While the reporting season is around the corner, there are some ASX-listed coming coming up with key financial updates. It includes Elders Limited from agribusiness sector, Tabcorp from entertainment industry and Abacus from real estate.

Elders Limited (ASX: ELD)

Elders is an ASX-listed agribusiness company that provides specialised knowledge and expertise to farmers and other market players of the agriculture industry.

Acquisition of AIRR

The company recently inked an acquisition deal with AIRR Holdings Limited to purchase 100% of its shares at a consideration of A$10.85 per AIRR share. The consideration values AIRR at $187 million on the basis of enterprise value and at $157 million on the basis of an equity. Moreover, both the parties have agreed to implement the acquisition by way of scheme of arrangement under which AIRR will be entitled to receive 50% of consideration in cash and 50% of consideration in the form of Eldersâ shares.

As per the companyâs information, the acquisition has the potential to deliver net synergies within the range of $6.6 and $9.3 million annually, which is projected to be gradually realised over the next two years. Elders eyes the transaction to create value for shareholders through EPS accretion as well as provide new growth avenue through access to independent retailers.

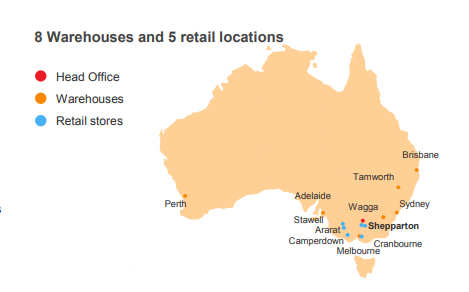

Established in 2006, AIRR brings in large scale national wholesale business with a network of eight warehouses. It presents a member-based marketing and buying platform for rural merchandise as well as pet and produce stores operating independently.

AIRR Business Portfolio (Source: Elders Presentation)

Capital Raising

Elders is funding the purchase price for the AIRR acquisition, transaction costs and repayment of debt through capital raising. It includes the equity raising of $137 million by a way of an institutional placement and an accelerated non-renounceable entitlement offer, fully underwritten by Macquarie Capital Limited.

Looking forward, the company expects its Pro forma FY19 return on capital (ROC) to be ~16% before synergies and ~17% post synergies. Estimated pro forma FY19 average net debt / EBITDA is anticipated to be < 2.0x before synergies.

ELD shares last traded at $7.190, down 0.691%, on 24 July 2019. The stock closed at a Price to Earnings multiple of 14.600x with a market capitalisation of $976.76 million.

Over the past 12 months, the stock has dropped 1.21% despite a positive price change of 16.17% in the past three months.

Tabcorp Holdings Limited (ASX: TAH)

Gambling and entertainment services company, Tabcorp Holdings Limited has witnessed a 8.73% growth in its share price since the start of 2019 (year-to-date).

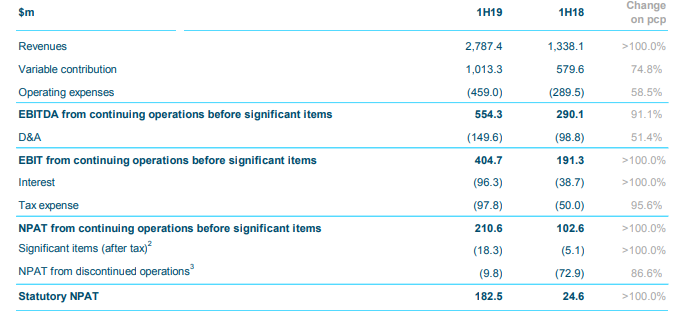

The company reported 1HFY19 revenue of $2787.4 million from continuing operations that reflects a 108.3% improvement compared to the previous corresponding period. EBITDA grew up 91.1% to $554.3 million for the six months ended 31 December 2018.

On the bottom line front, Groupâs statutory net profit after tax (NPAT) stood at $182.5 million, straight up from $24.6 million in previous corresponding period. TAHâs solid results in 1H19 outlines the diversification benefits led by the combination with Tatts besides the increase in digitalisation of companyâs lotteries and wagering business.

Snapshot of Tabcorpâs 1HFY19 Group Results (Source: Company Announcement)

Tabcorp stated that its integration with Tatts is progressing well, driving the EBITDA synergies and business improvements of the company. In 1H19, the integration delivered $24 million in EBITDA from cost synergies and business improvements on the back of organisational restructure and consolidation of information technology, among other things. Moreover, Tabcorp has upgraded its Fiscal 2019 guidance from previous $50 million to $55 million of EBITDA from synergies and business improvements in FY19. Overall, the group now targets to deliver $130 million-145 million EBITDA synergies and business improvements in Fiscal 2021.

TAH stock price closed at $4.590, down 0.434%, on 24 July 2019. The stock last traded at a price to earnings multiple of 54.880x with a market capitalisation of $9.31 billion.

Over the past 12 months, the stock has dropped by 0.86% including a negative price change of 5.53% in the past three months.

Abacus Property Group (ASX: ABP)

Real Estate company, Abacus Property Group announced a trading halt on 24 July 2019 to release the price sensitive information in relation to capital raising.

In a subsequent announcement coming on the same date, Abacus provided a business update and launched a $250 million placement to fund value accretive opportunities. Over the course of FY19, Abacus has increased exposure to its key focus sectors of Office and Self Storage through a series of acquisitions and partnerships.

Its FY19 unaudited underlying profit stood at 24.0 cents per security, with Funds from Operations of 22.2 cents per security and declared distribution of 18.5 cents per security. Abacus marked a solid progress during FY19 on its transition towards being a high conviction active owner, investor and manager, of long term value enhancing investments driving increases to preliminary unaudited net property rental income of $114 million, an 8% growth on FY18.

Abacus also announced that it is undertaking an equity raising comprising:

- a fully underwritten institutional placement to raise approximately $250 million (Placement) at a fixed issue price of $3.95 per new security.

- a non-underwritten security purchase plan to raise up to $25 million

The company intends to utilise the proceeds from equity raising to pursue in excess of $710 million of value-accretive identified opportunities in line with its strategic priorities and key sector focus of Office and Self-Storage. These identified opportunities include Australian Unity Office Fund (AOF), Church Street, Richmond VIC, Self-Storage and Sydney CBD Office asset.

Abacusâ Managing Director, Steven Sewell stated that Abacus is well advanced on its strategy to transition to a more annuity style, strong asset backed business model. The Equity Raising enables Abacus to accelerate this transition and positions Abacus for future growth beyond the near-term identified opportunities, with low gearing and over $900 million of acquisition capacity.

On completion of the placement, the company expects its pro forma gearing to reduce to 15% prior to funding the identified opportunities. Whereas, assuming all the identified opportunities are undertaken, pro forma gearing is reportedly expected to be approximately 27% remaining well below its target maximum gearing limit of 35%.

Abacus provides preliminary guidance for FY20 distribution per security growth of 2% - 3% on the declared FY19 distribution, including the impact of the placement. The report read that the payout ratio for FY20 is expected to increase to 85% to 95% of FFO, with the higher payout ratio expected to be supported by the increased contribution from more annuity style earnings.

ABP last traded at $4.270 with a PE of 9.740x as at 24 July 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.