Usually, to distribute a company’s profits, the company pays dividends to its shareholders. The company has an option of either to re-invest the surplus that it made in the year known as retained earnings or they generally give a part of their profits to its shareholders. Generally, the quantum of dividend a company is going is to pay is decided by the board of directors of the company, after taking into consideration of the capital allocation decisions. The major portion of the company’s profit is kept with them for their ongoing and future business activities, the remainder of the amount is allocated to their shareholders as a dividend, and are paid on a scheduled frequency, like annually, quarterly or monthly.

Generally, companies with a large market cap are known to be good dividend pays as they have more predictable profits. These companies seek to maximise shareholders wealth apart from normal growth. High growth companies and early stage companies such as start-ups do not usually pay dividends, because of their future growth opportunities and low disposable profits.

Let’s have a look at four good dividend paying stocks listed on ASX.

Scentre Group (ASX: SCG)

Scentre Group is engaged in the business of property management and development. The market capitalisation of the company stood at $20.67 billion on 25 October 2019.

Company’s COO to Retire in 2020: Greg Miles, company’s chief operating officer, has informed the company about his intention to retire in 2020 after almost two decades with the Scentre Group and Westfield executive teams.

In preparation for his retirement, Mr Miles will step down from his role of Chief Operating Officer and as one of the Group’s Key Management Personnel.

Cynthia Whelan Decides to Leave the Group: Company’s Chief Strategy and Business Development Officer, Ms Cynthia Whelan, has decided to leave the company. Cynthia joined Scentre Group to review and facilitate the implementation of the company’s strategy, technology and business development functions. Cynthia has advanced this work in an outstanding manner.

Highlights for the First Half of 2019: As the company focused on delivering what the customers want, the first six months of 2019 has been an active period for the company.

- Annual customer visitation has been more than 535 million and growing, with the customers staying for longer and visiting more frequently;

- the total annual sales have increased to $24.4 billion and the company’s platform accounts for more than 7% of all retail sales in Australia;

- An average specialty store in the company’s portfolio has generated annual in-store sales of more than $1.5 million and is growing and after the divestment of the Sydney Office Towers;

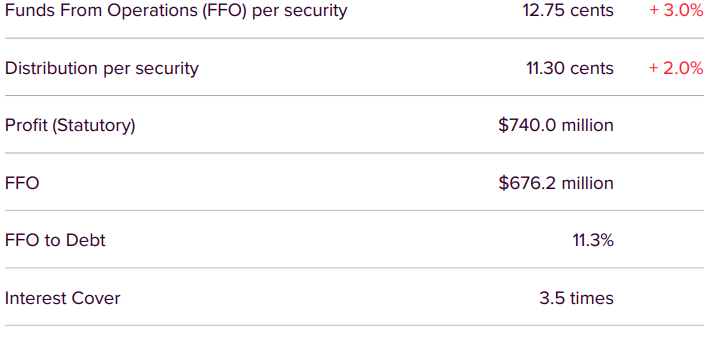

Half Year Results Source: Company’s Presentation

Stock Performance: In the time period of three months and six months, the company has generated a total return of -0.26% and -1.02%, respectively. The company had recently declared an interim dividend of 11.30 cents per share with an annual dividend yield of 5.74%. Currently, the stock is trading at $3.900 per share (as on 25 October 2019).

Woolworths Group Limited (ASX: WOW)

Woolworths Group Limited primarily operates in Australia and New Zealand, with 3,292 stores and approximately 196,000 employees. The primary activities in which the company is involved are:

- Australian Food: Operating 1,024 Woolworths Supermarket and Metros;

- Endeavour drinks: Operating 1,577 stores under Dan Murphy’s, BWS, and Summergate brands;

- New Zealand Food: Operating 189 Countdown Supermarkets as well as a wholesale operation which supplies a further 69 stores;

- Big W: Operating 183 BIG W stores;

- Hotels: Operating 328 hotels, including bars, dining, gaming, accommodation and venue hire operations.

WOW Announces Dates for AGM and EGM: Recently, the company informed the market that the Annual General Meeting would be held on 16th December 2019 and an Extraordinary General Meeting to consider stage 1 of the proposal announced on 3rd July 2019, to create and separate Endeavour Group, is also scheduled to be held on 16th December 2019.

Marley Spoon Secures a Funding Deal: Marley Spoon AG has approved structural debt transactions with two of its existing investors, Woolworths Group and Union Square Ventures, amounting to $8 million in aggregate. The key terms of the Convertible Bonds are as follows:

- Once fully issued, the USV Convertible Bonds can be converted by USV into an aggregate amount of up to approximately 8,170 shares/8,170,000 CDIs in the company at any time during the conversion period;

- Conversion price of $0.50 per CDI;

- Maturity Date - 3 years from the date of issue;

- Additional prepayment fee of US$ 2,776,487.50 to be paid by the company if, prior to conversion, the company elects to terminate and redeem the USV convertible bonds in case a change of control occurs.

