The S&P/ASX 200 Financials (Sector), trading under the code- XFJ on ASX, is trading at 6,440.7 or 9.1 basis points, up by 0.14 percent (s on 17 September 2019, AEST 1:31 PM).

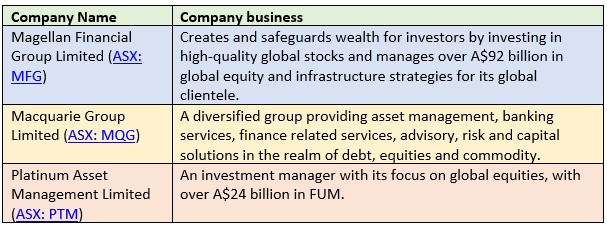

Let us look at the three stocks from the financial space and understand their stock performances and latest updates. Though, firstly, we would acquaint ourselves with the businesses that these companies cater to:

Magellan Financial Group Limited

MFGâs FUM Update

On 5 September 2019, the company intimated the market about its funds under management as at 30 August 2019. It mentioned that in August this year, MFG witnessed net inflows of $315 million, consisting of net retail inflows of $162 million and net institutional inflows of $153 million.

Augustâs FUM (Source: MFGâs Report)

Dividend Announcement

Recently, on 30 August 2019, MFGâs Chairman Mr Hamish M Douglass addressed the companyâs shareholders through a letter, stating that the company had a successful financial year with the average funds under management up by 28 per cent to $75.8 billion and the adjusted net profit after tax up by 35 per cent to $364.2 million.

For the six months period ended 30 June 2019, the companyâs board had declared a total dividend of 111.4 cents per share, 75 per cent franked. The dividend payment constitutes of a final dividend of 78 cps or cents per share, and a performance fee dividend of 33.4 cps. The performance fee is connected with the crystallised performance fees that the company had earned in FY19 period.

Besides this, the company on 13 August 2019, announced the IPO of the Magellan High Conviction Trust, a new investment trust to be listed on the ASX.

Issue of Shares

On 20 August 2019, MFG issued 4,981,885 ordinary shares without disclosure to investors under the Corporations Act 2001.

Macquarie Group Limited

Ordinary Capital and Convertible Securities Update

On 10 September 2019, the company notified that the number of ordinary shares on issue as at 31 August 2019 were 340,382,984, and MQG did not issue any new fully paid ordinary shares during August 2019. However, 1,646 unlisted Deferred Share Units were granted in the month and the total number of DSUs on issue was 3,616,454, while the total number of PSUs on issue was 1,031,514.

Around 62,419 securities (unlisted exchangeable) were on issue by Macquarie Capital Acquisitions (Canada) No.2 Limited, which is the companyâs subsidiary entity. Also, 32,010 securities (unlisted Exchangeable) on issue was there, by the subsidiary company.

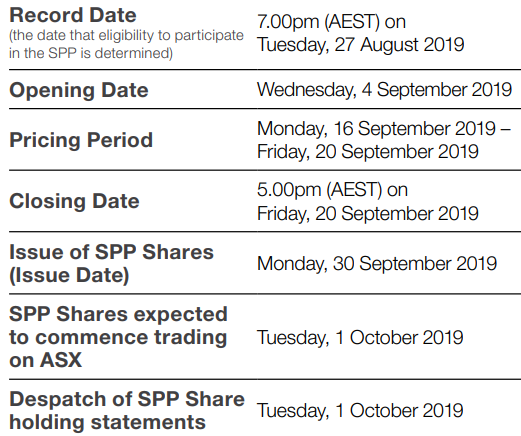

Share Purchase Plan

On 4 September 2019, MQG notified that it intended to conduct a Share Purchase Plan, and the SPP offer would close on 20 September 2019. The lower of the issue price paid by institutional investors as per the Placement was $120/share, along with a 1 per cent discount to the volume weighted average price of the securities traded during the five Australian Securities Exchange trading days before to and consisting of the closing date. The timeline of the same is highlighted in the table below:

SPP Timeline (Source: MQGâs Report)

The SPP allows eligible Macquarie stakeholders with a registered address in Australian region or NZ region to subscribe for up to $15,000 worth of fresh, fully paid ordinary shares, devoid of experiencing brokerage or other transaction costs. Recently, the company had conducted a placement of fully paid ordinary shares in Macquarie to institutional and professional investors, raising $1 billion, the proceeds of which would provide flexibility to invest in new opportunities, while maintaining appropriate capital levels in light of the ongoing regulatory change.

