What do investors consider before picking stocks?

Generally, before injecting funds, investors look at the fundamentals of a company, including market cap, profits earned and the price at which the stock is available.

Investors also prefer picking those stocks that trade at a price less than intrinsic value or book value. They hunt out stocks that are being undervalued by the stock market.

- Market Cap: Market cap of a company is determined by the multiplication of the share price with the number of outstanding shares. Market cap helps investors to get an idea about the relative size of the company. It is also an important indicator, as it helps in knowing whether the stock is undervalued or overvalued based on the current asset and income of the company.

- PE Ratio: PE ratio or Price to Earnings ratio is another important criterion considered by investors while selecting a stock. A higher PE ratio indicates that the stock is expensive and vice versa.

- Share Buyback: Share buyback is considered as a good sign of a strong investment, as buyback of shares by a company means that it is delivering better investor returns while reducing the number of outstanding shares.

- Profit Analysis: Another important parameter is profit analysis, which can be performed by checking various periodical results released by the company.

- USP/ Products and Services provided by the company and its scope in future.

FirstWave Cloud Technology Limited

FirstWave Cloud Technology Limited (ASX:FCT) is a technology and cloud service provider, engaged in delivering safety through the most accessible and adaptive cloud-based cybersecurity solutions.

Products/Services:

- Cloud Content Security Gateway

- Cloud Email Security

- Cloud Web Security

- Cloud Next Generation Firewalls

- Cloud Security Services

Importance of Cloud Security:

Cloud security helps in protecting data from theft, leakage or deletion from the cloud.

Future Scope of Cloud Security:

With increasing demand for cloud computing along with growing usage of cloud services, the future scope of companies operating in this business is brighter.

FY2019 Highlights:

- FCTâs revenue in FY2019 from ordinary activities increased by 13% to $8,831,731 as compared to the previous corresponding period (pcp), including a 14% increase in revenue from licensing and support and a 9.7% decline in revenue from professional services.

- Net loss after tax for the period increased to $11,007,337 from $8,717,386 in FY2018.

- Cash and cash equivalents at the end of FY2019 stood at $8,061,168.

Recent Update:

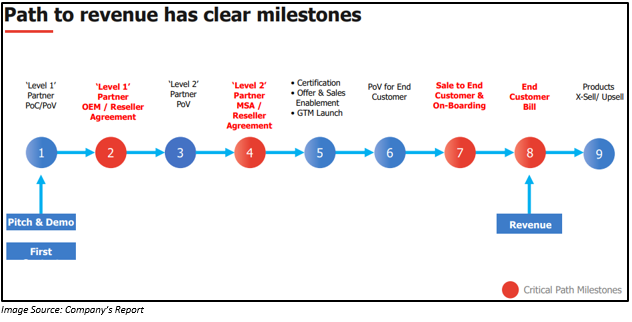

FCT has recently secured a reseller agreement with MobiFone Global in Vietnam, representing progress of the company towards its path to revenue.

Stock Information:

By the end of trading session on 16 September 2019, the shares of FCT closed at a price of $0.235, up 2.174% as compared to its last closing price. FCT has a market cap of $64.59 million and approx. 280.81 million outstanding shares.

ARQ Group Limited

ARQ Group Limited (ASX:ARQ) offers companies of different sizes with cloud-based technology services to do their business online. The company also provides services related to data analytics and mobile. ARQ offers its services to various industries such as banking & finance, health, travel, insurance and energy & commodities.

Cloud Computing:

Cloud computing is one of the most popular technologies across the world, as this technology helps users as well as enterprises to save a lot of money. In cloud computing, services are provided via the internet. The best part of this technology is its accessibility. A user can access data from any corner of the world and can continue sharing data and work on it.

As far as ARQ is concerned, growth and change in demand in various industries in which the company operates would influence the services offered, thereby helping the company to grow.

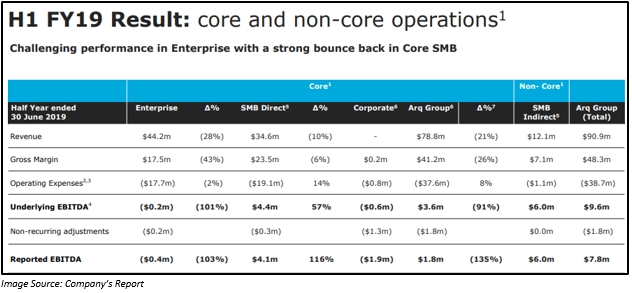

1H FY2019 Highlights:

In 1H FY2019 ended 30 June 2019, the companyâs total revenue declined by 19.1% to $90.898 million. The company incurred a loss of $0.564 million during the period. Disappointing results for the reported period were attributed to the underperformance of the Enterprise segment, execution issues in Melbourne and unexpected delays in turning on revenues from new contracts.

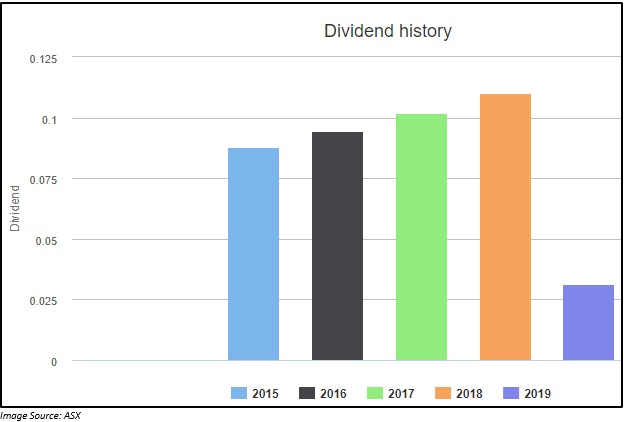

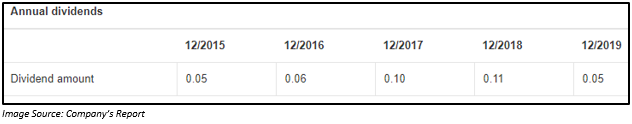

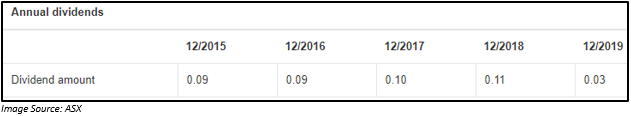

The stock has a track record of rewarding its shareholders with dividend.

