Retail sector -An Overview

Australia is one of the most developed societies in the world, with about 90 per cent of people living in the urban areas of Sydney, Brisbane, Perth, Adelaide, and Melbourne, as well as smaller town and cities within 100 miles of the ocean.

Despite, rising household debt and low increase in wages, the Australian retail sector showed a positive growth. The sector has grown significantly with 3.7 per cent year on year in September 2018. The future of the Australian retail sector largely depends on consumer spending pattern, and there is a significant shift in the consumer spending pattern due to the advancement in technology.

Australia is currently the tenth largest eCommerce market by revenue in the world. People are spending more time on online platforms and buying them more frequently. It was predicted that by the end of the year 2019, the Australian online businesses would see a 15.1 per cent growth in the revenue and online shoppers will reach ~ 20.3 million, which is 5 percent greater than last year.

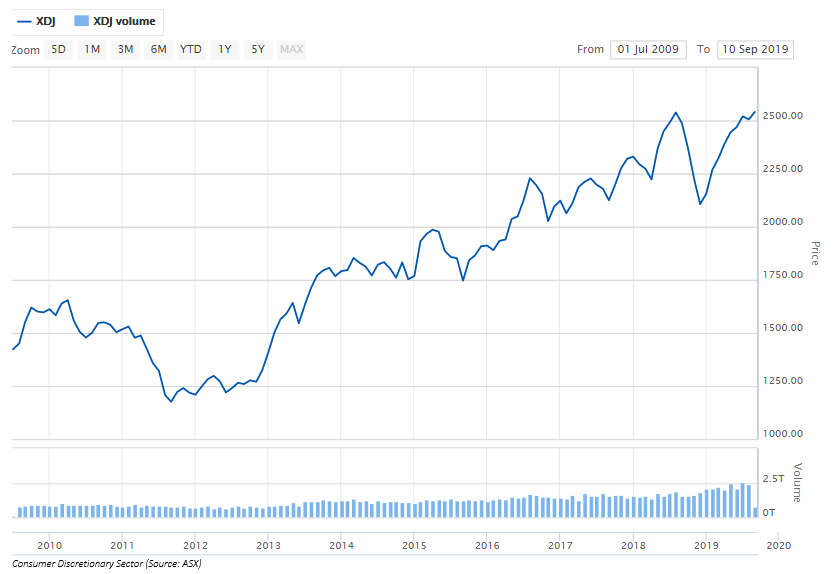

Consumer Discretionary, a part of the retailing group of industries, is gaining traction among the investors, since it is unfazed by the economic ups and down faced by the nation. On 12 September 2019, the S&P/ASX 200 Consumer Discretionary (Sector) was trading at 2,575.9 points, with a fall of 0.03% (at AEST 2:21 PM).

In the above image, we can see the upward trend in the S&P/ASX 200 Consumer Discretionary (Sector) index for the last one-decade period.

Let us now discuss five Consumer Discretionary stocks in detail:

JB Hi-Fi Limited

JB Hi-Fi Limited (ASX: JBH) headquartered in Victoria, Australia is a retailer of electronics and music goods such as car sound system, consumer electronics, DVDs and music with a number of stores located in different Australian states. JBH is segregated into 3 divisions, namely, JB HI-FI Australia, The Good Guys, JB HI-FI New Zealand. The company also offer consulting and IT services through its wholly owned unit JB Hi-Fi Solutions.

Recent Updates

On 10 September 2019, JBH notified that Mitsubishi UFJ Financial Group, Inc. ceased to be the substantial holder of the company from 5 September 2019.

On 4 September 2019, JBH had declared to the market that Mitsubishi UFJ Financial Group, Inc. became the substantial holder with 5.31 per cent of voting right in the company.

Additionally, on 3 September 2019, JBH declared that Ausbil Investment Management Limited ceased to be a substantial holder in JB Hi-Fi Limited, effective 30 August 2019.

Financial Highlights

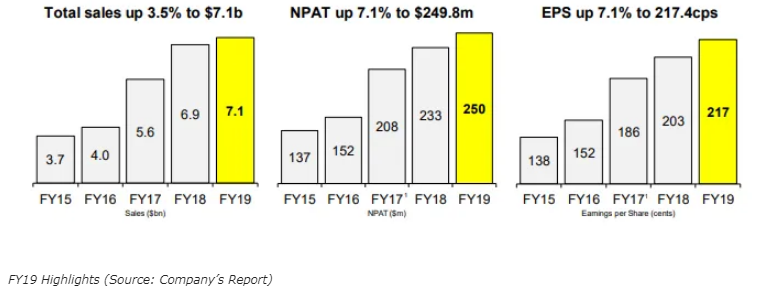

Below are the highlights of FY 2019 results, which was released on 12 August 2019, for the period closed 30 June 2019.

