Iron ore prices shot-up again to mark a third new multi-year high post the Australian mammoth iron ore miner- Rio Tinto (ASX: RIO) reduced its shipment guidance for the year 2019.

In an announcement made by the company on the Australian Securities Exchange, Rio mentioned that the company is facing operational challenges, which in turn, is compromising the quality of its iron ore blend.

The operational challenges in the Pilbara Region, specifically in the Great Brockman hub, reduced the Pilbara Blend quality, which in turn, prompted the company to cut the guidance. As per the company, it sold around 1.5 million of the Pilbara Blend in the first quarter of the year 2019 and would further sell the product during 2019.

The operational challanges led towards the reduction of original shipment guidance from 333-343 million tonnes to 320-330 million tonnes, which marked a decrease of 13 million tonnes of the Pilbara Blend shipment. Rio would further provide an update on per unit cost in the second quarter operational review.

The loss of the production on back of the shortage in supply supported the iron ore prices further, and the iron ore prices of 62 per cent grade reached another multi-year high in the international market.

Apart from the recent developments in the Australian iron ore market, another event that occurred in the Brazilian market has also influenced the prices. Post informing the market about the extended time required to restore the production level to normal at the Barcelona summit, the Brazilian Behemoth- Vale notified the media houses that the company would restart its Brucutu Mine in 72-hours (20 June 2019).

The local government suspended Brucutu Mine operations over the dam collapse in Brazil, but the mine received the consent of the local authorities to restart; however, further investigation in the dam collapse led towards the suspension of the mine again.

Iron ore Market:

The supply side of the iron ore market is weak over the shortage in the supply chain, and the Chinese ports have seen a consistent decline in the shipment across the 35 significant ports for ten consecutive months.

While on the demand side, the weaker steel prices have somewhat exerted pressure on the iron ore prices; however, the worries over the decline in the supply chain have kept the prices above the previous multi-year high.

The market derives its price from the steel industry as a high steel demand pulls the iron ore demand as well.

To read more on the Steel prices and its cascading impact on miners click Here!

Iron Ore Industry:

The industry players are relatively enjoying the high iron ore prices, and the share prices of many Australia miners have tested their recent 52-weeks high . The new freight standards are further expected to support the industry players over the long-run by strengthening the industryâs environmental performance.

The new International Maritime Organisation emission standards, known as IMO 2020, proposed to reduce the sulfur content from 3.5 per cent by weight to 0.5 per cent by weight, which in turn, would lead to less sulfur content in the cargo fuels.

The iron ore industry is a significant contributor (sixth in position) towards the carbon emission, and the global economies are becoming more and more carbon resilient in line with the Euro 6 standards. The IMO 2020 could help the industry to stay out of the government ban, which various governments across the world imposing bans from time-to-time to curb the emission.

The coal industry is an excellent example of such activities, where the various government have suspended the coal-based operations. China is particularly very stringent over the coal import, which prompted the Australian miner BHP to divert its Mt Arthurâs coal to japan.

Australian Iron Ore Industry Vs Brazilian Iron Ore Industry:

The IMO 2020 regulations are likely to inch up the price of per unit of shipment cost, which would be further add a cost premium to the iron ore prices and could be supportive if the demand remains high.

However, the environment of low demand could exert pressure on the iron ore industry worldwide. Despite as a burden in terms of high cost, the IMO 2020 would provide an extra advantage to the Australian iron ore industry as compared to the Brazilian.

In its blog the giant miner BHP mentioned the new shipping standards would push the cost of per tonne shipment by US$2 to US$3; however, the company also estimated that the same cost of transferring the iron ore to the Chinese ports from Brazil would mark a surge of US$4 to US$5.

The low cost of the Australian transfer would provide the domestic industry with an advantage over the rival Brazilian industry.

The Export Slump:

Post the downgrade in Rioâs shipment guidance; the market experts are estimating an export slump in the market, as many market participants believe that the prices have crossed the peak for the year.

