While several countries across the world are waking up to the benefits of medicalised/legalised marijuana, the industry has boomed rapidly and is one of the fastest growing markets in the world. Meanwhile, Australiaâs cannabis market is also in an exciting phase of development, facing significant opportunities in the local and global markets, with some tight government licensing policies still in place.

Following are the five Australian companies engaged in the cannabis business.

Cannabis and Hemp Player, ECS Botanics sets for ASX listing

About the business: Tasmania, Australia-based ECS Botanics Pty Ltd was established in February 2018, following the changes to the Australian food standards code in November 2017 which permitted the sale of low psychoactive hemp seed as a food in Australia. It is an agribusiness and food company focussed on industrial hemp which has been granted all necessary Industrial Hemp Licenses required for the cultivation, manufacturing and distribution of its wholesale and retail products.

ECS Acquisition Update: On 15 February 2019, Axxis Technology Group Ltd (ASX:AYG) announced to have signed a binding term sheet for the acquisition of 100% of the issued capital of hemp product company ECS Botanics Pty Ltd. AYG has no current assets and was suspended from the Official List on 22 September 2016. Accordingly, AYG now seeks to be re-admitted to the Official List on the basis of ECSâ industrial hemp business.

To execute the acquisition, AYG will be required to comply with Chapters 1 & 2 of the Listing Rules (Recompliance). On completion of the acquisition, AYG proposes to change its name to reflect the ECS Botanics brand.

As per the term sheet, AYG would be undertaking a pro rata non-renounceable rights issue of its fully paid ordinary shares on the basis of 2 New Shares for every 9 existing shares held. According to the latest prospectus lodged on 10 May 2019, AYG is conducting two offers:

- Public Offer: To raise a minimum of $4,500,000 up to a maximum of $6,500,000, to fund the activities of the Company (after the Acquisition of ECS) via a public offer of up to 162,500,000 Shares at an issue price of $ 0.04 each.

- Vendor Offer: AYG will issue 287,500,000 Shares and 131,250,000 performance rights to the vendors of ECS (no funds to be raised) as consideration for the Companyâs acquisition of 100% of the issued share capital of ECS.

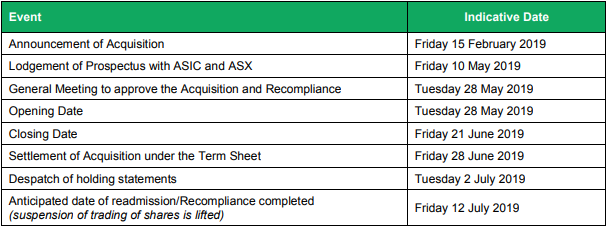

The indicative timeline for the acquisition is as follows:

Source: Axxis Technology Groupâs Prospectus

Creso Pharma Limited

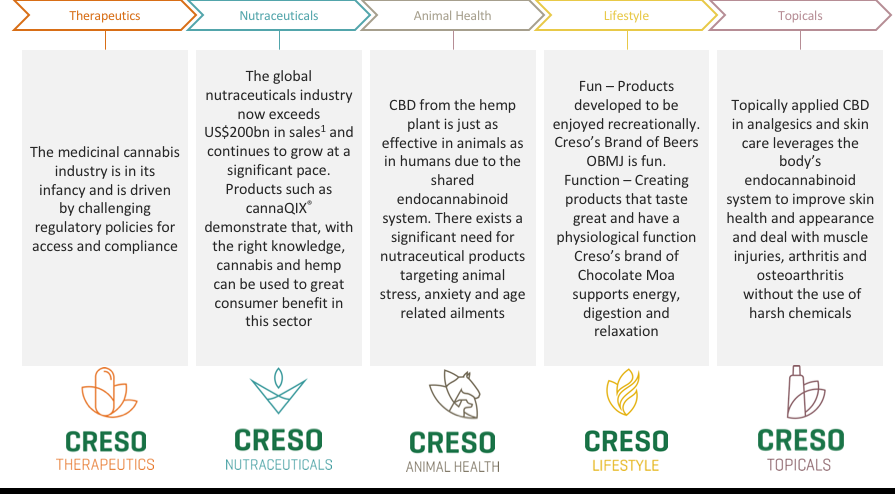

About the business: Creso Pharma Limited (ASX: CPH) provides cannabis derived therapeutic grade nutraceutical products. The company is engaged in the development, registration and commercialisation of pharmaceutical-grade cannabis and hemp-based products and treatments for customers in Australia.

