Overvalued Stocks:

Overvalued stocks are generally those stocks which are trading higher than their fair value i.e., the value that the companyâs fundamentals, like earnings per share or revenue growth, etc justify. Generally, for overvalued stocks, market value is greater than fair value of the stock because of biased consensus estimates and irrational increase in investor confidence. Such a stock is considered overvalued because of a surge in investor demand or a decline in its fundamentals, which the market fails to price in.

Letâs have a look at some ASX stocks:

CSL Limited

About the Company: CSL Limited (ASX: CSL) is into the business of manufacturing, marketing and developing of pharmaceuticals and diagnostic products, cell culture media and human plasma fractions. The company has a market capitalisation of $106.34 billion as on 30 September 2019.

On 17 September 2019, CSL informed that Paul Perreault, a director of the company disposed of 5,350 ordinary shares and is effectively holding 128,031 ordinary shares, 51,727 performance rights, 163,514 performance options and 54,113 performance share units.

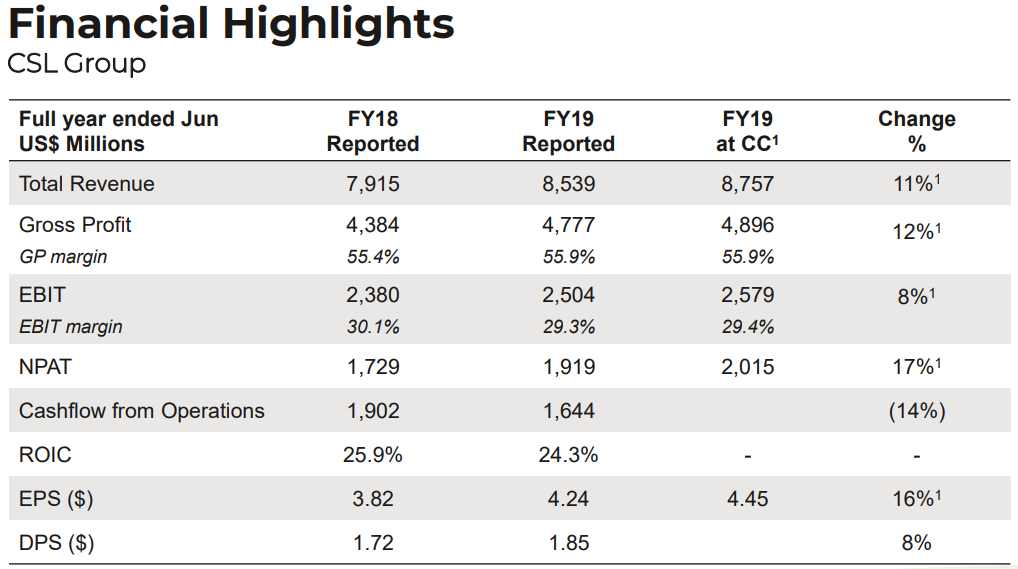

Key financial Highlights for the year ended 30 June 2019: Company reported strong results for FY19 with revenue up by 11% and NPAT up by 17% (both parameters when expressed at constant currencies and in US dollars) due to:

- Continued strong growth in core immunoglobulin and albumin therapies;

- Seqirus delivering on strategy with strong profit growth;

- Successful evolution of Haemophilia portfolio;

- High patient demand for speciality products Haegarda and Kcentra.

The company reported an EPS of US$4.236, up by 16% at constant currency. The final dividend stood at US$1.0 per share. And the dividend for full year increased to US$1.85 per share, up 8% over the previous year.

Source: Companyâs Presentation

Outlook for FY20 (at FY 19 exchange rates): For FY20, NPAT is expected to be in the range of US$2,050 million to US$2,110 million representing a growth of 7-10% over FY19 and this growth includes the one-time financial headwind of transitioning to a new model of direct distribution in China.

Stock Performance: The stock has generated a total return of 8.88% and 21.82% in the time period of three months and six months, respectively. The stock closed at $233.69 on 30 September 2019 and has a P/E multiple of 38.790X.

Wesfarmers Limited

About the Company: Wesfarmers Limited (ASX:WES) is into the business of outdoor living, home upgrading, clothing, office supplies and general merchandise. The company also an Industrial division with interests in energy, chemicals and fertilizers, safety products, etc. The company has a market capitalisation of $45.75 billion as on 30 September 2019.

