As coronavirus (COVID-19) pandemic is gradually subsiding, countries are beginning to reopen their economies in a systematic and planned manner. Market experts are estimating that the global economy will take quite some time to recover, as the wave of lockdowns and travel restrictions have largely hurt industrial output, manufacturing, services, and all kinds of economic activities. Millions of people have filed for unemployment claims, several retail stores and airlines are on the verge of bankruptcy, and GDP across countries has largely declined.

Consequently, state leaders are developing cautious approaches to reopen their economies while staying focused on avoiding a second wave of COVID-19. While that may be the case, it is interesting to note that equity markets have actually been performing and soaring, especially since the start of April 2020.

The US S&P 500 Index has moved up by more than 30% over the weeks since its steep drop on 23 March 2020, closing the trading on 22 May 2020 at 2955.45. A similar trajectory has been observed for the S&P/ASX200, which rallied by more than 20% from its steep drop on 23 March 2020, demonstrating improving investor sentiment throughout April 2020.

Good Read: Optimism Around COVID-19 Vaccine; ASX 200 Moves Up 1.81%

One explanation for the optimism amongst investors is simply the announcements made by the Federal Reserve, which has committed to lend or buy trillions of dollars of financial assets. It is not just the Fed but even the Bank of Japan is doing much the same, so as the European Central Bank, while several other governments are following suit in high capacities to cushion their economies.

For long-term investors, the underlying current scenario seems to be changing as the stocks are apparently on sale now, considering the low interest scenario, thereby presenting a good opportunity to revisit their portfolios. For others who may require money in the short term, putting money into the market and exposing the portfolio to high market volatility and uncertainty may not be the best thing to do. So, one must obviously practice due diligence and pick the right financial instruments or stocks.

Guide to Build Emergency Proof Portfolio Must Read

It is well known that stocks belonging to the healthcare and technology sectors have particularly been doing well such as Microsoft Corporation (NASDAQ:MSFT), which has rallied nearly 9% in the last one month and Apple, Inc. (NASDAQ:AAPL), which has climbed up by ~20% in the last one month.

Let’s look at some of the interesting ASX-listed technology and healthcare stocks.

Technology Sector

Afterpay Limited (ASX: APT)

Australia-based Afterpay Limited (ASX: APT), the pioneer in the “Buy Now, Pay Later” market space, on 25 May 2020, announced the appointment of Elana Rubin to lead the Company’s Board, effective immediately. APT appointed Sharon Rothstein as an independent Non-Executive Director, effective from 1 June 2020, while Cliff Rosenberg tendered his resignation as a Non-Executive Director of the Company with effect from 24 May 2020.

The Company recently reported a sharp increase in its active customer base using Afterpay services via merchant partners in the United States to more than 5 million, with premium brands like Furla, Herschel, Lancer Skincare, Birkenstock, Marc Jacobs Beauty, American Eagle and Perricone MD started offering Afterpay as a payment option to their customers.

The Company has been well capitalising on most shoppers having gone online to shop for their essential needs, other products and services and requiring things on an urgent basis with the option of paying over-time without resorting to loans with the burden of interest, fees or revolving debt.

While the world deals with major economic turbulence and volatility, Afterpay has been helping merchants to be more flexible with the purchasing power of consumers, thus diminishing friction in the whole shopping experience, as e-commerce is emerging as the primary medium to shop today.

The APT stock was trading 5.01% higher at AU$ 46.740 on 25 May 2020 (AEST 11:59 PM). APT has generated a positive return of 67.52% in the last one month.

Good Read: Record High Levels for BNPL Stock Afterpay: The Market Darling Amid Crisis!

Megaport Limited (ASX: MP1)

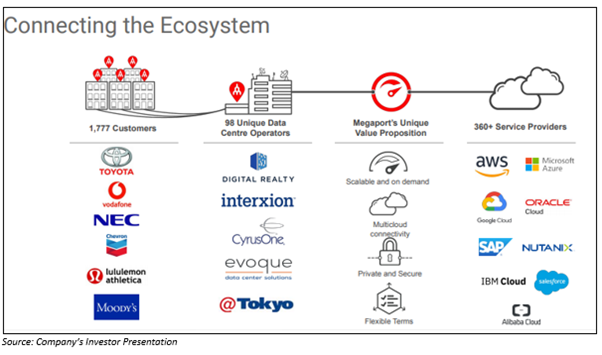

Megaport Limited operates as a Network-as-a-Service (NaaS) company, which focuses on elastic connectivity platform offering customers interconnectivity and flexibility between other networks and cloud providers connected to the platform worldwide.

For the March quarter 2020, the Company reported revenue of AU$ 15.19 million, an increase of 10% quarter-on-quarter (QoQ). Other highlights included total MRR for March 2020 at AU$ 5.4 million, an increase of AU$ 0.9 million, or 19% QoQ while total Installed Data Centres stood at nearly 329 at the end of the quarter, an increase of 12, or 4% QoQ. The Enabled Data Centres totalled 601 for the quarter, up 9% while the number of customers increased by 6% QoQ to a total of 1,777. Megaport closed the quarter with cash of AU$ 108.7 million.

On 25 May 2020 (AEST 12:33 PM), the MP1 stock was trading at AU$ 13.570, inching upward by 4.545%. MP1 has delivered a positive return of 13.76% in the last one month.

Healthcare

Sonic Healthcare Limited (ASX: SHL)

SHL is known for its expertise in radiology/diagnostic imaging, laboratory medicine/pathology, and primary care medical services.

During late last month, the Company informed to have partnered with the Australian Government to provide services to residential aged care facilities, covering a dedicated pathology service for rapid sample collection and testing for coronavirus. This demonstrated the Government’s prioritisation towards the health and safety of senior Australians during the national emergency with ~2,700 residential aged care facilities eligible to avail this service.

Since the coronavirus outbreak, Sonic Healthcare has been at the forefront of COVID-19 testing in Australia, beginning in New South Wales and Queensland.

The last two months saw Sonic’s laboratories testing over 100,000 Australians in total for infection by the virus. Recently, the Company, Australian Government and the Minderoo Foundation partnered to further expand the COVID-19 testing capacity across the country.

The SHL stock was trading at AU$ 27.850 on 25 May 2020 (AEST 12:41 PM), up 2.089%. SHL has generated a positive return of 8.86% in the last one month.

These are only a handful of examples of the Companies that have been performing well amid the COVID-19 situation.

Clearly each business is different and economic recovery is expected to be slow; however, with a slew of relief measures, easing restrictions, and accelerating R&D efforts towards finding a vaccine/treatment for this deadly disease, opportunities are expected for several businesses to capitalise upon in the upcoming period.

Must Read: Guide to Portfolio Strategies and Investment Avenues to Wade Through COVID-19 Crisis