The Australian benchmark index S&P/ASX200 Health Care (Sector), represented by code XHJ, settled the dayâs trade in the green zone on 08 October 2019, at 36,469.5, up by 181.9 basis points or 0.5 percent from the prior close of 36,287.6.

The Australian health care sector represents a lucrative sector for investors with the potential to deliver huge profit in a short period of time. This sector comprises of medical service, medical insurance and medical equipment providers, as well as companies dealing in drug development and R&D activities. Demographic trends of the aging population, latest advancements in medical technology, invention of precision medicines, competition among health care providers and drug developers, and increasing popularity of medicinal cannabis are some of the factors contributing to growing interest of investors in the sector.

Besides, other variables that are taken into consideration include-

- market cap,

- profit earned by the company,

- PE ratio,

- share buyback,

- patents granted,

- clinical trials,

- regulatory approvals.

Hence, vigilance on the latest developments and other clinical information is required before capitalising money in stocks.

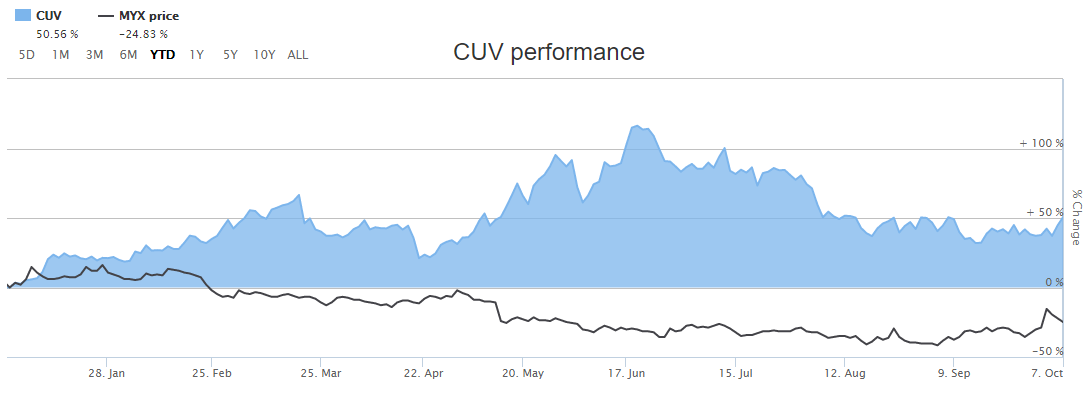

Letâs have a look at two players in health care sector, Mayne Pharma Group Limited (ASX: MYX) and CLINUVEL PHARMACEUTICALS LTD (ASX: CUV) and their recent updates on ASX. The comparative performance of MYX and CUV based on their YTD return is depicted in the figure below.

(Source: ASX)

Mayne Pharma Group Limited (ASX: MYX)

Headquartered in South Australia, ASX-listed Mayne Pharma is a technology-based pharmaceutical company with its expertise in developing novel drug delivery systems for the marketing of both branded and generic pharmaceuticals. With more than 100 clients across the globe, the company also deals in contract development and manufacturing services. MYX has a focus on treating womenâs health.

Recent Announcement

- As per the latest ASX announcement dated 02 October 2019, a 20-year exclusive supply and license agreement has been signed between Mayne Pharma and âMithla Pharmaceuticalsâ, SA (Mithra) for the commercialization of a combined oral contraceptive, E4/DRSP (a formulation of 15mg of Esterol (E4) and 3mg of drospirenone (DRSP)).

- Phase II and Phase III studies, of this innovative, next-generation contraceptive, E4/DRSP, that enrolled more than 3000 women have been completed and demonstrated promising top-line results. Studies unveiled E4/DRSPâs unique mode of action which could result in improved patient outcome.

- The Drug launch is likely to take place in the first half of calendar year 2021 in the United States which is subjected to US Food and Drug Administration (FDA) approval.

- After the FDA approval, it is anticipated that a five-year New Chemical Entity (NCE) title would be given to E4/DRSP exclusively from the FDA. It is also expected that the drug has a potential for patent protection beyond 2030.

- Chief Executive Officer, Mayne Pharmaâs, Mr Scott Richards commented that E4 would be the first native estrogen approved in a contraceptive product category in the US, if it obtains FDA approval and the first new estrogen to be introduced in the US in almost 50 years.

- This deal would significantly strengthen Mayne Pharmaâs leading position in the US branded generic oral contraceptive market with ongoing projects such as generic NUVARING®.

