In the recent past, property related stocks have delivered decent dividend returns for the investors. However, from the earnings point of view, the scenario of property segment seems to be gloomy as the real estate in Australia is going through a challenging time. Overall, the real estate segment posted mixed results in H1FY19. Few companies delivered decent growth, while others in the same segment failed to grow from the earnings point of view. Thus, most of companies across the segment is opting for Qualified Institutional placement.

Letâs go through a few stocks from the real estate sector:

Abacus Property Group:

Abacus Property Group (ASX : ABP) is an asset management company, which deals with investment across office spaces, self - storages, residential, commercial and industrial real estate properties The company derives its income from rental incomes. Also, ABP was listed on ASX in the year 1999.

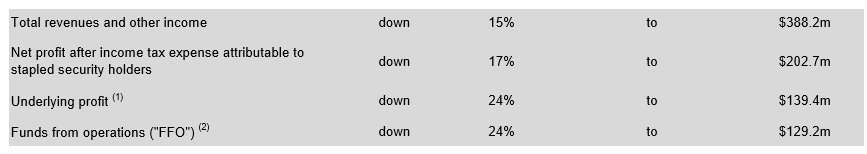

FY19 Financial Highlights: Abacus posted FY19 annual report, for the period ending 30 June 2019 on 16th August 2019 and reported revenue of $388.2million (down 15% y-o-y). Underlying net profit during the period stood at $139.4 million (down by 24% y-o-y basis). Funds from operations in FY19 stood at $129.2million vs $169.8 million in FY18. Interest coverage ratio for ABP came at 6.6 times.

Source: Companyâs Report

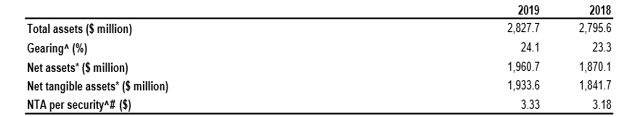

Total assets for the period, stood at $2,827.7 million vs $2,795.6 million a year ago. Capital gearing ratio stood at 24.1 percent. However, net assets stood at $1,960.7 million. Value of net tangible assets came at $ 1933.6 million.

Source: Companyâs Report

Dividend: The board of the company has declared an unfranked dividend of AUD 0.0925, for the six months period ending 30 June 2019. The dividend has a record date of 28 June 2019, ex-date of 27 June 2019, and is to be paid by 30 August 2019.

Acquisition of 201 Elizabeth Street, Sydney NSW: On 9th August 2019, with a press release ABP announced its joint acquisition of the building - 201 Elizabeth Street. The other party related to the acquisition is Charter hall Group (ASX: CHC). Abacus will retain 32% of the stake worth $201.6 million. Total consideration for the acquisition stood at $630 million. The transaction fees would be paid in two tranches, and Abacus & Charter hall will have full control after paying the first tranche.

201 Elizabeth Street is a premium property situated in a prominent position with Elizabeth Street and park street located in each corner. The property has a front view of Hyde Park along with through site link to Museum Station and upcoming Pitt Street Metro Station. The building has an area of 38,934sqm NLA spread over 38 levels. The building was constructed in 1979, and the above investment will deliver a market yield of 5% and c. $16,000 sq metres of net lettable area.

Outlook: The company on the outlook front, has stated that it would execute strategic objectives including of- enhancement of its investment in longer dated core plus and develop to core office assets, raising its investment in self-storage. The distribution guidance would range between 2 to 3 percent increase for FY 20 period. Also, the payout ratio for the FY 20 period is anticipated to grow to 85 to 95 percent.

Stock Performance: On 19th August 2019, the stock of ABP closed at A$3.9, down by 3.226% from the previous trading session. The 52-week trading range of the stock stands at a high of A$4.380 and low of A$3.120. The stock was quoted at a P/E multiple of 11.530x with an annualised dividend yield of 4.59%. The market capitalisation of the stock stands at A$2.59 billion with outstanding shares of ~643.85 billion. The stock has performed well in the recent past and delivered decent returns of 7.47% and 11.33% in last three months and six months, respectively.

