The Australian resource sector provides economic wealth, jobs and investment to the citizens. In addition, the resources commodities generally comprise of six of Australiaâs top ten goods i.e iron ore, coal, natural gas, gold, aluminium and petroleum. At the time of writing on 10th September 2019, the S&P/ASX 200 Resources sector is trading in red zone i.e 4,645.5 with a fall of 0.14%.

Syrah Resources Limited

Syrah Resources Limited (ASX: SYR) is largely into sales of natural flake graphite and continuing development of logistics. Recently, Syrah through a release dated 10th September 2019 provided an update to the market on the current natural flake graphite market as well as its planned near-term operational responses.

Natural Graphite Market

The company stated that the prices of spot natural flake graphite in China have witnessed a sudden and material decline. This was primarily because of depreciation of Chinese Yuan and Chinese inventory level problems. These have impacted price negotiations and renewal of contracts. This will expectedly weaken prices in the fourth quarter. The graphite market has also been impacted by cuts in Chinese electric vehicle subsidies, effective at the end of June, which have impacted near-term graphite demand growth for lithium-ion batteries in China as well as International trade tensions and tariffs which continue to weigh on consumer sentiment.

Operational Response

It was mentioned in the release that the companyâs 2019 production strategy and ramp up has been piloted by increasing production in accordance with market demand. On the back of current price indications, the company would maintain production, which is focused on value over volume and disciplined cash conservation. The near-term plan of the company is as follows:

- It will conduct an orderly decrease in production volume to the end of Q3 2019.

- Syrah will be performing an instant review of further structural cost rationalization at Balama as well as throughout the company.

- Syrah Resources Limited would work closely with suppliers, employees, customers, and other stakeholders in managing the effect of revised operational plans.

- Additionally, it will be holding a full-scale review for FY 2020.

Performance of Quarter

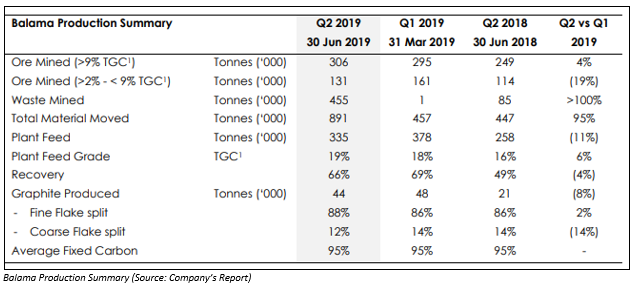

In the second quarter ended 30th June 2019, the net cash outflow from the operating activities stood at US$8.581 million after paying major payments for production and staff costs of US$29.55 million and US$5.424 million, respectively. The following picture depicts an overview of production at Balama for the quarter ended 30th June 2019:

On the stockâs performance front, the stock of Syrah Resources Limited was last traded at a price of A$0.470 per share on 10th September 2019. It provided negative return of 42.79% in the period of six months. On YTD basis as well, the stock witnessed a decline of 52.67%.

Newcrest Mining Limited

Newcrest Mining Limited (ASX: NCM) is engaged in exploration, development and operation of mines. It is also engaged in the sale of concentrates of gold and copper.

Key Takeaways from CLSA conference

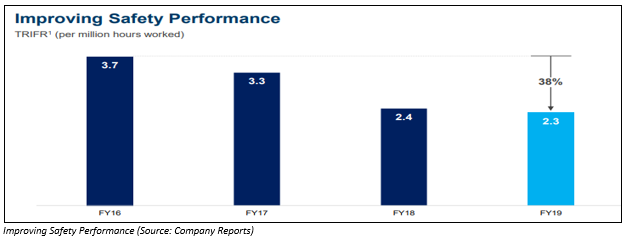

Safety has been its key priority, considering that the company reported Total Recordable Injury Frequency Rate of 2.3 in FY19. NCM added that its three safety pillars continue to deliver improvement, which includes

- A strong safety culture

- Critical controls for every high-risk task

- Process safety management

A look at FY19 Performance:

When it comes to production from operations, the company posted record annual gold production by Cadia operation of 913 thousand ounces of gold in FY19 against 600 thousand ounces of gold in FY18. In Cadia, the company also reported record low annual AISC (All in Sustained Cost) of $132 per ounce in FY19 in comparison to $171 per ounce in FY18.

In financial year 2019, the company has maintained an operating discipline in a rising gold price environment, wherein it reported all-in sustained cost for recently reported quarter of $1016 per ounce for Newmont Mining. It reported lowest All-In Sustaining Cost of $738 per oz for Newcrest Mining for the quarter ended March 31, 2019.

In the release, the company stated that it has settled the acquisition of 70% of the Red Chris mine in Canada on 15th August 2019, which was announced on 11th March 2019. The company added that for the wrap up of acquisition transaction for the final purchase price of $804 million is subject to debt and net working capital adjustments. The company reported free cash flow of $804 million, reflecting a rise of 34% will all operations having positive free cash flows. When it comes to debt position, the company has recorded a decline of 62% in net debt and the figure stood at $395 million as at 30th June 2019.

Dividend

The dividend policy of the company looks to provide a balance to the capital commitments as well as financial performance with cautious gearing and leverage levels. The company is aiming to provide a total dividend payout in the range of 10-30% of free cash flow (FCF). The Board of the company has recommended a fully franked final dividend amounting to US14.5 cps, which brings the full year dividend to US$22 cps. The payment date for the final dividend is 26th September 2019.

On the stockâs performance front, the stock of Newcrest Mining Limited was last traded at a price of A$34.160 per share on 10th September 2019. It provided return of 39.87% in the period of six months. On YTD basis as well, the stock of NCM provided return of 63.84%.

New Hope Corporation Limited

New Hope Corporation Limited (ASX: NHC) is primarily involved into exploration of coal as well as development of project in Queensland.

Pause in Trading

As per the release dated 10th September 2019 by Australian Stock Exchange, the securities of New Hope Corporation Limited would be under a trading halt on the back of request made by the company. The company requested for trading halt is because of pending of releasing an announcement. The pause in trading will be active unless decision is made to the contrary by Australian Stock Exchange. In the event of ASX does not make any decision, the securities would remain in pause until the earlier of the starting of normal trading on 12th September 2019.

Some Glimpses from Quarterly Activities:

The company recently updated the market with performance for the quarter ended July 19, wherein it stated that the total saleable coal production witnessed a rise of 39% and total sale of coal was 32% higher in comparison to the previous corresponding period primarily because of the increased ownership in the Bengalla mine. NHCâs share of coal produced at Bengalla within the Quarter was 2.0mt, which reflects an annualised run rate performance of 10 mtpa

When it comes to safety, the company reported 7 people experiencing a recordable injury, which led to disappointing result for quarter. However, the company has begun a Critical Risk* Management Program in July 2019 with personnel from each site attended a two-day Risk Workshop in Muswellbrook.

Update on Colton Project

New Hope Corporation Limited announced that in proceedings brought against Wiggins Island Coal Export Terminal Pty Ltd as well as others in the Supreme Court of NSW, NHC and its relevant subsidiaries were successful in getting a declaration that NHC was not bound by a Deed of Cross Guarantee to guarantee the debts of Northern Energy Corporation Ltd and Colton Coal Pty Ltd. In addition, it was also mentioned in the release that Wiggins Island Coal Export Terminal Pty Ltd has filed an appeal with the Court of Appeal in NSW, which is related to the decision made by Supreme Court of New South Wales.

On the stock price performance front, the stock of New Hope Corporation Limited was last traded at a price of A$2.340 per share on 9th September 2019. It provided negative return of 43.61% in the period of six months. On YTD basis as well, the stock of NCM witnessed a decline of 28.88%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.