Source: Companyâs website

CPH Acquisition Update: On 7 June 2019, Creso Pharma reached a scheme implementation agreement with Canada-based PharmaCielo Limited, a company engaged in cannabis cultivation, whereby PharmaCielo will acquire Creso Pharma.

Under the scheme, the shareholders of Creso Pharma would receive 0.0775 PharmaCielo shares for every Creso Pharma share held, reflecting a value of AU$ 0.63 based on the PCLO VWAP while the Creso Pharma option holders would receive 0.0185 PharmaCielo shares for each listed option held, representing an offer price of AU$ 0.15 based on the PCLO VWAP.

PharmaCielo is a TSX Venture Exchange listed company with the license to cultivate medicinal cannabis oil products in Colombia. The company has a robust balance sheet with a cash balance of around CA$ 40 million as reported.

The acquisition highlights include creation of a vertically integrated supply chain, experienced Board and Team, expansion of cultivation, processing facilities, commercial networks and product portfolio. Lastly, it involves continued participation for Creso Pharma securityholders as stated above.

Other Update: On 23 May 2019, the company reported that its Canada-based 100%-owned subsidiary Mernova Medical Ltd, had harvested the first cannabis from its state-of-the art facility in Nova Scotia, following its receipt of growing license in mid-Feb 2019.

Stock Performance: With a market capitalisation of around AU$ 64.87 million and approximately 133.74 million outstanding shares, CPH is trading at AU$ 0.490, up 1.03% as on 11 June 2019 (2:49 PM AEST).

THC Global Group Limited

About the business: THC Global (ASX: THC) manufactures and provides medicinal cannabis products to Australian patients through existing access schemes and operates through a Farm -to-Pharma pharmaceutical model. In addition to this core business, THC Global also owns two Canada-based companies including -Crystal Mountain Products, and Vertical Canna Inc.

Business Updates: Previously on 15 May 2019, EVE Investments Limited (ASX:EVE) provided the market with an update on its agreements with THC Global. The agreements encompass a couple of things including site lease, tea?tree off?take, cannabis off?take, directed towards the organic farming operations of THC Global as well as the development of novel tea?tree and cannabis products by both THC Global and EVE.

On the same day, THC Global informed that it had been granted a Medicinal Cannabis Export Licence by the Australian Office of Drug Control (ODC), that now enables the company to export medicinal cannabis from Australia. In addition, the company also received a green flag from Therapeutic Goods Administration (TGA) regarding production of cannabis and non-cannabis products at its Queensland bio-pharmaceuticals extraction facility, subject to licencing and approval of procedures.

Stock Performance: With a market capitalisation of around AU$ 57.94 million and ~ 134.75 million outstanding shares, THC is trading at AU$ 0.440, up 2.33 % (As at 2:49 PM AEST, 12 June 2019).

Ecofibre Limited

About the business: Queensland-based Ecofibre Limited (ASX: EOF) operates as a holding company. Through its subsidiaries, the company operates in the hemp-derived nutraceutical sector and serves customers in Australia as well as the United States. With a market capitalisation of AU$ 615.6 million and around 309.35 million outstanding shares, EOF is trading at AU$ 2, up 0.5% (As at 3:03 PM AEST, 11 June 29019). The company recently debuted on the Australian Securities Exchange in March 2019.

Business Updates: On 21 May 2019, Ecofibre released its Investor Presentation giving its company overview, timeline of business activities so far and a glance through its operating performance.