The export from the major Australian trio of Rio Tinto (ASX: RIO), BHP Billiton (ASX: BHP), and Fortescue Metals (ASX: FMG) is expected to decline in the range of 31.3 million tonnes to 11.3 million tonnes, as compared to the previous year.

Even if the three-giant miners reach the top of their export target, export numbers would still be down by 11.3 million tonnes, as compared to the previous year.

Moreover, the export gap from the previous year would widen by 31.3 million tonnes if the trio reach the lower end of their export guidance.

Due to the expected lower export, the market could mark a further shortfall; however, the Brazilian Miner is planning to start the Brucutu Mine soon, which in turn, could further offset the shortage gap, and investors should keep a close eye over the developments.

Iron ore Price and Price Action Scenario:

Iron ore prices are moving up on the Dalian Commodity Exchange from the level of RMB 448.00 (low in December 2018) to the present month high of RMB 837.00 (Dayâs high on 20th June 2019).

DCE Iron Ore on Charts:

DCIOU9 Daily Chart (Source: Thomson Reuters)

DCIOU9 Daily Chart (Source: Thomson Reuters)

On following the developments on a daily chart, we can see that the iron ore prices are moving in a continuous uptrend post witnessing a Golden Cross (bullish signal) of 20-days and 50-days exponential moving averages.

The prices corrected to the level of approx. RMB 692.8 after making a high, the upside movement followed by a correction presented perfect points to join the Fibonacci Series. The points of connection are marked as 0,1,2 on the chart shown above.

The outcome of the series after connecting the points (0,1,2) are as follows:

28.6 per cent reaches the level of RMB 731.6, 38.2 per cent reaches the level of RMB 755.6, 50.0 per cent reaches the level of RMB 775.1, 61.8 per cent reaches the level of RMB 794.5, and 100.0 per cent reaches the level of RMB 857.4.

CME Iron ore Reaches New high:

On the Chicago Mercantile Exchange, the iron ore prices breached its previous multi-year high of US$105 and settled at US$107.21 on 20th June 2019.

CME Iron Ore on Charts:

