As per the Australian Governmentâs Department of Foreign Affairs and Trade, Australia and New Zealand have a close-knit and bilateral relation. The countries are natural allies with a strong trans-Tasman sense of family, and share a close and co-operative relationship, be it in trade, politics, sports or migration.

On the similar lines, New Zealandâs Foreign Affairs and Trade believes that New Zealand has the closest and most significant relationship with Australia, driven by their shared values, history, geographical proximity, personal connections and healthy competitive sports landscape.

It should be noted that there are substantial resident populations of New Zealanders in Australia, and Australians in New Zealand.

Given the imminence of the two nations, this article would revolve around a renowned New Zealand player, Summerset Group Holdings Limited (ASX:SNZ), which is stepping its first foot on the Aussie ground, by acquiring land in Melbourne, to build its first Australian retirement village.

Before understanding the developments around the same, let us acquaint ourselves with the company in discussion:

Summerset Group Holdings Limited

Dual-listed on the NZX and ASX, Summerset is one of New Zealandâs lead developer and operator of retirement villages, which started out as a family business. SNZ has been operative for the last 22 years and is well established in NZ. The company, regarded as the fastest growing retirement village operator in NZ, offers living options and care facilities to over 5,000 residents. Recently, in 2019, it was honoured with the Readerâs Digest Quality Service Award.

Till date, the company has 28 villages completed or in development across NZ, along with 10 sites for developments, in Marlborough, Auckland, Canterbury, Northland, Waikato, Kapiti Coast, New Plymouth and capital city of Wellington. The addition of the recent Melbourne site for development brings the total number of sites to 39.

SNZ Sites (Source: SNZâs Report)

SNZ Sites (Source: SNZâs Report)

SNZ Buys Land to Build its First Australian Village

On 24 September 2019, the company pleasingly announced that it was finally launched in its neighbouring country, Australia, by acquiring land in Cranbourne North, which lies south-east of Melbourne, and is an established suburb. The acquired eight-hectare property would be the spot of SNZâs first village in Australia. The companyâs Board had taken the step forward post a protracted phase of scrutiny, and the site acquisition and subsequent development would be funded from the existing bank facilities.

The land seems to be a lucrative spot and is well located with amenities close by. It is near to various shopping centres and a gold course. An add-on to them is the availability of public transportation, which would be adjacent to a public reserve with walking tracks.

Pleased by the acquisition and tagging the site to be a good entry point for SNZâs growth plans in Melbourne, CEO Mr Julian Cook believes that the companyâs reputed stature would be welcomed in Australia.

Mr Cook notified that the Village design was progressing well, and the company plans on including a signature main building apart from several single-level villas.

The CEOâs take on Melbourne

According to Mr Cook, Melbourneâs ageing population was underserved by aged care offering and quality retirement village, and SNZ would quench this concern by launching the care retirement village model in Victoria. He also believes that the residential property market in the region was steadily recovering after a prolonged period of decline of over a year (by 11 per cent). On the positive side, in the last three months, the residential prices had depicted an uptrend and stabilisation seemed to be on the cards.

Even though the demand for SNZâs retirement living and aged care is not driven by the conduct of the residential property market, given the improving landscape, SNZ is entering the market at a good point in the property cycle.

SNZâs 2019 Interim Dividend

On 4 September 2019, the company had set the strike price for the dividend reinvestment plan at NZ$5.8336 per share, inclusive of a discount of 2 per cent, for the dividend which was payable to the companyâs shareholders on 9 September 2019.

SNZâs Half Year Report for 2019

During the reporting season of August, wherein ASX-listed companies released their earnings report, SNZ intimated about its 2019 interim results and half-year report on 13 August 2019. The highlights of the same are listed:

- Underlying profit was NZ$47.8 million, up by 6 per cent on pcp;

- Reported IFRS PAT was NZ$92.6 million, down by 4 per cent on pcp;

- Total assets grew to NZ$3 billion, up by 24 per cent on pcp;

- The net operating cash flow amounted to NZ$93.3 million;

- Gearing ratio was reported to be of 31.3 per cent;

- SNZ acquired six new sites in the year and delivered 139 new retirement units;

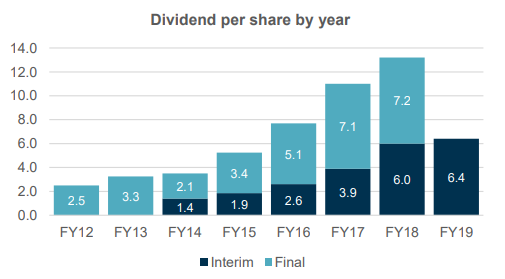

- As part of the results, an interim dividend of NZ 6.4 cents per share was announced;

- The companyâs developed margin was locked at 28.4 per cent.

(Source: Companyâs Report)

A major highlight of the result was the receipt of the first CEMARS by SNZ, which makes it the first New Zealand CarboNZero certified retirement village group. The certification, Certified Emissions Measurement and Reduction Scheme, was given for a retirement village group in 2018 in the country. Keeping the pace on, the company signed up to the Climate Leaders Coalition with the intent to fight climate change and shun down the carbon emissions in the nation.

Speaking of certifications, the companyâs new care centre in Hobsonville gained a four-year certification. Besides this, Wanganui achieved four-year certification.

Another highlight was the launch of the Community Connect pilot, which was SNZâs way to engage residents with technology and the local community and help them in solving problems through local school students. Moreover, the initiative aids residents with their IT needs and enhances local community and intergenerational connections.

On the outlook front, for a couple of upcoming years, the company would aim to gain the relevant consents to start development at sites acquired over the last 18 months. SNZ has its focus on increasing the number of sites (on which retirement units were being delivered) from the present number of 7 to around 10â14 at any one time.

Share Price Information

At the time of writing on 27 September 2019 (at 1:37 PM AEST), the companyâs stock was trading flat at $5.960, with a market cap of $1.35 billion and approximately 226.8 million shares outstanding. The stockâs P/E multiple is 6.080x and its annual dividend yield is 1.64 per cent. In the past three months, the stock has generated a return of 14.62 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.