About Dividend

When one buys a share of a company, he/she becomes an owner (partly) of the company, and dividends represent his/her share in the profits made by the company. Generally, when a company earns profits, it becomes part of cash and cash equivalents in the balance sheet. The decision henceforth lies with the board of directors on the utilisation of this cash, which ideally happens in four ways:

- Saving the excess cash for future use (reserves and surplus);

- To reduce the companyâs debt;

- Buy-back of shares;

- Payment of dividends

Importance of Dividend

Dividend is not fixed income, but generally, investors rely on it as a source of income as companies pay dividend from time to time and investors ideally create a portfolio that welcomes a planned dividend from time to time. This can be applied for older people who use this method as a proficient retirement plan. For the younger generation, who have other sources of income as well, re-investing the amount in buying more shares through Dividend Reinvestment Plans is a feasible option.

Scale for Measuring Dividend

The most commonly used and most effective way of measuring dividend is through Dividend Yield, which is calculated by dividing the companyâs annual dividend by its current market price. Generally, it is considered that a higher dividend yield is better, though a much higher dividend yield might be risky as it becomes more unsustainable. However, there is one way to check the dividendâs safety- by looking at its payout ratio, or in simple words- the portion of profit that the company is paying off in a way of dividend. If itâs more than 90%, the dividend yield might be unstable.

Why do Companies Pay Dividend?

Dividend is considered as a reward to the companyâs investors, for keeping their trust on the company. If a company pays high dividend, it is believed to be doing well, as a result of which shareholders are rewarded with dividend. Moreover, it hints that the company does not have any major upcoming plans to generate better returns.

In this context, let us look at two companies - Telstra Corporation Limited and Premier Investment Limited.

Telstra Corporation Limited

About the company- Telstra Corporation Limited (ASX: TLS) is an Australian technology and telecom player, which offers a wide range of communication services. The company majorly operates in Australia and has over 350 retail stores. It delivers 3.7 million retail fixed bundles, 18.3 million retail mobile services and 1.4 million retail voice services. The market capitalisation of the company is $42.22 billion, as on 19 September 2019.

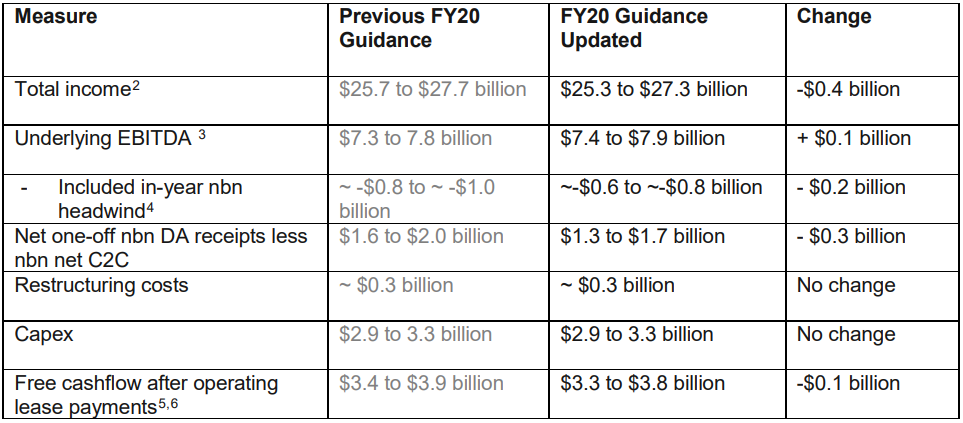

Changed guidance for FY20 due to NBN Corporate Plan 2020- Telstra recently changed its guidance for FY20, after the release of NBN Coâs Corporate Plan 2020, which gave an updated information of the companyâs outlook for FY20, unveiling a reduction in the total number of premises forecast which were supposed to be connected in FY20. The number decreased from 2 million to 1.5 million, a drop of 25%. These 500,000 reductions would be divided into two parts- 400,000 less brownfield premises and 100,000 less Greenfield premises that were supposed to be connected in FY20.

Revised FY20 Guidance (Source: Companyâ Report)

Revised FY20 Guidance (Source: Companyâ Report)

Financial Highlights- The company reported a decline in revenue of 3.6% in FY19 to $27.8 billion. Reported EBITDA also slumped by 21.7% to $8 billion. The net profit after tax of the company stood at $2.1 billion, down by 39.6%.

Dividend- The company announced to pay a fully franked dividend of 8 cents per share, which comprises of 5 cents per share of ordinary dividend and 3 cents per share of special dividend. For FY19, the shareholders of TLS would be given a total dividend of 16 cps.

The dividend payout ratio for ordinary dividend is 59% and 63% for special dividend. The annual dividend yield of the company stood at 2.82% on 19 September 2019.

Stock Performance- On 19 September 2019, the TLS stock closed the dayâs trade at $3.63, up 0.42% from the prior close. In the last six months period, the stock has generated a positive return of 9.78% and has a PE multiple of 19.610x.

Premier Investment Limited

About the Company- Premier Investment Limited (ASX: PMV) is an investment vehicle focused on acquiring, owning and operating businesses in the areas of retail, consumer products and wholesale. The market capitalisation of the company is $2.4 billion as on 19 September 2019.

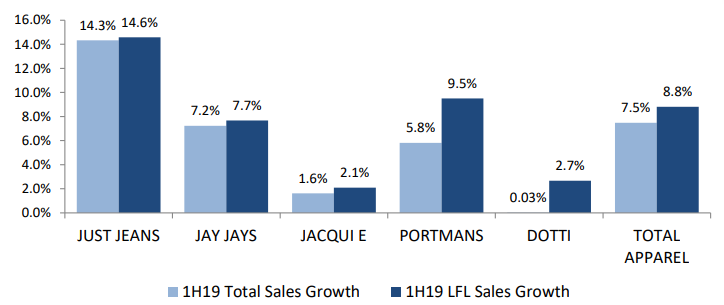

Half yearly result review- PMV reported a net profit after tax of $88.8 million in 1H19, up by 13% as compared to 1H18. Premier Retail delivered record sales of $680.2 million, up by 8% as compared to 1H18. EBIT increased by 11.1% to $113.9 million in 1H19. In 1H19 Apparel Brands registered strong sales growth, with sales up by 7.5%. Online sales were up by 35.2% to $75.7 million as compared to 1H18.

Apparel Brands deliver strong sales growth- The ANZ regionâs retail environment was competitive during 1H19. PMVâs Apparel Brands continued its focus on the key strategies and delivered excellent results with like-for-like sales up by 8.8% and total Apparel Brand sales up by 7.5%.

Apparel Brands Sales growth Source: Companyâs Report

Strong gross margins- Premier Retail reported a gross margin of 63% by implementing key long-term foreign currency hedging policies allowing for long-term merchandise planning. Direct sourcing sustained to bring benefits from new and existing suppliers by devoting in better merchants and bringing better products.

Focus on CODB- The Cost of Doing Business (CODB) was down by 68 basis points, as a percentage of sales to 46.3%. The company continued to control its cost despite the structural inflationary strain. In the last one-year, Premier Retail shut down 16 stores, in order to close unprofitable stores, taking the total closed stores to 101 over the past 6 years.

Dividend- The PMV Board increased its record interim dividend by 13.8% (compared to 1H18) to 33 cents per share. The annual dividend yield of the company is 4.3% as per ASX.

Stock Performance- On 19 September 2019, the PMV Stock closed the dayâs trade at $15.71, up by 3.9% from the prior close. In the last six months period, the stock has generated a negative return of 7.07% and has a PE multiple of 25.480x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.