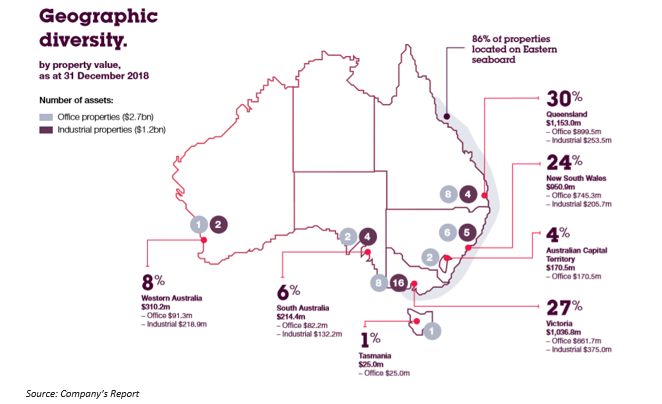

Growthpoint Properties Australia

Growthpoint Properties Australia (ASX : GOZ) is into management of quality investment property and focusses on its ownership as well. The company has a diversified portfolio of 57 office and several industrial properties which is valued at $3.8 billion. The properties of the company are located at Western Australia, Victoria, Queensland, New South Wales etc.

In a market update on 30th July 2019, GOZ has declared that it had issued 5,933,623 Stapled Securities at an issue price of A$3.97 per new stapled security. The securities were issued on 31st July 2019 under the security purchase plan as the subject of the Appendix 3B. Earlier, on 15th April 45,231 Stapled Securities were issued under a voluntary resignation deed between the entity and the entityâs former Chief Operating Office.

Completion of security purchase plan: GOZ, on 28th June, has informed about the successful completion of security purchase plan (SPP) announced to the Australian Securities Exchange (ASX), which was first disclosed on Growthpointâs $150 million institutional placement update on 27th June.

As per the SPP booklet released to ASX on 3 July 2019, GOZ was seeking to raise a capital infusion of approximately $15 million under the SPP. Meanwhile, the SPP got oversubscribed, with approximately $23.6 million and the management decided to increase the amount of capital raised under the SPP offer up to $23.6 million. Thus, the company had issued 5,933,623 million new stapled securities in Growthpoint (SPP Securities) on 31st July 2019.

The company, on 15th July this year, informed about the announcement of its upcoming results for the period ending 30 June 2019, on 22nd of August via teleconferencing and webcast. The company will post its numbers at 16:00 (AEST Melbourne time).

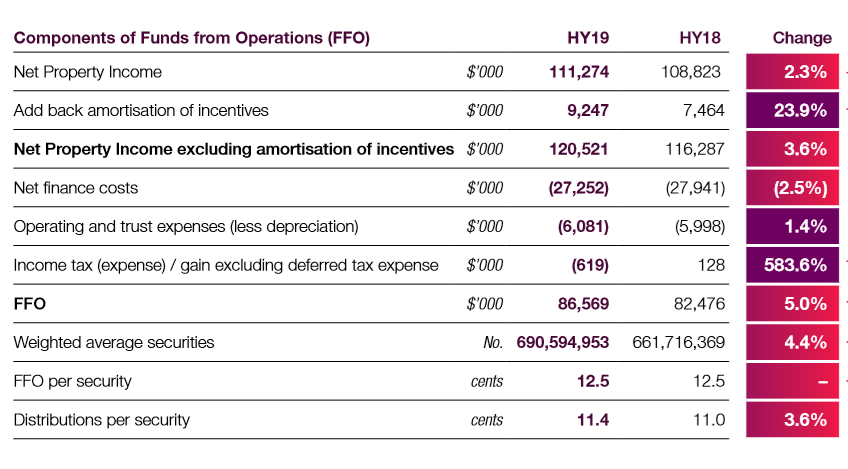

H1FY19 updates: The company has posted Net Property Income excluding amortisation of incentives standing at $120,521, ~ 3.6% y-o-y. FFO of the company came during H1FY19 at $86,569, ~5% y-o-y.

Source: Companyâs Report

Stock Performance: On 19th August, GOZ has closed at A$4.4, up by 1.382% from its previous EODâs price. GOZ has a market capitalisation of A$3.35 billion followed by a dividend yield of 5.3% annually. At the current market price, the stock is available at a p/E multiple of 8.770x. The total number of shares outstanding for the company is at ~771.51 million. In the last three and six months the stock has delivered positive return of 0.93% and 7.43%, respectively.

Cromwell Property Group:

Cromwell Property Group (ASX : CMW) is an asset management entity, which has its investments across real estates and properties in Australia. The company operates in three segments, which are Direct property investment, Indirect property investment and Funds and asset management.