Stock Information:

By the end of the trading session on 16 September 2019, the shares of ARQ closed at a price of $0.545, up by 0.926% as compared to its last closing price. ARQ has a market cap of $65.95 million and approx. 122.13 million outstanding shares.

Xref Limited

Xref Limited (ASX:XF1) is an IT sector player that develops human resources technology, catering to clients in the regions of Europe and North America, in addition to Australia and New Zealand. The company, through its cloud-based automated platform, provides its clients with unique candidate referencing solution, thus enabling them to save their time and money as well as make smarter and informed hiring decisions.

Scope of Cloud-based Recruitment:

All the cloud-based services are expected to have a brighter future. Cloud-based recruitment management system integrates more seamlessly into existing recruitment ecosystems. It enables recruiters and hiring managers to assess and find the right candidate for the job.

FY2019 Result Highlights:

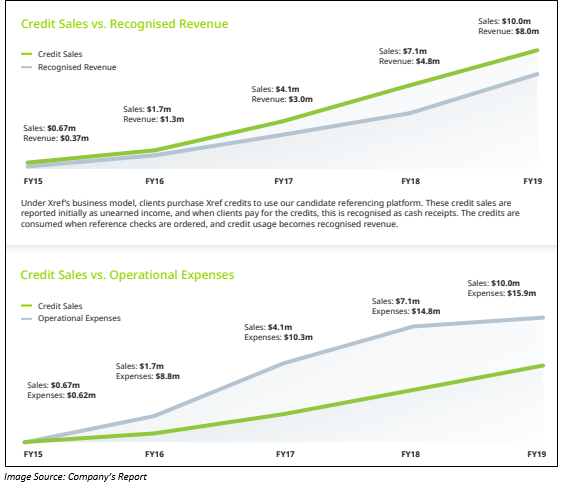

XF1 has updated the market with its FY2019 results for the year ended 30 June 2019.

- Total sales increased by 42% to $10 million.

- Total recognised revenue increased by 66% to $8 million.

- The company incurred a loss of $8,318,251 in FY2019.

Stock Information:

By the end of trading session on 16 September 2019, the shares of XF1 traded flat at a price of $0.375. XF1 has a market cap of $62.8 million and approx. 167.46 million outstanding shares.

Novonix Limited

Novonix Limited (ASX:NVX), formerly known as GraphiteCorp, is engaged in the development, production and sale of the most accurate high precision battery cell testing equipment in the world. The equipment is designed for battery makers, equipment manufacturers and research organisations.

Organisations using NVX Battery Cell Testing Equipment:

Apple, Microsoft, Tesla, Bosch, GM, 3M, Dyson, XALT Energy, Panasonic, ATL and CATL are some of the big players that are using the companyâs battery cell testing equipment.

Device Patent:

Recently on 02 September 2019, NVX announced that it was granted a patent for battery electrolyte analysis by the United States Patent and Trademark Office.

Stock Information:

By the end of trading session on 16 September 2019, the shares of NVX traded flat at a price of $0.480. NVX has a market cap of $61.51 million and approx. 128.14 million outstanding shares.

Technology One Limited

Technology One Limited (ASX:TNE) is the largest enterprise software company in Australia with more than 390 enterprise customers in 1H FY2019, representing a 39% growth from 1H FY2018.

SaaS:

Software-as-a-Service or SaaS is a category of cloud computing, hosted on a remote server, accessible via the internet and managed from a central location. Companies into the SaaS business have a brighter future, as it is a new way of selling and distributing software over the cloud. It has a wide range of applications and is used by both IT professionals as well as businesses. Application of SaaS can be seen in almost all fields.

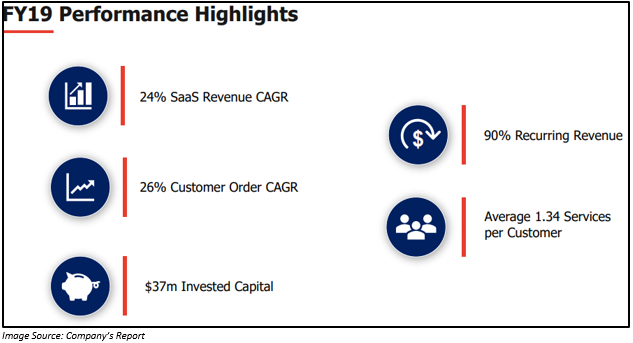

1H FY2019 Highlights:

- Revenue from ordinary activities soared by 5% in 1H FY2019 to $129.287 million.

- NPAT improved by 119% to $17.921 million.

- The companyâs 1H FY2019 dividend stood at 3.15 cents per share.

Stock Information:

By the end of trading session on 16 September 2019, the shares of TNE closed at a price of $6.920, down by 2.26% as compared to its last closing price. TNE has a market cap of $2.25 billion and approx. 317.83 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.