The global COVID-19 turmoil is turning into one of the most difficult challenges for humanity in recent memory, as the coronavirus infection has infected more than two million people worldwide, resulting in sealed borders and slowdown in the economic activities.

As per the polls of economists from around the world, the global economy will suffer its sharpest contraction on record this year, to be followed by a recession due to the ongoing pandemic.

At present, the significant fluctuations in financial markets emphasise the extent of uncertainty and disruption. The International Monetary Fund (IMF) recently revealed that in 2020, the "Great Lockdown" recession would pull the global Gross Domestic Product (GDP) drop by 3%, but the managing director of IMF at this time believes the gloomy outlook could be too optimistic. According to IMF, due the COVID-19 pandemic 170 nations will be going to suffer with reduced GDP per capita by this year end.

However, in the event of current COVID-19 the demand for active pharmaceutical ingredient (API) for developing treatment/vaccine, medical devices, sanitizers as well as masks is increasing. As the companies are focusing on developing the laboratories for detecting and diagnosing the deadly virus.

ALSO READ: Enhanced Demand for Medical Devices and Ventilators amid Virulent Environment

In this article, we are highlighting how the healthcare sector is playing a significant role in supporting the global economy during this pandemic-

Singapore Industrial Production Rise Unexpectedly

In March, Singapore industrial production rose surprisingly, preceded by a sudden surge in the biomedical output as the demand for pharmaceuticals rose amid the COVID-19 pandemic, information from the Economic Development Board. The production in Pharmaceuticals was at the core of the manufacturing surge observed in March.

According to some media reports, in Singapore, the factory production in March climbed at its fastest speed in more than last nine years and has surged all the previous anticipations. And in this factory output surge, major role was played by the pharmaceutical manufacturing industry as the production in pharma manufacturing was observed more than twice.

Moreover, on a monthly and seasonally adjusted basis industry output climbed by 21.7% and data from the Singapore Economic Development Board indicated, the highest jump since January 2011.

On a year-on-year basis, in March the industry production climbed 16.5% after a 0.7 % decrease in February and is stated as the highest surge since January 2018. Moreover, it was significantly above expectations for a 6.3% plunge as forecasted by the economists.

Apart from biomedical manufacturing, the industrial output stayed unaffected in March, after a 2.2% plunge in February. The pharmaceutical industry production soared by 126.6% year-on-year, with increased production of API (active pharmaceutical ingredients) as well as biological products. According to the media, the annual exports from Singapore increased by 17.6% in March due to shipments of pharmaceuticals.

Pharma and Healthcare Companies Make Hay While the Sun Shines

Unsurprisingly, however, if there is anything left to support economic activity, it is the healthcare and pharmaceuticals industry profiting from a significantly increasing demand.

Let us discuss few healthcare companies-

COVID-19 and increased demand for ResMed’s Ventilator

A medical device and software company, ResMed Inc (ASX:RMD) develops advanced quality medical devices for providing a superior and better-quality life to patients of chronic obstructive pulmonary disease (COPD), sleep apnoea and other chronic diseases.

As per the press release of ResMed, the Company stands with the globe in the challenging period caused by the COVID-19 turmoil, and is prepared to help in lessening its impact as well as assisting the infected patients who are in intensive care to breathe while their immune system fights the virus.

The Company stated that the requirement of its ventilators had been increased than usual and ResMed is working with hospitals, governments, physicians, health authorities as well as patients across the worldwide to gauge their requirement, and to provide the ventilation therapy.

RMD share price rose by 0.924% and was trading at AUD 25.120 (at AEST 12:59 PM) on 27 April 2020 with a market cap of AUD 36.1 billion.

USCOM 1A Doppler Haemodynamic Monitor for COVID-19 Patient

An innovative medical technology company USCOM Limited (ASX:UCM) disclosed that it is playing a major role in tackling coronavirus and its produce USCOM 1A is the exclusive accessible Doppler Haemodynamic Monitorin the world to be utilised for cardiovascular assistance when coronavirus infected individual is in the Intensive Care Unit. The Company is engaged in the expansion, as well as the global marketing of non-invasive cardiopulmonary medical tools.

Additionally, UCM’s produce USCOM 1A is recommended by the Chinese National Health and Medical Commission of the People’s Republic of China for the curing acute COVID-19 infection in both kids and in grownups.

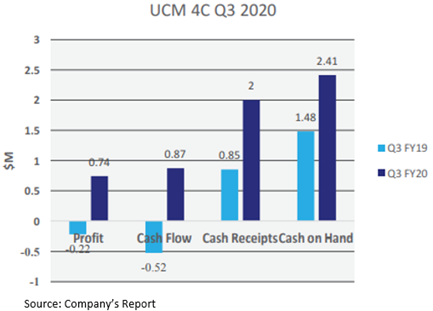

On 20 April 2020, UCM revealed its quarterly report for the quarter ended on 31 March 2020, quick highlights are-

On the operational front, in the first operating quarter, USCOM China seems to be profitable. Chinese government advises the use of USCOM 1A for the treatment of critically ill COVID-19 patients.

On the financial front, the Company generated a profit of AUD 0.74 million, which is up by AUD 0.96 million as compared to pcp with nearly AUD 2.41 million cash on hands.

The share price of UCM fell by 2.381% and was trading at AUD 0.205 (at AEST 2:33 PM) on 27 April 2020 with a market cap of AUD 31.43 million.

DO READ: USCOM now authorised to sell its Type II Medical Devices directly in China

Amgen Continues to Provide an Uninterrupted Supply of Medicines

An American multinational biopharmaceutical Amgen, Inc (NASDAQ:AMGN) said that the Company remains on track to provide an uninterrupted supply of medicines for patients across the globe. The Company has clinical research ongoing at investigational sites across the globe and is joining the race to discover and develop novel treatment/vaccine for the treatment of novel coronavirus.

Amgen’s share price rose by 1.63% to close the day’s trade at USD 236.28 on 24 April 2020.

Sanofi Under the partnership with BARD to develop a vaccine against SARS-CoV-2

Recently, the US Department of Health and Human Services (HHS) stated that it had partnered with French drugmaker Sanofi S.A. (NASDAQ:SNY) to develop a vaccine against SARS-CoV-2. Under this partnership, BARDA is offering its expertise and giving capital to Sanofi for funding the development of the vaccine, while Sanofi is employing its recombinant DNA-based and egg-free vaccine development system to produce a novel vaccine candidate. Since 2004, BARDA and Sanofi are working in partnership for development of vaccines.

Moreover, in mid-April, Sanofi also joined hands with GlaxoSmithKline (GSK) and the two pharma giants have strategised to begin the phase I clinical trials after June in the current year and intend to complete the development required for accessibility by the H2 2021, if successful and is subject to regulatory requirements.

This partnership between GSK’s and Sanofi’s establishes a significant mark in ongoing contributions of both the companies to support the global fight in the ongoing crisis.

ALSO READ: GSK Join Forces with Sanofi To Develop Covid-19 Vaccine

On 24 April 2020, Sanofi’s shares closed the day’s trade at USD 49.85, climbing up by 3.06%.