Coronavirus outbreak induced lockdown is projected to shrink the world’s output and push the global economy into the worst recession since the Great Depression. Safeguarding human lives and maintaining adequate healthcare capacity have forced the need for self-isolation, lockdowns, and widespread closures to slow the spread of the virus.

IMF has projected world output to plunge by 3% in 2020, worse than during the financial crisis of 2008-09.

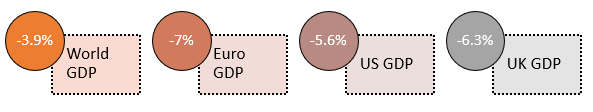

Fitch Ratings has predicted that the world GDP will diminish by 3.9% in 2020, down from the previous estimate of 1.9% and called it a recession of unprecedented depth.

The revision in GDP figure comes after major advanced economies extended the lockdown period. He stated that the decline in activity would be twice as severe as during the 2009 recession. The GDP fall will be equivalent to a fall in global income levels by USD2.8 trillion compared to 2019.

The most significant downward revision is in the eurozone at 7% where measures taken to curb coronavirus spread have had weighed heavily on the economic activity during Q120. Lockdowns have resulted in a fall in the GDP forecasts for Italy, Spain and France. Similarly, despite aggressive macroeconomic policy easing, GDP in the US and the UK is predicted to fall by 5.6% and 6.3% respectively.

US and Eurozone GDP are projected to fall below pre-virus levels in 2021 as per the rating agency.

ALSO READ: Economies On COVID-19 Fight, Will Their Measures Suffice?

There has been a much sharper fall in GDP revision for emerging markets. The rating agency expects an outright contraction in the emerging market GDP in 2020 with China and India are anticipated to register sub-1% growth. Plummeting commodity prices, capital outflows, and constrained policy actions are further aggravating the effect of measures being taken to contain the virus.

South Korea posts biggest GDP plunge

South Korea witnessed one of the worst economic contraction since 2008 as coronavirus crushed global consumer demand and business activity. As per the median prediction from the survey of 10 economists, South Korea’s GDP is anticipated to contract by 1.5% from the last quarter during the period of January-March.

The government has planned budget worth 7.6 trillion won after stimulus packages of 11.7 trillion won in March along with a rescue package of 100 trillion won. The interest rates have been slashed by 50 bps by Bank of Korea with an expectation of further rate cut.

IMF has projected the GDP of South Korea to fall by 1.2% in 2020.

With the country having reduced its infection cases without heavy shutdowns, new risks loom around its exports. During the period of 1-20 April, exports fell by nearly 27%, and further worsening is anticipated in the second quarter.

However, as the demand from major trading partners diminishes, the economy needs to brace up for a bigger shock.

Australian economy fades

The rate of coronavirus cases has been slowing for more than two weeks helping Australia in flattening the curve. However, the coronavirus outbreak has hit the economy hard with travel bans, supply and trade disruptions. Restrictions on people movement have hampered industries like retail, leisure and tourism, pushing millions of workers out of jobs.

IMF has projected Australia’s Real GDP to fall by 6.7% in 2020.

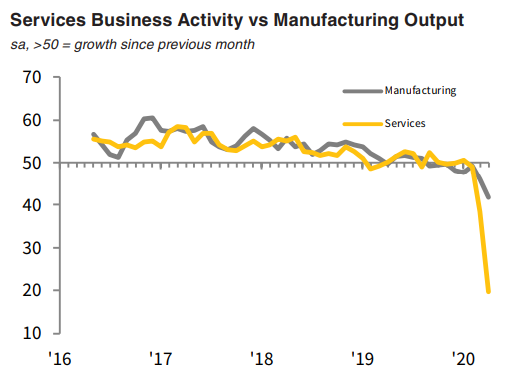

The Purchasing Manager’s Index (PMI) figures have shown deterioration in services and manufacturing activity.

Source: IHS Markit

While the Manufacturing PMI, which depicts timely changes in business conditions in the manufacturing sector, has dropped by 4.1 points in April to 45.6. This was because of a steep slump in consumer demand due to COVID-19 with new orders falling and leading to an increase in supplier’s delivery time.

ALSO READ: Keeping Faith in the Economy when Worst is Ahead

The Services sector PMI, which depicts timely changes in business conditions in the services sector, diminished to 19.6 in April from 28.5 in March 2020. Shutting down of companies and lockdowns to prevent the spread of coronavirus led to a severe decline in the business activity and new orders in April. The number of people employed reduced for the third month straight by the companies while the input costs plunged for the first time due to lower wages and fuel prices.

As per CBA,” The fall in the Composite PMI was led majorly by the services sector which was hit much harder than the manufacturing. As businesses are shutting down, job losses are evident. A recovery in PMIs is dependent on the length of coronavirus lockdowns.”

On 21 April, RBA governor declared that the unemployment rate is projected to be at 10% by June as the total hours worked are predicted to be reduced by 20%.

The Federal government has taken stimulus measure worth $320 billion till date to lift up the economy currently crippled due to coronavirus outbreak and has helped millions of workers through its JobKeeper Program. The lockdown measures in the country are expected to ease gradually only after September and further strengthening of the economy from thereon. The Australian economy is projected to grow by 6-7% after a 6% plunge in GDP growth in 2020.

Outlook ahead

Brian Coulton, Chief Economist at Fitch Ratings, stated that” Unmatched macro policy responses will serve as a cushion to the economy in the near-term. But with businesses being shut down and resulting in a massive loss of jobs, the path to recovery will be slow once the virus is contained.”

The economic picture will be altered substantially once the crisis is over. However, partial recovery is anticipated in 2021 with prevailing uncertainty about the strength of the recovery. Fears are already looming of a second coronavirus wave in advanced economies where rates have been slowing and are looking to ease lockdown restrictions. The rebound of the disease must be guarded.