The current period has been witnessing humanity fighting a battle with time, as the COVID-19 pandemic is accelerating. According to World Health Organization (WHO), the total number of confirmed cases across the world has surpassed 1.8 million, while the number of deaths has exceeded 1,17,217 in more than 210 nations till date.

Do Read: Ray of Hope amid Coronavirus- Potential Vaccine For COVID-19 is Underway

Healthcare sector is a classic example of defensive play. Irrespective of the share market of the state or global economy, individuals will continue to access the healthcare sector. Consequently, healthcare shares on Australian Securities Exchange (ASX) have had a tendency of generating stable earnings and consistent dividends throughout the cycle of the economy. Owing to the continuous need of medical formulations, healthcare stocks tend to be more constant during numerous stages of the business cycle.

Also Read: The Run-up for 7 Quality ASX Shares in Healthcare Space

In recent weeks, share markets have been unpredictable, seeing sharp movements in both directions (red and green) as the agencies throughout the world revealed massive amounts of stimulus to stem the economic impact of the COVID-19.

On 15 April 2020, the Australian benchmark index S&P/ASX 200 ended the trading session, going down by 0.39% and was at 5,466.7 points. Also, the S&P/ASX 200 health care sector closed in red and was at 44,597.0 points, with a drop of 0.28% compared to the last close.

In the given backdrop, we are highlighting three ASX listed healthcare stocks- NAN, RMD, RHC

ResMed Inc Experiences Increased Demand for Ventilators

ASX-listed medical device maker, ResMed Inc (ASX:RMD) develops superior-quality devices for offering a better and improved life to individuals facing sleep apnoea, COPD (chronic obstructive pulmonary disease), and other chronic disorders.

RMD ramps up production of the ventilator to meet the global requirement

As per the press release of ResMed, the Company stands with the globe in the ongoing challenge of the coronavirus pandemic and is prepared to help in lessening its impact as well as assisting individuals to breathe while their immune system fights this deadly virus.

RMD informed the market that requirement of its ventilators is elevated than normal this time in particular from profoundly affected COVID-19 countries; though, the Company emphasised that new patients detected for sleep apnoea might decline as hospitals are focused on the treatment of the infected people.

Further, the Company revealed that over 7.5k members are working in over 140 nations for providing the treatment of COVID-19.

Remarkably, RMD has joined hands with health authorities, governments, hospitals, physicians, as well as patients at the international level to evaluate their requirement, and to offer the ventilation therapy, which is essential for the treatment of COVID-19 induced respiratory complications.

Likewise, the Company mentioned that it is considering the manufacturing of ventilators to twofold or threefold and at the same time, improve the production of a ventilation mask higher than tenfold.

Q3 Fiscal 2020 Earnings update-

In an ASX update dated 9 April 2020, ResMed disclosed that the Company plans to release its financial and operational outcomes for the third quarter of FY2020 on Thursday, 30 April 2020, after the closing of New York Stock Exchange (NYSE).

The stock of RMD last traded at $25.100, up by 0.28% from its last close, as on 15 April 2020, with the market capitalisation at nearly $36.21 billion.

Ramsay Health Care Limited stands to benefit from government backing

A global health care company Ramsay Health Care Limited (ASX:RHC) is engaged in providing high-quality services and offering outstanding patient care including hospital management. Ramsay is known as one of the biggest and also the most varied private health care firms across the globe. It provides primary and acute health care services from its 480 facilities throughout 11 countries.

The reason leading towards the triumph of Ramsay is providing superior-quality outcomes for patients and centering on relationships with doctors and other staff.

Private hospitals to battle with 2019-nCoV

Private hospitals have suffered from the cancellation of elective surgeries but are now being drafted into the government’s COVID-19 response plan.

The Government of Australia has decided to guarantee the viability of private hospitals and this is on the anticipation that all private hospitals maintain capacity for responding to the COVID-19 pandemic and non-COVID-19 and are able to recommence operations at the end of this pandemic situation.

Ramsay Health Care confirms that the conversations with the Australian Federal and State Governments regarding the capacity and support that Ramsay can provide as part of the Government’s COVID-19 response continues.

All territories and states would complete private hospital COVID-19 partnership agreements in the upcoming days, which will outline the integration plan, and activity requirements and the Australian government would contribute funding of 50% towards this activity.

Moreover, the viability guarantee also needs private hospitals to develop infrastructure, equipment, supplies, and other capabilities fully available to Australian governments for applying in the coronavirus response along with some non-COVID-19 activities.

Notably, the government disclosed that this guarantee is intended to confirm continuity of capacity of the private hospital during the crisis and enable the sector to recommence business as normal events after the COVID-19 pandemic has ended.

On 15 April 2020, RHC stock last traded at $64.000, down by 0.249% compared to its previous close, with a market cap of nearly $12.97 billion. The stock has almost 202.08 million outstanding shares on ASX.

Nanosonics Limited Provided Business update in the wake of current COVID-19 situation

The infection prevention solutions provider Nanosonics Limited (ASX:NAN) develops unique automated high-level disinfection device, and is also a pioneer in providing high-level ultrasound probes disinfection. The Company provides a unique, automated, high-level disinfection device trophon® EPR which is a complete solution for lessening the spread of healthcare-acquired infections (HAI) by reducing the spread of infection between the patients.

NAN provides a business update based on the current COVID-19 situation and highlighted-

In the third quarter of FY20, the unaudited sales were significantly up on prior corresponding period (pcp) representing continued underlying growth momentum for the business and a growing awareness and understanding of the importance of ultrasound probe decontamination.

To the end of third-quarter consumables sales up and are aligned with the pre-COVID-19 anticipations of Nanosonics. The potential for COVID-19 to impact consumables sales in the fourth quarter of the financial year 2020 is uncertain at this stage.

Furthermore, NAN stated that the Company is closely monitoring and managing its supply chain and is at present well positioned to meet up the requirement of the customer having enhanced inventory of raw materials as well as finished products for consumables and capital equipment.

Nanosonics disclosed that as on 31 December 2019, it had a strong balance sheet with cash assets of nearly $82.0 million.

FY20 half year highlights-

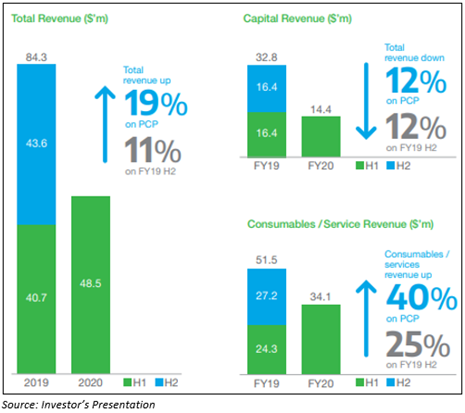

- The Company recorded first half sales of approximately $48.5 million, increased by 19 per cent on PCP and 11 per cent on prior half.

- The continued robust worldwide installed base growth, up by 17 per cent in last one year and 8 per cent in last six months to 22,500 units.

On 15 April 2020, NAN stock last traded at $6.260, going up by 0.321% versus the last close, with a market cap of nearly $1.88 billion. The stock has almost 300.54 million outstanding shares on ASX.

Also Read: Be A Smart Investor, Escape These Myths While Investing In Stocks