Dividend distribution: On 2nd of August 2019, the company has declared dividend against each ordinary share held for the quarter ending 30 June 2019. The amount of fully franked dividend per share stands at AUD 0.01812500. The record date of the dividend was of 28th June 2019 followed by ex-date of 27th June 2019. The dividend is to be paid by 23 August 2019.

Sale of Northpoint tower: On 1st July, the company has announced the selling of its real estate property at Northpoint Tower for a price of $300 million. The buyer of the aforesaid property was Early Light International, a Hong-Kong based company. CMW sold its 50% stake to the Hong-Kong based company.

SPP Oversubscribed: The company, with a press release on 26 July 2019 had announced the conclusion of its security purchase plan on 24th July 2019. Further on 31 July 2019, the company mentioned that it had received an application for ~$32.5 million for capital infusion, depicting an oversubscription amount of ~$2.5 million. The reason behind the placement was to support strategic growth opportunities across Australia and Europe. The company has an intention to utilise the proceeds, with recycled capital from asset sales to deliver $1 billion of accretive value-add development opportunities throughout CMWâs Australian Core+ and Active real estate portfolio.

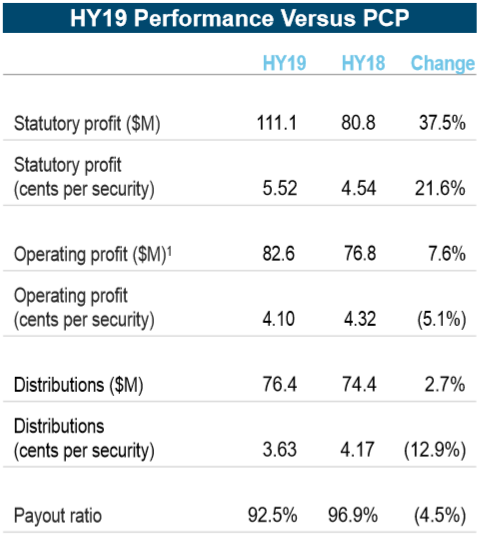

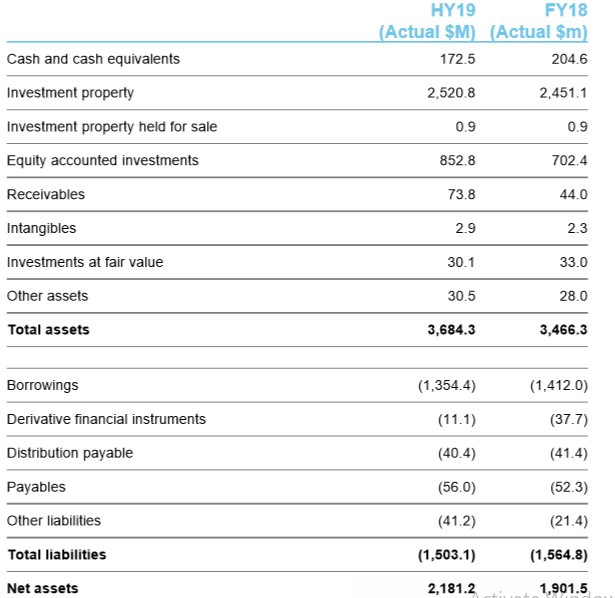

H1FY19 update: The company during H1FY19 released on 28 February 2019, for the period ending 31 December 2018 has declared a Statutory Profit of $111.1 million, up 37.5% on pcp basis (H1 18 $80.8 million) followed by H1FY19 Operating Profit standing at $82.6 million, grew 7.6% on y-o-y basis. Cash balance of the company stood at $172.5 million. Total assets increased by increased by 6.3%. Total borrowings of the company came down at $ 1,354.4 million from $ 1,412.0 million in H1FY18. Total receivables stood at $ 73.8 million vs $ 44 million on H1FY18.

Source: Companyâs Report

Source: Companyâs Report

Stock Performance: The Stock of CMW closed at A$1.21 on 19th August 2019, up by 0.412% from previous dayâs closing price. The stock has given a healthy dividend yield of 5.97% annually. The total market cap of the company stands at A$3.15 billion, followed by ~2.59 billion outstanding shares. The stock has a P/E multiple of 10.24x. CMW has delivered a positive return of 3.40% and 11.47% in the last 3 and 6 months, respectively. The 52-week trading range of the stockâs low was noted at A$0.980 to a high of A$ 1.270.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.