The materials sector includes companies that are into the discovery, development and processing of raw materials, which are used in many other industries. Some of the companies operating in the sector deal with building products, construction and engineering, forest products, construction materials, transportation infrastructure, containers and packaging.

In the past few years, several players in the materials sector experienced challenges and some troubles, owing to slow down in residential and civil construction activities in Australia. However, according to several market reports, the Australian property market is showing some signs of improvement with a regain in growth in the construction sector expected from 2020.

Moreover, in the minutes of the monetary policy meeting released on 5 November 2019, the Reserve Bank of Australia highlighted improved conditions in the property market and ongoing spending on infrastructure. The RBA also unveiled that approvals for non-residential building had increased in recent months and there is a high-level pipeline of work for both private infrastructure and non-residential building. This would be great opportunity for market players.

Let us discuss five stocks from the materials sector and take a glance at how they are performing in the current environment.

Brickworks Limited (ASX:BKW)

New South Wales headquartered Brickworks Limited (ASX:BKW) is into the development and distribution of concrete and clay products. BKW is one of the largest and diverse manufacturers of building materials and has 12 operating brick plants and one manufactured stone plant in North America.

AGM Presentation

The company updated the market with its AGM presentation on 26 November 2019, which covered business overview and performance during FY2019 (year ended 31 July 2019).

- The company delivered a record full-year underlying EBITDA from continuing operations of A$346 million, up by 12% compared to the prior corresponding year (pcp).

- Underlying net profit after tax from continuing operations was reported at A$234 million, up by 4% year on year.

- The company recorded statutory NPAT of A$155 million for FY2019.

- Three acquisitions done in the last year, with the Redland Brick acquisition scheduled for completion in February 2020.

Board Governance - Brickworks appointed two new independent non-executive directors- Mr Malcolm Bundey (effective 1 October 2019) and Ms Robyn Stubbs (effective 1 January 2020).

Outlook

The outlook of the company for FY2020 varies across each division within the group.

- Dividends, earnings, and market value of WHSP are expected to grow over the long term.

- In Australia, for the first half of the year 2020, the earnings are expected to be the low point, affected by high energy costs, low building activity and particularly difficult conditions in Western Australia.

- In the fiscal year 2020, the Property Trust is expected to deliver another strong result due to the possible capitalisation rate compression and completion of new developments.

- For Building Products North America, the company is expecting supportive market conditions for steady growth.

Stock Performance

The BKW stock closed the dayâs trading at A$18.260 on 27 November 2019, down by 0.545% with approximately 149.9 million outstanding shares. The market capitalisation of the stock was A$2.75 billion. The BKWâs stock has generated a return of 10.94% on a YTD basis.

Fletcher Building Limited (ASX:FBU)

Based in Auckland, New Zealand, Fletcher Building Limited (ASX:FBU) is a significant manufacturer of building products and is engaged in construction and infrastructure projects. The company employs more than 16,000 people in Australia, New Zealand and the South Pacific, and operates through various divisions- distribution, concrete, building products, construction and residential & development.

New Zealand International Convention Centre (NZICC) Insurance Update

In a recent ASX update on 26 November 2019, the company updated about the progress with respect to insurance for the NZICC project, which got damaged by a fire that started on 22 October.

On the basis of the assessment to date, the insurers have confirmed that Contract Works insurance policy for this project would respond to the damage or loss after the fire. Meanwhile, Fletcher is continuously working to determine the fire impact on delivery time, cash flows and costs of the project.

An update of any announcement related to the companyâs half-year results would be provided in February 2020.

Stock Performance

The FBU stock settled at A$4.975 on 27 November 2019, down by 1.093%, with a market cap of A$4.2 billion. The stock has approximately 834.62 million outstanding shares with 52 weeks low and high price of A$3.990 and A$5.270, respectively. The stock has generated a positive return of 11.28% on a YTD basis.

Orora Limited (ASX:ORA)

An ASX listed material sector company, Orora Limited (ASX:ORA) is operating in seven countries and is a leader in providing new packaging solutions. The company offers various solutions which include packaging product manufacturing and designing. Orora has a team of more than 6,800 employees and 54,000 shareholders.