- The companyâs total sales increased by 3.5 per cent to $7.1 billion compared to the previous corresponding period.

- The net profit after tax went up by 7.1 percent to $249.8 million and EPS increased by 7.1 per cent to 217.4 cps.

On 12 September 2019, JBHâs stock was trading at AUD 33.91, up by 0.563 percent (as on AEST 03.16 PM). The company has ~114.88 million shares outstanding, and a market cap of AUD 03.87 billion. The 52-week high and low value of the stock was noted at AUD 34.090 and AUD 20.300, respectively, at the time of writing the report.

Nick Scali Limited

Nick Scali Limited (ASX: NCK) is Australiaâs biggest importers of good quality furniture. The company was listed on Australian Stock Exchange in 2004, classified under the Consumer Discretionary sector. NCK products include of lounges, dining tables, dining chairs, buffets, coffee tables etc. The company is involved with sourcing the retailing of furniture utilised in the houses and accessories associated to it. Nick Scali functions brands, comprising of Nick Scali brand, containing more than forty stores, and Sofas2Go that has ~ 5 stores.

Recent Updates

On 10 September 2019, Nick Scali notified that UBS Group AG and its related bodies corporate have ceased to be the substantial holder of the company w.e.f 5 September 2019.

On 6 September 2019, the company announced that itsâs Annual General Meeting would be held on 29 October 2019, at its head office, NSW.

Financial Highlights

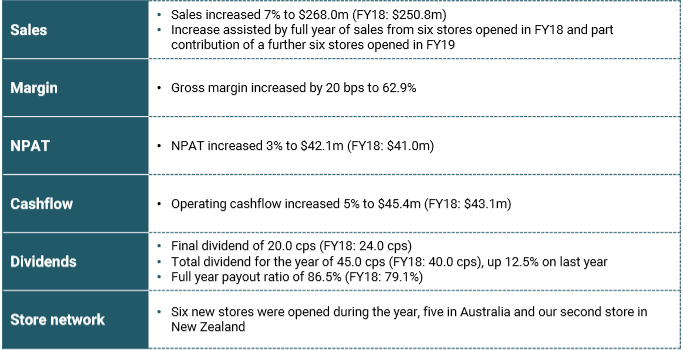

On 8 August 2019, Nick Scali released its FY 19 results, for the period ending 30 June this year, marking its 7th consecutive record profit, with NPAT reported to be at $42.1 million up by 2.8 per cent from previous corresponding year. Also, sales revenue increased by 7 per cent to $268.0 million (FY18: $250.8 million) and gross margin was up by 20bps to 62.9 per cent.

The company also declared the final dividend of 20.0 cps, to be paid by 29 October this year. It has an ex date of 7 October this year and would go record on 8 October this year.

FY 19 Highlights (Source: Companyâs Report)

FY 19 Highlights (Source: Companyâs Report)

Stock Performance

On 12 September 2019, NCKâs stock was trading at AUD 7.085, slipping by 0.631 percent (at AEST 3:58 PM). The company has ~81 million shares outstanding, and a market cap of AUD 577.53 million. The 52-week high and low value of the stock was at AUD 7.390 and AUD 4.800, respectively, at the time of writing the report.

Kathmandu Holdings Limited

Kathmandu Holdings Limited (ASX: KMD) is a specialist outdoor retailer and develops sustainable products like equipment and clothing associated with travel. The company opened its first store in 1987. Kathmandu Holdings product breakdown includes approx. 60 per cent of Apparel and 40 per cent of equipment.

Recent Updates

On 12 September 2019, the company notified that with regards to its Annual Shareholder Meeting, the last date to accept director nominations is 27 September this year.

On 4 September 2019, KMD declared that Jarden Partners Limited changed its substantial holding by ~1 per cent with 13.497 per cent as total percentage held in class and 30,603,351 of total number held in class, and total in class standing at 226, 739, 717.

Additionally, on 14 August 2019, the company announced the lapse of 537,848 performance rights.

Financial Highlights

On 8 August 2019, the company announced unaudited financial results for FY 2019 ending 31 July 2019. Total sales of the company increased by 9.6 per cent to NZ$545 million in FY 2018, Same store sales growth of the group increased by 0.6 per cent at the constant exchange rates. Net debt of the company decreased to NZ$19.2 million from NZ$31.4 million (FY 18), Normalised EBIT of the company was between NZ$82.5 million and NZ$84.0 million.

