Australia's largest enterprise SaaS company, TechnologyOne Limited (ASX: TNE) on 21 May 2019, announced the 1H FY2019 results for the period ended 31 March 2019. The company reported strong growth during the period with profit up by 130%, driven by the fast growth of the TechnologyOne enterprise SaaS solution.

The company has delivered the 10th year of record profit, record revenue and record SaaS fees. There was an increase in the revenue by 5% to $129.3 million. The Net Profit Before Tax was up by 130% to $24.5 million. The expenses during the period declined by 7% to $104.8 million. The annual contract value of SaaS increased by 45% to $85.8 million. The net profit for the period attributable to members increased by 119% to $17.921 million. The company declared a dividend of A$0.0315 per share, which is 75% franked, to be paid by 14 June 2019.

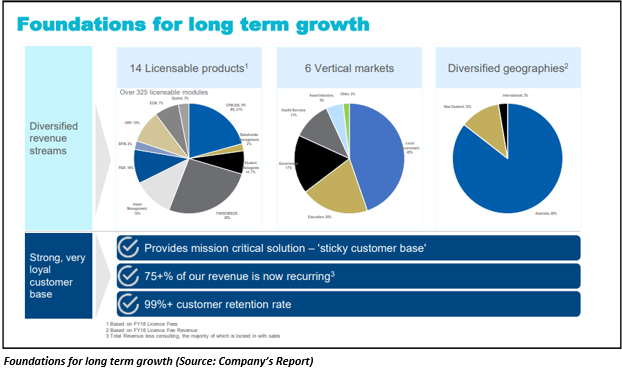

During the period, the company was successful in increasing the number of large-scale enterprise SaaS customers by 39% to 389 as compared to the previous corresponding period. These consumers have 100s of 1000s of users. Thus, making the company, the largest multi-tenanted ERP SaaS offering in the Australian region.

The company continues to dominate the local government sector as well and have more than 300 council customers and are continuing to grow fast.

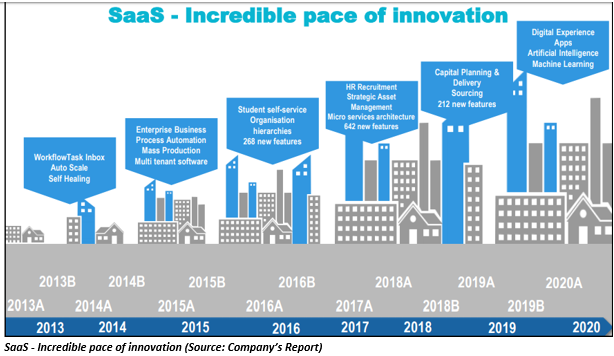

Mr Adrian Di Marco, the Executive Chairman of TNE, stated that since the time it was listed on ASX, TNE had consistently delivered a strong and growing result due to its clear vision and strategy. The companyâs ability to successfully undertake large-scale cutting-edge R&D, along with its successful commercialization, has underpinned its success. Further, the company will continue to make investments in the new exciting ideas and innovation such as Artificial Intelligence and Machine Learning.

On the balance sheet front, the company witnessed a decrease in the net assets base due to a fall in the total assets. The total shareholdersâ equity was worth $75.772 million. Further, during the period, there was an increase in the receipt from the customer from $112.079 million to $128.097 million. As a result, there was a net cash inflow of $7.791 million from the operating activities of the company.

From the cash flow perspective, a net cash outflow of $19.790 million was recorded in the investing activities of the company. The primary drivers of cash outflow were in the form of payments made for property, plant and equipment, payment for intangible assets, payments for contract acquisition assets and payment for contingent consideration. Also, there was a net cash outflow of $24.146 million from the financing activities of the company.

By the end of the 1H FY2019, on 31 March 2019, the company had net cash and cash equivalent worth $68.177 million.

Outlook:

The company expects to see strong continuing growth in 2019, with the net profit before tax to be in the range of $71.6 million to $76.3 million. The company expects its SaaS ACV to grow up by 45% on its pcp. The total expenses are expected to increase by 7% for the full year. There will be no acquisitions in the second half of FY2019.

By the end of the trading session, the shares of TNE were at A$7.830, down by 13.481% as compared to its previous closing price. TNE holds a market cap of A$2.87 billion with approx. 317.12 million outstanding shares and a PE ratio of 56.070x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.