On 26 August 2019, the S&P/ASX 200 Information Technology (Sector) closed at 1,293.3, down 2.03%, while the benchmark index settled at 6,440.1, depicting a fall of 1.29%. Letâs take a look at the recent updates of 5 IT stocks listed on the Australian Stock Exchange.

Hansen Technologies Limited

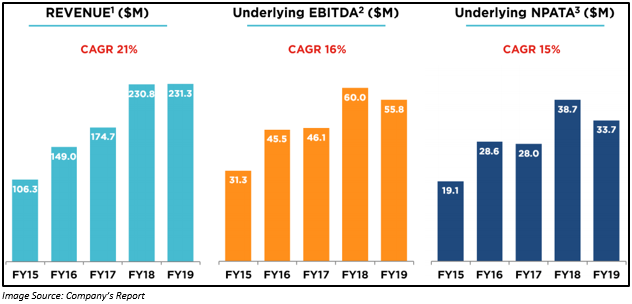

On 23 August 2019, Hansen Technologies Limited (ASX:HSN), the top global provider of customer management, data management as well as billing software for the utilities and communications sectors, released its full-year results for FY2019 ended 30 June 2019.

The companyâs FY19 results were as per the guidance. HSN during the period registered operating revenue of $231.3 million, up by 0.2% as compared to FY2018. The underlying EBITDA decreased by 6.9%, while underlying NPATA declined by 12.8% and adjusted EPS fell by 13.5%. The company declared a final dividend of 3 cents per share (partially franked), scheduled for payment on 26 September 2019. The net debt of the company by the end of FY2019 was $148.3 million.

Operational Highlights:

- The company was able to secure a major contract during the period to deliver its second billing system in Finland.

- Another major contract was won by the company during the period to provide the next-generation Meter Data Management solution in Sweden.

- At present, there are 20 customers in the Nordic region, using the new Utility analytics SaaS product.

- A total of 8 clients upgraded to the new version of the companyâs US municipalities billing system.

- Being the existing MDM solution provider for a major distributor of energy in Australia, the company was selected to deliver a new network billing solution, ensuring metering and billing are in a single system.

- The Vietnam development centre has grown to 100 people from 9 people since the last year.

- The company acquired Sigma Systems during the period for A$163 million. Sigma offers catalog-driven software products for companies operating in the telecom, media and high-tech sectors.

Outlook:

The company expects its operating revenue to be in the range of $305 million to $310 million, while EBITDA is expected between $70 million and $76 million. The guidance is inclusive of a full year contribution from Sigma; however, it excludes the impact of IFRS 16 as it would take effect in FY20.

Stock Information:

The stock of HSN closed trading at A$3.560 on 26 August 2019, down 7.05% from its previous closing price. HSN has a market capitalisation of A$757.06 million with approximately 197.66 million outstanding shares, an annual dividend yield of 1.57% and a PE ratio of 35.140x.

Iress Limited

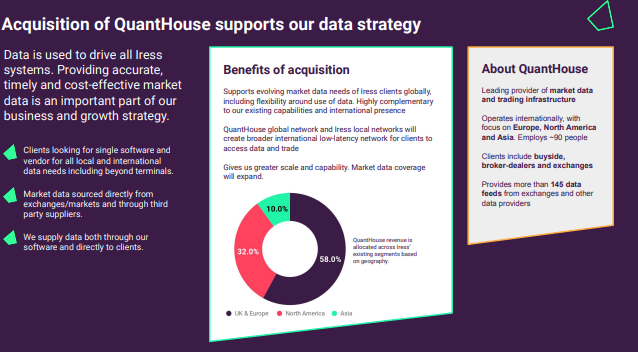

Iress Limited (ASX: IRE), a provider of IT solutions to financial market participants and wealth managers, released its 1H 2019 results for the half-year ended 30 June 2019, on 23 August 2019. Group revenue during the period increased by 5% to $241.8 million as compared to the prior corresponding period (pcp), backed by underlying performance in Australia, UK and South Africa. Moreover, the acquisition of international market data business QuantHouse fueled the group revenue. Overall revenue growth was in line with the companyâs expectations.