Transaction structure and financial impacts

With over ten million American women using combination oral contraceptives, patches or vaginal rings each day, the contraceptive market in the United States stands at US$5.4 billion.

- Under this deal, Mayne Pharma would pay US$8.75 million in cash and 4.95% of Mayne Pharmaâs ordinary shares at closing comprising a total of US$295 million payment.

- Following FDA approval, US$11 million in cash and a further 4.65% of Mayne Pharmaâs ordinary shares (based on issued shares at closing) would be paid by Mayne Pharma along with the contingent payments on reaching cumulative net sales targets.

- It was further reported that, the product would be EBITDA positive in its first full financial year following its approval and if the cumulative net sales of E4/DRSP surpass US$2.25 billion, the entire amount of US$295 million would be paid.

- Moreover, depending on the percentage of net sales a transfer price including a fixed and variable component has been fixed.

- Upfront equity cash, further equity and cash after FDA approval, collectively with sales-based milestone cash payments comprise the total amount to be paid.

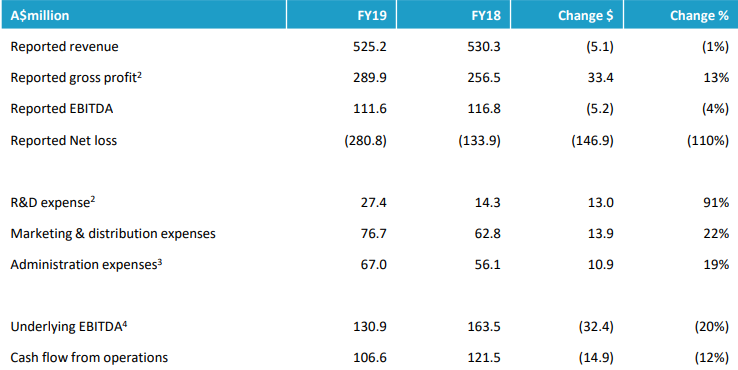

Key Financials (Source: Companyâs Report)

Stock Performance:

After the trading hours on 08 October 2019, MYXâs shares quoted $0.60, up by 8.03%. The Company has a market cap of $892.29 million and 1.59 billion outstanding shares, witnessing a 52 weeks high and low price at $1.28 and $ 0.43, respectively. The stock has generated a negative YTD return of 24.83%.

CLINUVEL PHARMACEUTICALS LTD (ASX: CUV)

Headquartered in Melbourne, Australia, CLINUVEL PHARMACEUTICALS LTD is a global biopharmaceutical company engaged in the development of drugs targeted towards the treatment of patients suffering from a range of severe genetic and skin diseases. It came into existence after twenty years of testing the SCENESSE® technology.

Recent Announcement

Dated 07 October 2019, the Company updated that the Employment Agreement of life science executive and CLINUVEL Managing Director Dr Philippe Wolgen has been renewed for a period of three years till 1 July 2022.

- Dr Wolgen has been a long-serving key executive of CUV and has led the Company since its restructuring in 2005 to its present leading position.

- The Remuneration Committee, which is responsible for the offering appropriate and fair remuneration practices for its key executives, pursues to, where possible, secure and retain professional talent to lead and steer the Company via executing its demanding short- and long-term strategy.

Dated 02 October 2019, CUV updated the market that a clarification notice has been released by US Food and Drug Administration regarding the PDUFA (Prescription Drug User Fee Act) goal date for review of the submission of CLINUVELâs principal candidate, SCENESSE® (a formulation of synthetic peptide afamelanotide 16mg) scientific dossier to be on 8 October 2019, which was earlier reported to be on 06 October 2019 as a result of a miscommunication by the agency.

Financial Highlights for the year ended 30 June 2019

As per the financial results for FY 2019 released on 28 August 2019, CUV reported-

- An increase in total revenue to $31.05 million from $25.49 million for FY2018.

- An increase in Net profit before tax to $18.12 million for FY2019 compared to $12.94 million for FY2018.

- Cash and cash equivalents amounting to $54.27 million at the end of June 2019.

- An increase in earnings per share by 35.7 on a year-on-year basis.

- Inclusion in the S&P / ASX 200 Index in June 2019.

Stock Performance:

After the trading hours on 08 October 2019, CUVâs shares quoted $28.09, up by 3.65% from its previous close price. The Company has a market cap of $1.33 billion and 48.96 million outstanding shares, witnessing a 52 weeks high and low price at $39.85 and $14.1, respectively. The stock has generated a negative YTD return of 50.56%. CUVâs stock generated an annual dividend yield of 0.09% and the P/E ratio stands at 72.07x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.