Stock Performance: In the time period of three months and six months the company has generated a total return of 7.5% and 17.56%, respectively. The company had recently declared an interim dividend of 57 cents per share with an annual dividend yield of 2.72%. The stock was trading at $37.93 per share, up by 1.012% from its previous close with the market capitalisation of $47.36 billion (as on 25 October 2019).

WAM Capital Limited (ASX: WAM)

WAM Capital Limited is one of Australia’s leading Listed Investment Companies which is managed by Wilson Asset Management which provides investors with exposure to an actively managed diversified portfolio of undervalued growth companies. The company has a market capitalisation of $717 million as on 25 October 2019.

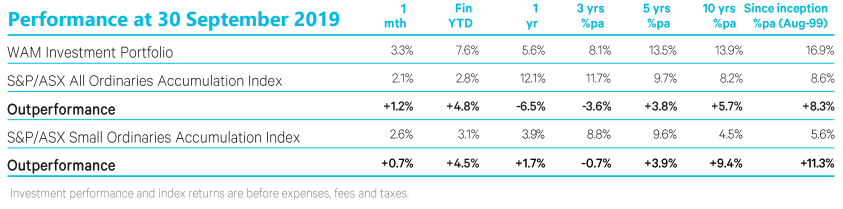

Portfolio Update: WAM Capital investment portfolio increased by 3.3% in September as compared to S&P/ASX All Ordinaries Accumulation Index, which increased by 2.1% in September, and the portfolio beat the S&P/ASX All Ordinaries Accumulation Index by 1.2%.

Performance of Portfolio (Source: Company Reports)

Financial Highlights for FY19: WAM Capital reported an operating profit before tax of $6 million and an operating profit after tax of $14.5 million in FY19. The after-tax figure was up because of $8.5 million income tax benefit due to franking credits received on franked dividend income from investee businesses.

WAM Capital’s NTA before tax decreased 1.3% in the 12 months to 30 June 2019, including the 15.5 cents per share in fully franked dividends paid to shareholders during the year and this decrease is after corporate tax payment of 6.3 cents per share or 3.1% during the year.

Stock Performance: In the time period of three months and six months, the company has generated a total return of 0.91% and 8.33%, respectively. The company has declared a fully franked final dividend of 7.75 cents per share which brings 2019 fully franked full-year dividend to 15.5 cents per share. The company has an annual dividend yield of 7.01% and the stock was trading at $2.210 per share, no change from its previous close (as on 25 October 2019).

Rural Funds Group (ASX: RFF)

Rural Funds Group Limited is engaged in the business of leasing agricultural equipment and properties. The company is a lessor of agricultural property with revenue derived from leasing almond orchards, poultry property and infrastructure, macadamia orchards, cattle properties, vineyards, cotton properties, agricultural plants and equipment, cattle and water rights.

Retirement of Joint Company Secretary: Mr Stuart Waight has resigned from the position of RFM’s, the responsible entity and manager of RFF. After working for over a decade and half with the company during which he has held varied roles, including CFO, COO, General Manager – Corporate Services and most recently, Executive Manager, Mr Stuart’s planned for his retirement.

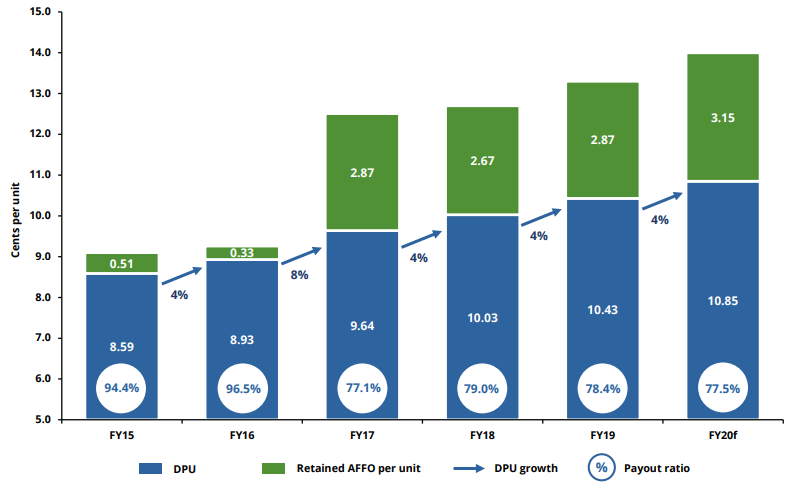

Outlook for FY20: RFM provided a forecast FY20 AFFO per unit of 14.0 cents, RFF will pay forecast distribution totalling 10.85 cents per unit. This represents a 4% increase on FY19 distributions and therefore consistent with the fund’s strategy.

DPU, DPU Growth, AFFO Retention and Payout Ratio Source: Company’s Presentation

Stock Performance: The company has generated a total return of -24.26% and -21% in the time period of three months and six months, respectively. The company has recently declared a 2.7 cents per share. The company has an annual dividend yield of 5.92% and as on 25 October 2019, the stock was trading at $1.780 per share.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.