The company recently updated the market with its annual general meeting presentation, which highlighted the summary for FY19 ended 30 June 2019 and ORAâs strategy.

- The company reported an underlying net profit after tax (NPAT) of A$217.0 million, up by 4.0% year on year.

- The cash flow of the company from operating activities was A$268.9 million, a decline of 17.3% from the year ago period.

- The company completed acquisitions of Pollock and Bronco in North America during the year.

- In FY2019, the company generated sales revenue of approximately A$3.4 billion and EBITDA of nearly A$350 million from the North American Businesses and the Australasian Beverage.

Orora would sell its Australasian Fibre business to Nippon Paper Group and the company expects to complete this transaction in the early of FY2020.

Stock Performance

The ORAâs stock closed the dayâs trading at A$3.300 on 27 November 2019, up by 2.484% with a market cap of A$3.89 billion. The stock has approximately 1.21 billion outstanding shares with 52 weeks high price at A$3.470 and low price at A$2.60. The stock has generated a positive return of 6.27% on a year to date basis.

CSR Limited (ASX:CSR)

North Ryde, Australia headquartered material company CSR Limited (ASX:CSR) is engaged in providing building products for residential and commercial construction in New Zealand and Australia. The company has a strong distribution network for customers across Australasia.

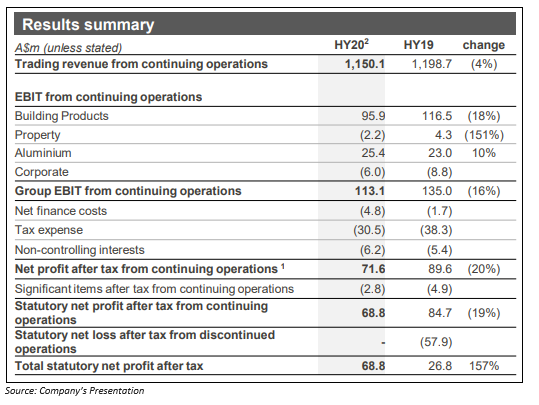

CSR recently announced half-year results for the period ended 30 September 2020

- The company generated trading revenue of A$1.15 billion, which was down by 4% on the prior corresponding period (pcp).

- Statutory NPAT of the company was reported at A$68.8 million for the half year, up from A$84.7 million as compared to the pcp.

- The company reported Group EBIT of A$113.1 million, down by 16%

- CSR has achieved key targets- ROFE of 19.4% and an EBIT margin of 11.4%.

Stock Performance

The CSR stock settled at A$4.695 on 27 November 2019, up by 0.968% with a market cap of A$2.29 billion. The stock has approximately 491.45 million outstanding shares with 52 weeks high price at A$4.750 and low price at A$2.598. The stock has generated a positive return of 69.30% on a year to date basis.

Adelaide Brighton Ltd (ASX:ABC)

An ASX listed material sector company Adelaide Brighton Ltd (ASX:ABC) is engaged in the manufacturing and distribution of cement, lime, concrete and concrete products. The company operates in almost every state and territory in Australia and has nearly 1,500 employees.

Financing Facilitiesâ Update

In an ASX announcement, the company unveiled about the extension of financial facilities. The company revealed that the maturity of its debt has been extended, and the borrowing limits have been increased to A$900 million from A$715 million.

Half-yearly results (period ended 30 June 2019)

- For the first half, the company generated a revenue of A$755.7 million, down by 6.3% due to slowing demand for construction materials.

- Adelaide reported an underlying EBIT of A$85.2 million, down by 31% as compared to prior corresponding period (pcp).

- The underlying NPAT was reported at A$55.3 million, which was down by 35.1% on the pcp.

For the full year 2019, the company is expecting to register underlying NPAT, excluding property in the range of $120 â $130 million

Stock Performance

The ABC stock settled the dayâs trade at A$3.480 on 27 November 2019, up by 2.969% with a market cap of A$2.2 billion. The stock has approximately 651.72 million outstanding shares with 52 weeks high price at A$5.352 and low price at A$2.845. The stock has generated a negative return of 19.57% on a YTD basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.