Stock Performance

On 12 September 2019, KMDâs stock last traded at AUD 2.41, rising by 0.837 percent from the last close. The company has ~226.74 million shares outstanding, with a market cap of AUD 541.91 million. The 52-week high and low value of the stock was at AUD 3.180 and AUD 1.955, respectively, at the time of writing the report.

Kogan.com Limited

Kogan.com Limited (ASX: KGN), headquartered in Melbourne, has retail and services businesses. The company contains more than 2,000 brands across a wide range of categories including homewares, hardware and electronics. The company also owns and operate 18 exclusive private label brands.

Recent Updates

On 4 September 2019, KGN announced that Credit Suisse Holdings (Australia) Limited ceased to a substantial holder of the company.

On 27 August 2019, the company announced the change in one of its directorâs interest Mr. Ruslan Kogan. After the change on 23 August 2019, the director now holds 335,000 fully paid ordinary shares in the name of Walsh St Management Pty Ltd ATF Walsh S Trust and 20,797,522 fully paid ordinary shares in the name of Kogan management Pty Ltd ATF the Ruslan Tech Trust.

Additionally, KGN announced the change of interest in director - Mr David Shafer. He now holds 8,098,236 shares in the name of the Shafer Corp Pty Ltd ATF the Shafer Family Trust.

Financial Highlights

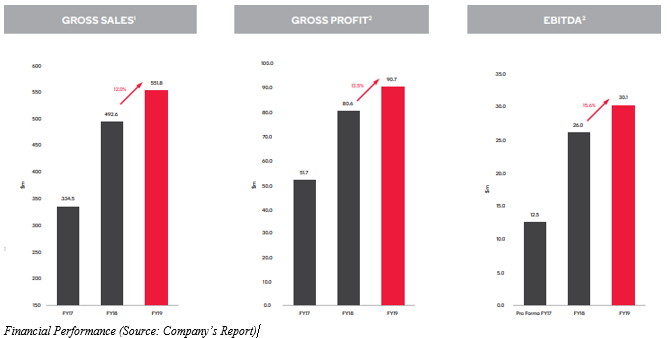

On 20 August 2019, Kogan declared the financial results for the period ended 30 June 2019. The company reported gross sales of $551.8 million, up by 12 per cent on previous year corresponding year and revenue of $438.7 million, up by 6.4 per cent. The gross profit stood at $90.7 million, up by 12.5 per cent on the previous year, while EBITDA was up by 15.6% to $30.1 million, KGN possessed cash of $27.5 million and inventories of $75.9 million.

Stock Performance

On 12 September 2019, KGNâs stock, by the end of the trading session was at AUD 6.640 on with a fall of 0.747 per cent from the previous close. The company has ~93.96 million shares outstanding, and a market cap of AUD 628.59 million. The 52-week high and low value of the stock was at AUD 6.930 and AUD 2.10, respectively, at the time of writing the report.

Premier Investments Limited

Premier Investments Limited (ASX: PMV) is an Australian company that provides maximum growth in capital returns to shareholders with the acquisition of strategic shareholdings of the Australian premier companies. PMV was listed on the stock exchange on 15 December 1987.

Financial Performance & 2020 Outlook

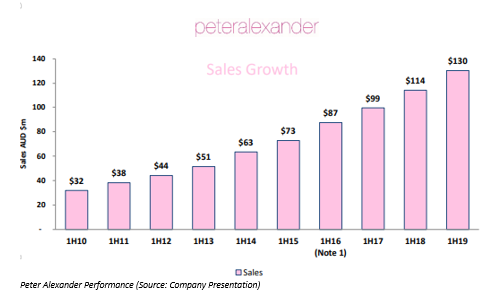

On 22 March 2019, PMV declared half-year report ending 26 January this year wherein, PMV mentioned that Peter Alexander delivered sales of 1H19 of $130.4 million up from 14.1 per cent on 1H18. The Premier Retail also achieved growth in online sales and continues to invest in this channel. Peter Alexander brand is well ahead of 2020 projected growth plan of providing $250 million sales by 2020. The brand had earlier planned to open 40 new stores between FY18-FY20, and the company had already opened 26 stores, proving that they are well ahead of the plan.

Stock Performance

On 12 September 2019, PMVâs stock trading settled at AUD 15.900, with a rise of 0.76 per cent. The company has ~158.43 million shares outstanding, and a market cap of AUD 2.5 billion. The 52-week high and low value of the stock was at AUD 20.160 and AUD 13.610, respectively, at the time of writing the report.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.