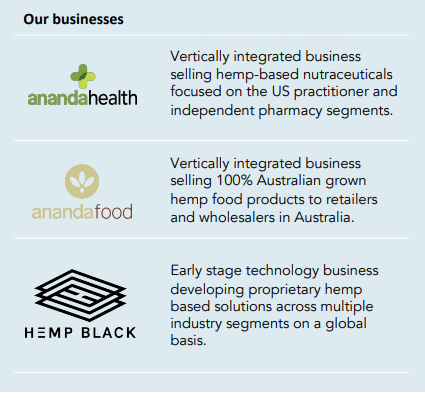

The company operates through three key business segments focused on serving specific consumer markets and geographies- Ananda Health, Ananda Food, and Hemp Black.

Source: Companyâs Investor Presentation

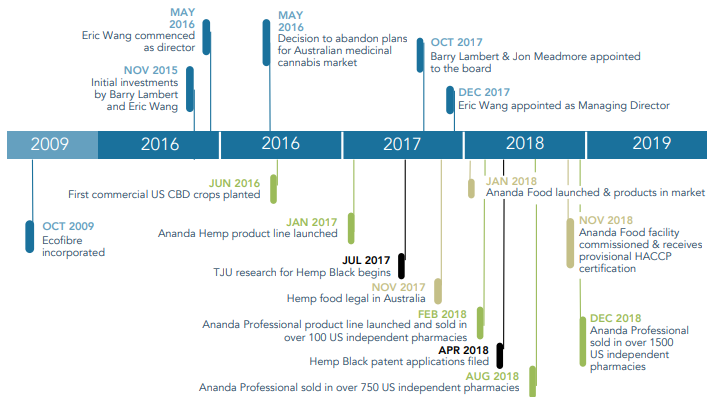

Ecofibre has a long history in hemp capabilities that underpin a recent focus on commercialisation. A quick peek into its journey of commercialisation and expansion is illustrated though the figure below.

Source: Companyâs Investor Presentation

Financial Performance: The company delivered a loss of $ 8.7 million in FY18 and expects to deliver a small profit in FY19. However, the revenue recorded for Q3 FY19 amounted to $ 10.1 million, driven primarily by Ananda Health. Besides, the total revenue for FY19 is expected to be 5.5x greater than FY18 revenue as can be inferred from the figure below. Over the last year, the companyâs margin has expanded on the back of its business model choices, operational maturity and scale.

Source: Companyâs Investor Presentation

Lifespot Health Ltd

Melbourne-based Lifespot Health Ltd (ASX: LSH) develops and commercializes medical diagnostic and monitoring technology.

Source: Companyâs Presentation

Business Updates: Recently on 5 June 2019, one of Lifespot Healthâs Director Frank Cannavo acquired an Indirect interest in the company upon purchasing 500,000 unlisted options with an exercise price of AU$ 0.20, expiring 5 June 2022, in accordance with Resolution 6 as approved by shareholders at the Annual General Meeting of the Company held on 24 May 2019.

As per companyâs quarterly update for the three months to 31 March 2019, Lifespot Health continued to tightly manage the operational expenditure with a focus on business development. The company had strong cash reserves of $ 1,789k as of 31 March 2019 and recorded revenues of $ 26k, depicting the prevailing challenges in Metabolic Syndrome diagnostics.

The company commenced recruitment of Business Development Lead to service US and Canadian clients with an expectation of having the roles role filled as soon as possible during the second quarter of 2019. It also launched the first hardware product Medihale® Medical Cannabis Vaporiser system in the quarter.

A strong level of Business Development networking and negotiation is under progress. Besides, as per a leading consumer healthcare industry consulting organisation, the vaping category is anticipated to grow in the next 4-5 years to the value of $ 48 billion by 2025.

Stock performance: With a market capitalisation of around AU$ 5.27 million with ~ 77.57 million outstanding shares, the LSH stock is trading at AU$ 0.066, down 2.94%. The stock has generated a positive YTD return of 13.33% so far.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.