Source: Companyâs Report

IRE reported a 10% growth in the group segment profit to $74.1 million. Its reported NPAT for the period stood at $30.4 million, a decline of 5% when compared with the same period a year ago. IRE declared an interim dividend of 16 cents per share, which is 10% franked. The companyâs fundamentals remained strong for the period with cash conversion of 100% in the half, recurring revenue, which is around 90% and a net debt balance of $193.3 million.

FY19 Outlook:

The company expects register 6% and 11% ($146 million-$153 million) growth in segment profit in 2019. Total non-operating costs are expected to be in the range of $4 million -$6 million for the year 2019, including QuantHouse transaction and integration costs.

Stock Information:

The stock of IRE closed trading at A$12.430 on 26 August 2019, down by 5.905% as compared to its previous closing price. IRE has a market capitalisation of A$2.31 billion with approximately 174.75 million outstanding shares, an annual dividend yield of 3.48% and a PE ratio of 36.290x.

Adslot Ltd

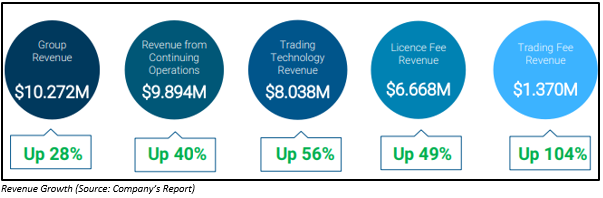

On 23 August 2019, online and digital media player Adslot Ltd (ASX:ADJ) released its full-year results for the year ended 30 June 2019. Group revenue increased by 28% year-on-year to $10.272 million, while revenue from continuing operations went by 40% to $9.894 million, revenue from trading technology surged by 56% to $8.038 million, licence fee revenue grew by $6.668 million and trading fee revenue went by 104% to $1.370 million as compared to the previous corresponding period.

The operating cost of Adslot declined during the period, while EBITDA and NPAT improved in FY2019. The EBITDA loss dropped by 59% to $2.619 million in FY19 from $6.34 million in the same period a year ago. The net loss after tax declined by 40% to $7.043 million on pcp.

Cash receipts during the period increased by 110% to $17.401 million, while net operating cash outflows reduced by 79% to $1.110 million. The net cash and cash equivalents at the end of FY19 were $8.166 million.

FY2020 Strategic Objectives:

- Execution of master service agreement with six global agency holding companies.

- Expansion of sources of supply on the Adslot Media marketplace.

- Maintaining focus on cost management.

Stock Information:

The stock of ADJ closed trading at A$0.027 on 26 August 2019, down by 6.897% as compared to its previous closing price. ADJ has a market capitalisation of A$46.05 million and approximately 1.59 billion outstanding shares.

LiveTiles Limited

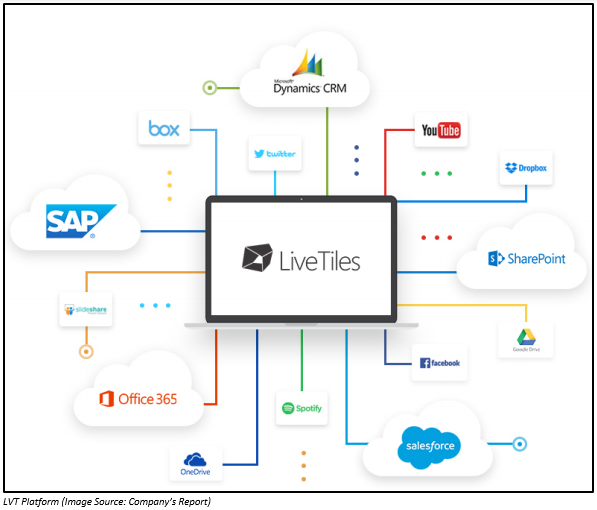

On 23 August 2019, LiveTiles Limited (ASX:LVT), a global software company that allows its users to create their own intelligent workplace experience, announced its strategic partnership with GO1.com. Under the terms of the collaboration, LVT would combine its intelligent workplace technology with the online platform of GO1.com and provide targeted learning solutions based on the profile of an employee. Go1.com is the largest online compliance, professional development and training marketplace in the world. It provides online training and development services to more than 1.5 million learners from 1,000+ organisation.

