base grew by 130% 4.6 million compared to the previous year

- Active merchant base also surged by 101% to 32,000

- Total income (pro-forma) for Afterpay increased by 115% to $251.6 million

- Cash in hand stood at over $230 million

- Debt decreased by $111.4 million or 69% from the previous year

- Underlying free cash flow stood at $33.3 million

- Global merchant acquisition run rate is in excess of 1,900 new merchants every month

Source: Companyâs Report

Outlook

For FY2020, APT plans to

- Continue to invest in growing global merchants and customers, as well as technology and people platforms.

- Continue boost its customer base in the United States and the United Kingdom

- Roll out new features

Stock Performance

The stock of APT was trading at $33.220 on 20 September 2019 (AEST 01:56 PM), up 1.311% from its previous close. The company has a market cap of $8.28 billion and approx. 252.64 million outstanding shares. The 52-week high and low value of the stock is at $34.280 and $10.360, respectively. The stock has generated a positive return of 58.94% in the last six months and 173.25% on a year-to-date basis.

Kogan.com Limited

Kogan.com Limited (ASX: KGN), headquartered in Melbourne, manages retail and services businesses. The company has more than 2k brands across various categories, including hardware homeware and electronics. All these brands are offered via its business units - Kogan Retail and Kogan Marketplace. The company also owns and operates 18 exclusive private label brands. Other business units of the company are Kogan Travel, Kogan Internet, Kogan Mobile, Kogan Health and Kogan Insurance.

Recent Updates

- On 4 September 2019, Credit Suisse Holdings (Australia) Limited and its affiliates ceased to a substantial holder of KGN.

- On 27 August 2019, the company announced changes to the director interest for Mr Ruslan Kogan. After the change, the director holds 335,000 fully paid ordinary shares in the name of Walsh St Management Pty Ltd ATF Walsh S Trust and 20,797,522 fully paid ordinary shares in the name of Kogan Management Pty Ltd ATF the Ruslan Tech Trust.

- Additionally, there was a change in the director interest for Mr David Shafer, who now holds around 8.09 million shares in the name of the Shafer Corp Pty Ltd ATF the Shafer Family Trust.

Financial Highlights

On 20 August 2019, Kogan announced financial results for the period ended 30 June 2019. Few highlights from the results are:

- The company reported gross sales of $551.8 million, up by 12% on the previous corresponding year

- Revenue stood at $438.7 million, up by 6.4% year-on-year

- Gross profit reached $90.7 million, representing an increase of 12.5% on the previous year

- EBITDA was up by 15.6% to $30.1 million

- KGN had cash of $27.5 million and inventories of $75.9 million at the end of FY2019

- The board also declared a final dividend of 8.2 cents per share, with total dividend for the year reaching 14.3 cents per share

Stock Performance

On 20 September 2019 (AEST 02:00 PM), the stock of KGN was trading at $6.280, up 0.48% from its previous close. The company has ~93.96 million outstanding shares and a market cap of $587.25 million. The 52-week high and low value of the stock is at $6.930 and $2.610, respectively. The stock has generated a positive return of 66.67% in the last six months and 79.08% on a year-to-date basis.

Wesfarmers Limited

Wesfarmers Limited (ASX:WES), headquartered in Western Australia and founded in 1914, is a provider of home improvement and outdoor living solutions, apparel and general merchandise, and office supplies. Additionally, the company has businesses in fertilisers, chemical, energy and safety products. WES has a shareholder base of 490,000.

Scheme Update

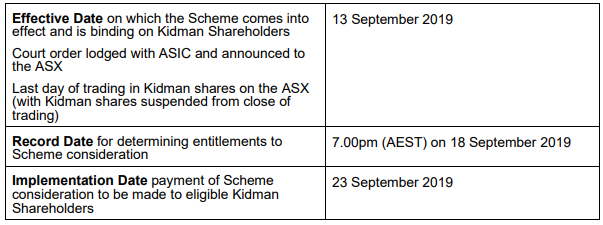

On 13 September 2019, Kidman Resources Limited (ASX:KDR) announced that the scheme of arrangement, under which Wesfarmers Limitedâs wholly owned subsidiary Wesfarmers Lithium Pty Ltd would acquire all the issued ordinary shares of Kidman, has become legally effective. The scheme has secured approval from the Federal Court of Australia and a copy of the court orders has been submitted with the with the Australian Securities and Investments Commission.

Timetable and Next Steps (Source: Companyâs Report)

Timetable and Next Steps (Source: Companyâs Report)

On 5 September 2019, the companyâs shareholders voted in favour of the scheme of arrangement. The ordinary shares of Kidman are being acquired at a price of $1.90 cash per share.

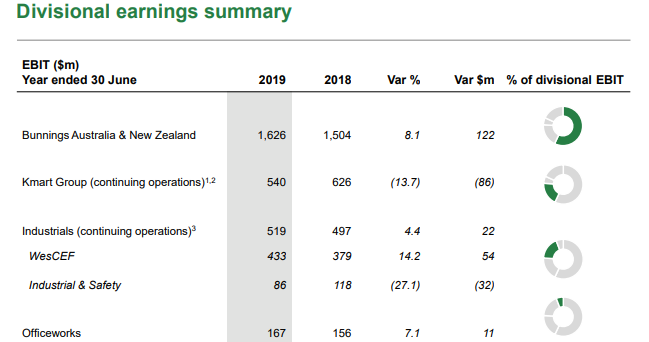

FY2019 Highlights

- Free cash flow reduced to $2.96 billion in FY2019 from $3.42 billion in FY2018

- Gross capital expenditure decreased by $80 million to $860 million

- Net profit after tax from continuing operations increased by 13.5% year-on-year to $1.94 billion

- Divisional cash generation from continuing operations remained strong at 97%

- The company operating cash flow stood at $2,718 million which is impacted by the demerger of Cole, Divestment of Bengella and removal of associated earning cash flow

Source: Companyâs Report

Total dividend for the year stood at 278 cents per security.

Outlook

All the divisions would remain focused on long-term business success and delivering shareholder value. The company would maintain focus on developing a deeper & broader digital offer and developing great talent & teams, as well as driving entrepreneurial initiative. Additionally, the company remains well placed for a range of economic conditions.

Stock Performance

On 20 September 2019 (AEST 02:03 PM), the stock of KGN was trading at $39.910, up 1.552% from its previous close. The company has ~1.13 billion outstanding shares and a market cap of $44.56 billion. The 52-week high and low value of the stock is at $40.430 and $29.537, respectively. The stock has generated a positive return of 13.42%in the last six months and 28.20% on a year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.