Platinum Asset Management Limited

Annual Report 2019

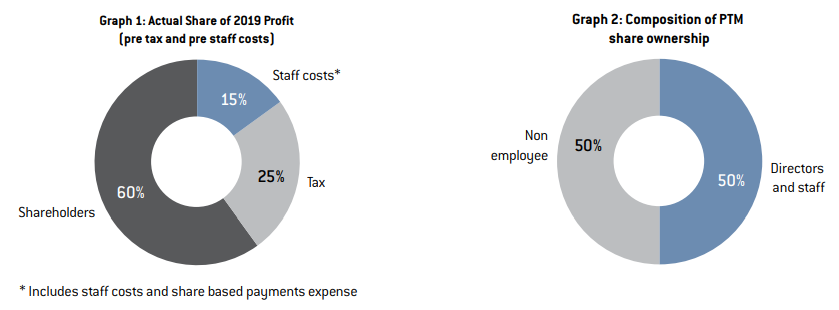

On 16 September 2019, the company released its annual report for 2019, for the period closed 30 June this year. Like a lot of Australian companies, PTM witnessed a challenging year, as the investment returns for most of its managed funds and portfolios slumped in the broader market, which consequently incurred lower fund flows, lower investment performance fees and a dip in the EPS and dividends. The highlights of the Annual Report are discussed below:

- FUM at 30 June 2019 was approximately $24.8 billion, down 4 per cent on pcp.

- The reduction in FUM was catalysed by the net fund outflows of $0.2 billion and the year-end net cash distribution and other capital outflows of $0.9 billion.

- Average FUM for the financial year decreased by 4% to $25.3 billion.

- The on-going US-China trade war left its adverse impact on PTMâs overall performance.

- The total revenue and other income for PTM decreased by 15% to $299.3 million, for the 12 months to 30 June 2019.

- Profit after tax attributed to members decreased by 17% to $157.7 million.

- EPS for the year amounted to 27 cents per share.

- The decline in investment management fees was 4%, in sync with the decline in average FUM. However, the average fee margins were maintained during the period.

- Driven by lower revenue and profit for the period, the aggregate variable remuneration across PTM was well down.

- PTMâs executive key management personnel- Elizabeth Norman and Andrew Stannard received reduced variable awards under the General Employee Plan for the 2019 financial year.

- As a part of the results, PTMâs board of directors declared a 2019 final fully franked ordinary dividend of 14 cents per share, which is due to be paid on 20 September 2019. However, the existing Dividend Reinvestment Plan was not activated for the period.

- During the year, PTM established a distribution office in London and has continued to leverage its distribution relationship with AccessAlpha Worldwide in the US.

- In March, Kerr Neilson, Founder and CEO disposed of 60 million ordinary PTM shares by way of a fully underwritten private placement to institutional and professional investors, deepening PTMâs institutional shareholder base.

PTMâs Remuneration Report (Source: PTMâs Annual Report)

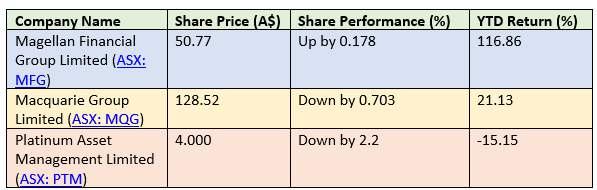

Share Price Information

Let us now look at the share performance (as on 17 September 2019, AEST 2:22 PM) and YTD return of the three financial stocks in discussion:

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.