As per the agreement, LVT would be utilising its artificial intelligence capabilities of Intelligent Directory, powered by LiveTilesâ Hyperfish product. Through this, enterprises would be provided with a complete training and learning solution. It would provide a valuable resource to help employee onboarding, tracking as well as ensuring compliance with regulatory training needs and for ongoing training and development of the employee. Enterprises would be able to create their own courses as well as create innate, sophisticated reporting to stay on top of the growth of their team. They would also be able to select from a catalogue of more than 500k courses developed by experts around the world.

The strategic partnership with GO1.com would help the company in expanding its potential reach into the established customer base of GO1.com. Both the partners would be able to expand their existing customer footprints, look for further opportunities and quickly bring innovation to the market.

Stock Information:

The stock of LVT closed trading at A$0.440 on 26 August 2019, down by 4.348% as compared to previous closing price. LVT has a market capitalisation of A$303.91 million and approximately 660.67 million outstanding shares.

Codan Limited

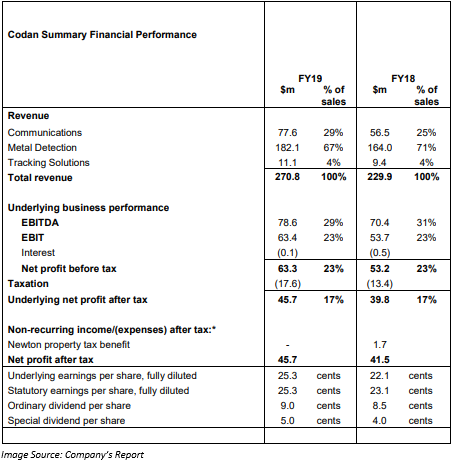

Codan Limited (ASX:CDA), an Australia based technology company, released its full-year results for the period ended 30 June 2019, on 26 August 2019. The company reported record sales of $271 million for the period. The statutory net profit after tax for the period was $45.7 million, on the back of a consistent level of gold detector sales into Africa. Moreover, the FY19 record profit can be attributed to strong growth in sales of recreational metal detectors and a successful transition into systems and solutions for the companyâs communications business.

For Codan Communications, sales grew by 37% to $78 million, while segment profit went up by 147% to $16.7 million. In the past, the company had expected its base-business sales to be in the range of $65 million to $75 million per annum. With the successful expansion into the global military market, the companyâs base-business to sales increased and is now in the range of $70 million to $80 million per annum.

The annual dividend for FY2019 was 9 cents per share. The company also announced an annual special dividend of 5 cents per share (fully franked). CDA has maintained a strong balance sheet with net assets increasing from $188.065 million in FY2018 to $211.214 million in FY2019. The net cash and cash equivalents by the end of FY2019 were $37.521 million.

Operational Highlights:

The company made heavy investments in new products and expanded into new markets to widen its sales and lessen earnings volatility.

Codan Limited during the period stepped towards the development of its second simultaneous multi-frequency coin, Multi-IQ® and treasure detector, VANQUISH⢠which is expected to be released in 1H FY2020. A Minelab sales and distribution centre was established in Brazil in order to increase the companyâs market penetration into the key gold detecting regions of Latin America. Development of new Sentry® Military Manpack was completed during FY19, as a result, enabling the company in expanding its communications offering to the military market. The company also integrated high-precision tracking capability of Minetec into Caterpillarâs Minestar® underground solution desgned for hard-rock mines

Outlook:

Owing to these initiatives, in addition to the investments in FY2019, the company has increased its base-business sales to a range of $200 million - $220 million and NPAT to $28 million - $33 million. It represents an 11% increase in base-business sales as well as profitability.

Stock Information:

The stock of CDA closed trading at A$4.500 on 26 August 2019, up by 3.211% as compared to its previous closing price. CDA has a market capitalisation of A$781.43 million with approximately 179.23 million outstanding shares, an annual dividend yield of 1.95% and a PE ratio of 16.210x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice