The Federal Government has supported two new gas projects in Queensland and Victoria, one of which would be anointed under the New Generation Investment Program, which is a multi-phased program, aimed to bring the electricity prices down in the domestic market.

To Know More About Other Programs and Measures Adopted by the Government to Provide Reliable Energy, Do Read: Energy Policies to Fuel ASX Energy Stocks Over the Long-Run?

The Morrison Government is all set to back a 132-megawatt gas plant in Gatton, and another 330-megawatt gas generator project in Dandenong. The Government indicated a green light for both the private companies- Quinbrook Infrastructure Partners (Queensland) and APA Group (Victoria), that proposed the project; and,

· The Federal Energy Minister- Angus Tylor recently announced that the Government had reached an initial agreement to underwrite both the gas power stations, and also mentioned that the final agreement is anticipated to be reached next year. The construction is expected to start once the private companies secure financial pipelines.

The 330-megawatt gas-powered generator proposed in Dandenong by APA Group would be built in two stages with 220-megawatt power initially generated from 12 fast start engines, and 110-megawatt from six additional generating units.

· Mr Tylor also mentioned that the Government would now enter into detailed underwriting and contractual negotiations with the proponents of the gas-fired generators before making investment decisions while mentioning that the projects are well advanced with demonstrated financial viability.

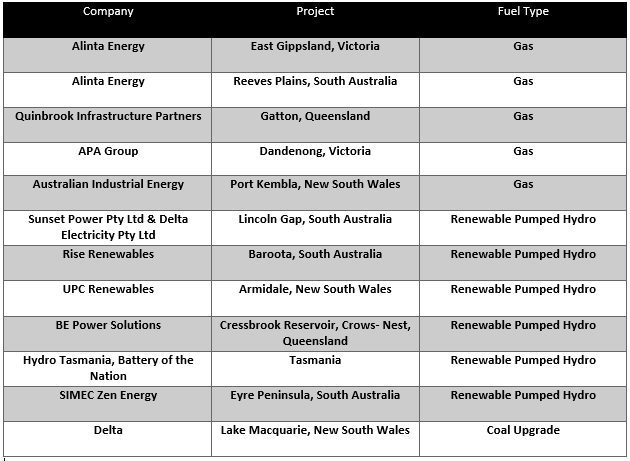

Under the New Generation Investment program, the federal Government selected 12 projects, in which five remained gas-powered, and the Government is now moving towards the two of them to address the issues of spiked electricity prices.

While the gas-powered projects saw the green light, the Prime Minister also signalled towards the possibility of coal-fired power generation for Queensland and NSW.

The Prime Minister-Scott Morrison highlighted that while Australia suffers through a record-breaking heatwave, the Government would not be deterred by “shouting noises” towards coal-fired power plants and would explore all options to meet the energy demand.

What’s Coming Further?

Post announcing the support for the Gatton and Dandenong gas-powered generators, Mr Tylor also suggested that a pumped-hydro project for South Australia is also expected to get a green light soon under the New Generation Investment Program in 2020.

The Government included three pumped hydro proposals in South Australia under the New Generation Investment Program, i.e., Sunset Power and Delta Electricity project, Rise Renewables, and SIMEX Zen Energy.

The Federal Government would also bring coal-capacity into the picture ahead, as indicated by the Prime Minister in an interview with radio 2GB, when Mr Morrison mentioned that the energy mix is what is required to address the energy needs.

While the small capacity addition of coal could be witnessed if the Government push for it, the energy market operator- AEMO anticipates the coal power-plants would not witness renewal post the retirement under standard study case.

However, the extreme temperature could prompt the coal-fired power amid its abundant and cost-friendly resources across the National Electricity Market (or NEM).

To Know More, Do Read: The future of energy generation in Australia; solar to increase three-fold by 2024

Residential Electricity Price Trend 2019

In the latest report published by the Australian Energy Market Commission (or AEMC) over price trend in the residential electricity market, the department anticipates the residential electricity prices and bills to fall on a national basis in the period from 2018-19 to 2021-22.

The reducing wholesale costs in most of the states and territories would primarily drive the decreasing price trend as the new capacity enters into the system. The annual residential bills are anticipated by the department to decline by 7.1 per cent or by $97 over the reporting period.

The Australian Energy Market Commission also anticipates the wholesale costs to decline by 11.6 per cent or $62 over the reporting period amid an influx of new generation of 8,594-megawatt.

The regulated network costs are also projected to decline by 1.8 per cent or $11 over the reporting period amid a reduction in distribution cost and metering costs, mainly in South East Queensland.

The environmental costs are anticipated to fall as well during the reporting period by 23.9 per cent or $21 amid a decline in Large-scale Renewable Energy Target costs.

Trend Across South East Queensland

The annual residential bills are anticipated to decline by 19.5 per cent or $278 over the reporting period, with a decline of 12.4 per cent or $64 amid an influx from committed renewable generation including 595-megawatt of solar and 496-megawatt of wind.

To Know More, Do Read: ASX-Listed Oil & Gas Stocks- A Perfect Buy For Short-term Gains?

The regulated network cost is anticipated to fall by 14.7 per cent or $95 amid a reduction in distribution cost.

The environmental costs are also projected to decline over the reporting period by $24 or 33.1 per cent with a decline in Long-renewable energy target costs stemming from a reduction in the cost of renewable certificates.

To Know More, Do Read: Australia Government Policies and Programs To Attain A Net-Zero Carbon Emission

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

.jpg)