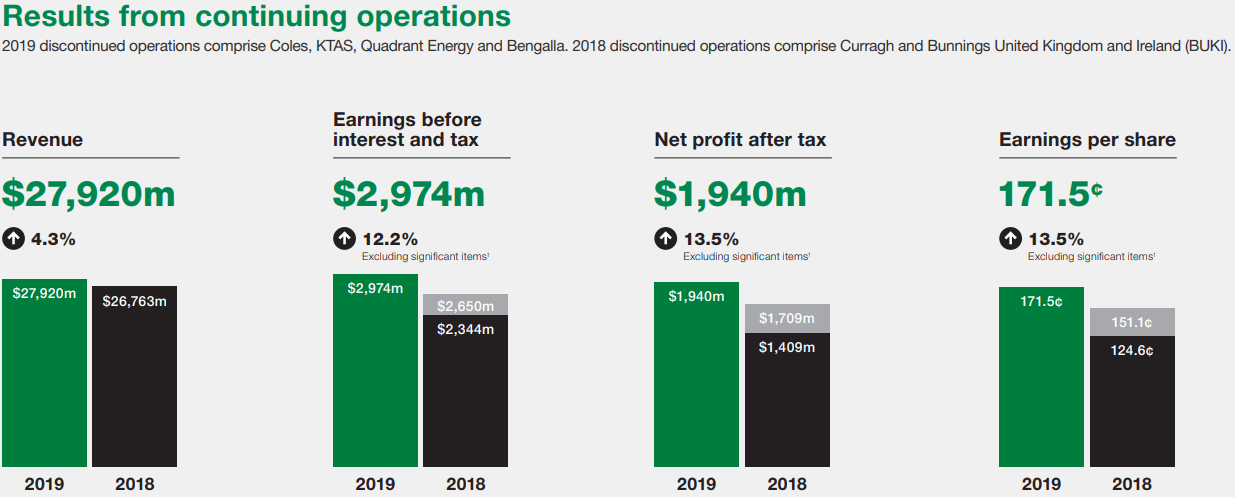

Key financial highlights for the year ended 30 June 2019: The companyâs reported NPAT of $5,510 million for FY19 and the reported profit consists of post-tax significant items of $3,171 million due to discontinued operations from gains on the demergers of Coles and disposals of Bengalla, KTAS and Quadrant Energy, which were executed in the first half of the financial year 2019.

Source: Company Presentations

Stock Performance: The stock has generated a total return of 10.28% and 18.54% in the time period of three months and six months, respectively. Currently the stock is trading at a PE multiple of 8.280X and closed at $39.80 on 30 September 2019.

Woolworths Group Limited

About the Company: Woolworths Group Limited (ASX: WOW) is into the business of food, general merchandise and speciality retailing through chain store operations. The company has a market capitalisation of $47.25 billion as on 30 September 2019.

Marley Spoon Secures a Funding Deal: Marley Spoon AG, a global subscription-based meal kit provider, has approved structural debt transactions with two of its existing investors, a subsidiary of Woolworths Group Limited and Union Square Ventures (USV), amounting to $8 million in aggregate. The total amount of $8 million will be divided in two parts and each of the existing investors would pay half of the amount.

Two funds affiliated with USV will initially extend a commercial loan facility of $4 million to the company. WES proposes to seek shareholder approval to convert this loan into convertible bonds, subject to the following conditions:

- Maturity Date - 3 years from the date of issue;

- Interest of US$ LIBOR + 5% p.a. and payable at maturity unless the bond is converted

- Conversion price of A$0.50 per instrument;

- Once fully issued, the USV Convertible Bonds can be converted by USV into an aggregate amount of up to approx. 8,170 shares/8,170,000 instruments in the company at any time during the conversion period;

- Additional prepayment fee of US$ 2,776,487.50 to be paid by the company if, prior to conversion, the company elects to terminate and redeem the USV Convertible Bonds in case a change of control occurs.

The contribution by Woolworths Group will initially be structured as a senior secured commercial loan of $4 million bearing a fixed rate of interest of 7% p.a. This loan may be converted to a convertible bond at a later stage with shareholder approval.

Stock Performance: The stock has generated a total return of 12.43% and 24.18% in the time period of three months and six months, respectively. The stock closed at $37.28 on 30 September 2019 and has a P/E multiple of 18.210X.

Domino's Pizza Enterprises Limited

About the Company: Domino's Pizza Enterprises Limited (ASX: DMP) is a food retailer operating pizza chains which comprise of both franchisee owned and company owned corporate stores. The company has a market capitalisation of $4.06 billion as on 30 September 2019.

Change in Directorâs Interest: Mr Don Meij, the Managing Director of the company, has sold a total of 43,343 shares in Dominoâs Pizza Enterprises Limited. It was done by Mr Meij to meet financial obligations relating to taxation. Mr Meijâs shareholding now compromises of:

- 1,263,062 shares directly in his own name;

- 536,939 shares indirectly through Invia Custodian Pty Ltd as trustee for the Meij Family Trust making it a total of 1,800,001 shares.

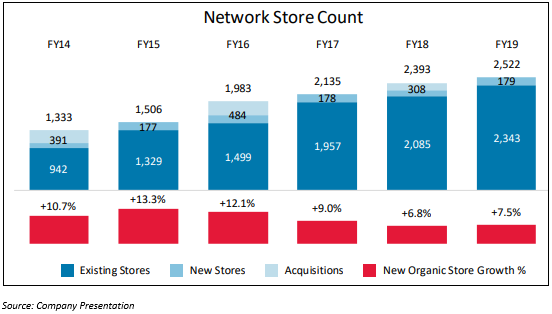

Key financial highlights for the year ended 30 June 2019: The company performed very well in FY19 with double digit growth in network sales and online sales growth. This year the online sales were strong, and the company grew in all markets with digital sales increasing by 18.2% to $1.94 billion, accounting for 67.1% of all sales.

Stock Performance: The stock has generated a total return of 24.09% and 12.14% in the time period of three months and six months, respectively. The stock closed at $46.45 on 30 September 2019 and has a P/E multiple of 34.890X.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.