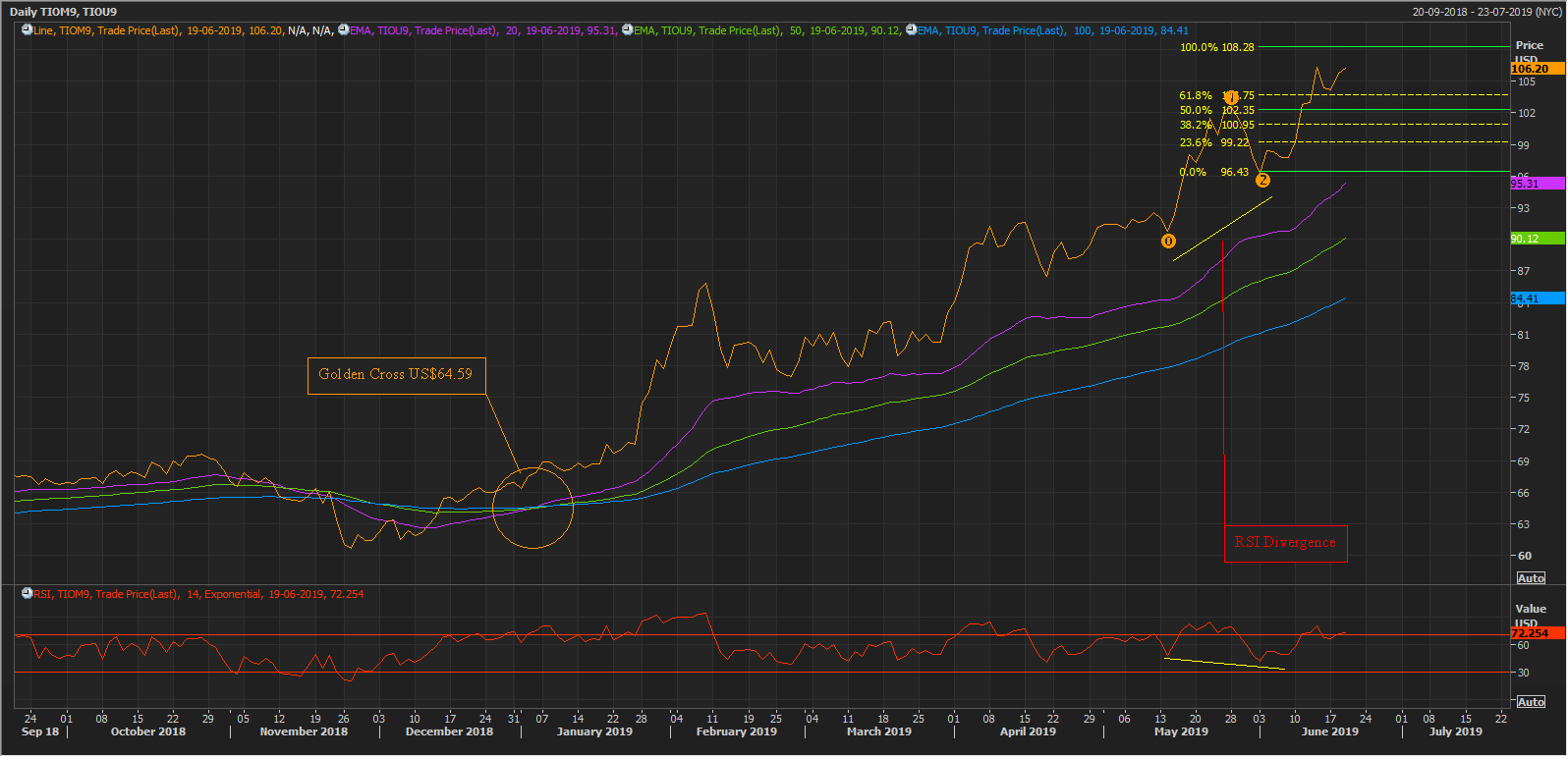

TioM9 Daily Chart (Source: Thomson Reuters)

TioM9 Daily Chart (Source: Thomson Reuters)

Upon carefully studying the daily price chart, it can be seen, that the iron ore prices rose post marking a Golden Cross (bullish signal) of 20,50, and 100-days exponential moving averages. The prices are currently above from the trio of moving averages, which are at US$95.31 (20-days), US$90.12 (50-day), and US$84.41 (100-days) respectively.

During its recent up-rally, the prices corrected from its previous high and bounced back, which in turn, provided spots to connect the Fibonacci Series. The projection points are marked as 0,1,2 on the chart shown above.

The Fibonacci outcome is as follows; 28.6 per cent reaches the level of US$ 99.22, 38.2 per cent reaches the level of US$ 100.95, 50.0 per cent reaches the level of US$ 102.35, 61.8 per cent reaches the level of US$ 104.75, and 100.0 per cent reaches the level of US$ 108.28.

On the technical indication front, the Relative Strength Index of 14-days period, which is at 72.254, is showing a divergence with the price actions. The iron ore prices are moving from low to high; while the value of the 14-days Relative Strength Index is moving from high to low. The opposite movement of the prices and the Index is creating a diversion on the technical chart.

Iron ore and the Australian Miners:

The high iron ore prices have supported the share prices of the Australian miners, and in the status quo, the share prices of the Australian miners have breached their previous 52-week high.

In todayâs session (as on 21 June 2019) the Australian miner- BHP Billiton (ASX:BHP) reached a new 52-week high of A$41.380 (as on 21 June 2019, 1:34 PM AEST)

However, the recent reduction in the Pilbara Blends, which enjoys the highest premium among all other Rioâs product, has exerted pressure on the Rioâs share. The shares of RIO plunged from its recent 52-week high of A$107.990 (Dayâs high on 28th May 2019) to the present level of A$101.270 (as on 21st June 2019, 1:34 PM AEST).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.