Small cap stocks are the stocks of those companies that have a market capitalisation near to the low end of the public traded spectrum. The market capitalisation of the company can be calculated by multiplying the current market price of the share to the total number of outstanding shares of the company.

These stocks show a higher growth possibility as compared to bigger companies. The smaller companies enjoy the larger rooms for future growth and provide attractive options for investors. The spikes in the share price are more in case of small cap stocks as compared to mid and large cap stocks. These spikes in the share price provide the investor an opportunity to earn more in the short span of time.

However, the risk associated with small cap stocks is also more in comparison with other stock categories. Moreover, there are chances of steep fall in their share prices too, which can result in losses for the investors.

As small cap stocks are less liquid, the low liquidity results in the potential unavailability of the stocks at a decent price and sometimes it is very difficult to sell these shares due to the price of the stocks. The investors should do all the due diligence about the companies before investing in their stocks.

Let us take a look at two mining stocks from the small cap space – Om Holdings Limited and Cygnus Gold Limited.

OM Holdings Limited (ASX: OMH)

Integrated manganese and silicon company, OM Holdings Limited has more than 20 years of experience in the industry and intends to become the primary ferroalloy supply partner to major steel mills and other industries.

Approval for Staged Recommencement of In-Pit Mining Operations

On 24 December 2019, OM Holdings announced that its wholly owned subsidiary OM (Manganese) Ltd has received approval for the company for the recommencement of in-pit mining operations at the Bootu Creek Manganese Mine.

The Northern Territory Department of Primary Industry and Resources provided the approval, as the mining operations were suspended in August 2019 after a fatal accident and tragic death of Mr Craig Butler. The recommencement can be done in phases, with each stage subject to independent review and approval by nominated parties.

Investor Presentation

On 28 November 2019, the company released an investor presentation, discussing Bootu Creek mining operations update, Sarawak Smelting operations update, and other business aspects. A few highlights from the presentation are as follows:

Ø Under the Bootu Creek mining operations update, the company highlighted that it is focusing on restarting mining while exploring expansion projects.

Ø For the Sarawak Smelting operations, OM Holdings is focusing on optimising production, and diversifying customers by producing higher value products. Its Phase II-A expansion projects are nearing the completion stage, while Phase II-B expansion projects involve the increase of 2 to 4 new manganese furnaces and upgrading of 2 existing furnaces to metallic silicon.

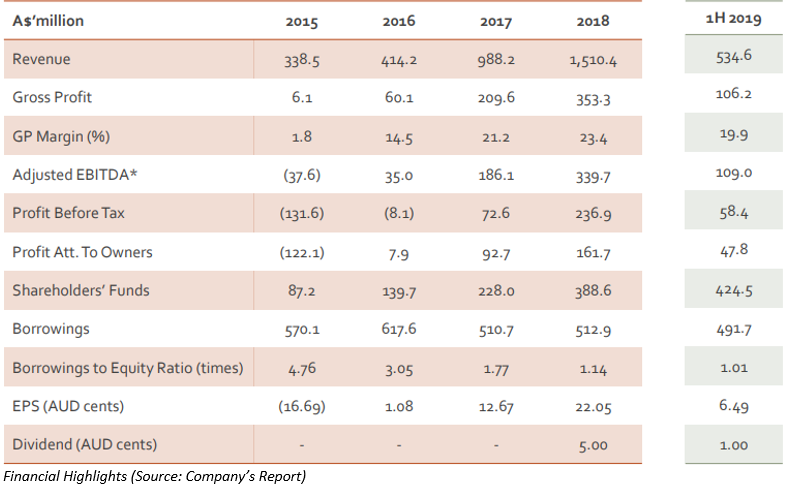

Ø The company achieved $109 million in EBITDA in 1H 2019.

Proposed Listing on Bursa Malaysia

On 31 October 2019, the company announced plans regarding a secondary listing of its ordinary shares on the main market of Bursa Malaysia Securities Berhad, as OM Holdings seeks to boost its potential shareholder base while increasing liquidity.

· The company has appointed UOB Kay Hian Securities (M) Sdn Bhd as the primary advisor for the proposed secondary listing;

· The proposed secondary listing execution is still in a preliminary stage and would be subject to requisite approvals from the relevant authorities in Australia and Malaysia;

· Assuming prevailing market conditions and all the relative terms & conditions related to the proposed secondary listing process are appropriate, it is expected that the exercise could be completed by the third quarter of 2020.

Stock Performance of OM Holdings Limited

The stock of OMH closed the day’s trading at $0.465 on 30 December 2019, down by 8.824 per cent from its previous close. The company has approximately 738.62 million outstanding shares and a market cap of $376.7 million. The 52 weeks low and high value of the stock is $0.395 and $1.430, respectively. The stock has generated a negative return of 39.64 per cent in the last six months and a negative return of 59.20 per cent on a year to date basis.

Cygnus Gold Limited (ASX:CY5)

Cygnus Gold is engaged in the discovery high graded gold deposits within the Wheatbelt region of Western Australia. The company is also managing two significant joint venture (JV) agreements with ASX-listed Gold Road Resources, whereby the company is managing exploration on the Lake Grace with an interest of 49% and Yandina Projects with an interest of 25%.

On 27 December 2019, the company informed that Gold Road Pty Ltd has decided to withdraw from the Wadderin Letter Agreement, and the program and budget for 2020 related to the Lake Grace and Yandina Joint Ventures are currently in the process of being finalised.

Bencubbin North Project Drilling Update

Cygnus Gold recently updated the market with the progress of the drilling program at its wholly owned Bencubbin North Project, comprising three granted tenements (E70/4988, Bencubbin, E70/5169, Bencubbin North and E70/5168, Bencubbin South). The company has drilled forty-eight holes of a 4000m aircore program, which is designed to test high priority nickel and base metals targets at the project.

The drilling program is co-funded by a grant from the WA Government’s Exploration Incentive Scheme (EIS), a strong endorsement of the Company’s technical team and projects.

The aircore program has now been paused for the Christmas break and is expected to resume early in the New Year. The company is expecting to receive the final analytical results from the samples from these first group of holes submitted to a laboratory in late-January 2020.

Change of Director’s Interest

On 9 December 2019, the company notified regarding a change in its director’s interest (Mr Michael Bohm) with effect from 4 December 2019. The number of securities held by the director after change is fully paid ordinary shares: 4,226,669 and unlisted performance rights: 100,000.

Stock Performance of Cygnus Gold Limited

The stock of CY5 traded flat at $0.044 on 30 December 2019, with approximately 68.25 million outstanding shares and a market cap of $3 million. The 52 weeks low and high value of the stock is $0.025 and $0.098, respectively. The stock has generated a positive return of 46.67 per cent in the last six months and a negative return of 32.31 per cent on a year to date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.