Understanding Diversified Portfolio

A diversified portfolio consists of a variety of stocks with different risk levels and yields, sought at lowering the assumed risk and leveraging a significant percentage of the variability of the portfolio performance. Diversification is aimed at reducing risks to investors by allocating their resources into different stocks. Diversification enables investors to expand into global markets or into diverse sectors. Therefore, it relates to the famous saying âDo not put all your eggs in one basket.â

Let us discuss five stocks operating in different sectors. All these stocks have registered profit during recently reported financial results, with anticipated positive growth prospects in the near future.

Nick Scali Limited

Nick Scali Limited (ASX:NCK) is among the largest importers of quality furniture in Australia. The company is engaged in the sourcing and retailing of household furniture and their related accessories. NCK got listed on the Australian Stock Exchange in 2004 under the consumer discretionary sector. Some of the products offered by the company include lounges, dining tables, dining chairs, cabinets and coffee tables.

September Updates

- On 10 September 2019, UBS Group AG and its related bodies corporate ceased to be a substantial holder of NCK.

- On 6 September 2019, the company announced that its Annual General Meeting would be held on 29 October 2019 at the Nick Scali Head Office in New South Wales.

- On 5 September 2019, Nick Scali updated the market regarding a change in the interest of substantial holder, KUKA Investment and Management Co., Limited.

- Meanwhile, Airlie Funds Management Pty Ltd on its behalf and behalf of Magellan Financial Group Limited became an initial substantial holder with 5.244 million fully paid ordinary shares and a 6.47 per cent voting right.

- Interest of Perpetual Limited and its related bodies corporate in NCK also changed from an 8.46 per cent voting power to a 10.10 per cent voting power.

- On 4 September 2019, UBS AG, Australia Branch entered into an agreement for underwriting a secondary block of ordinary shares in NCK. As a result, UBS holds 14.77 per cent of NCKâs ordinary shares.

FY2019 Highlights

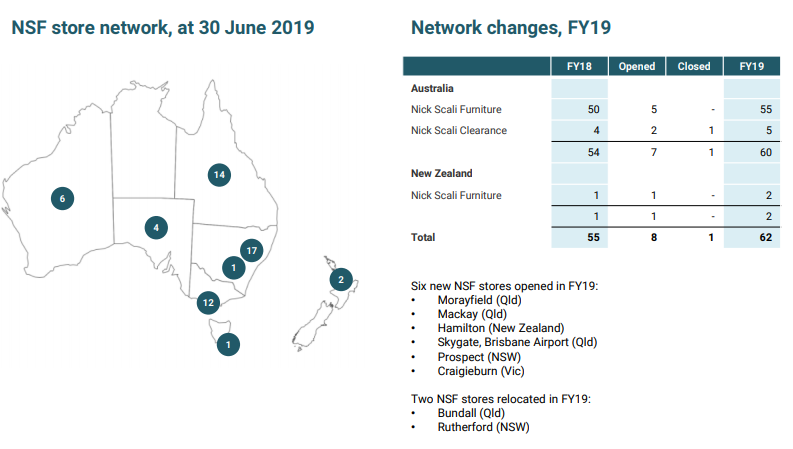

- Sales of the company increased by 6.9 per cent to $268.0 million compared to the previous year corresponding period.

- Gross margin went up by 20 bps to 62 per cent.

- Net profit after tax increased by 3 per cent to $42.1 million.

- The company has opened 6 new stores during the year, including five stores in Australia and one store in New Zealand.

- Net operating cash flow increased by 5.4 per cent to $45.4 million.

- The company did not purchase any major asset during the year.

Store Network (Source: FY19 Presentation)

The company declared a final dividend of 20 cps (fully franked) for FY2019 compared with 24 cps in FY2018. Total dividend for the year stood at 45 cps with full year pay-out ratio of 86.5 per cent.

Stock Performance

On 11 September 2019 (AEST 12:36 PM), the stock of NCK was trading at $7.080, up 0.141 per cent from its previous close. The company has ~81 million shares outstanding and a market cap of $572.67 million. The stock has generated returns of 20.65 per cent in the last six months, while its YTD return stands at 38.36 per cent.

Ingenia Communities Group

Ingenia Communities Group (ASX: INA) is an owner and manager of a diversified property portfolio including holiday communities, rental living or seniors and lifestyle communities.

Addition to S&P/ASX Indices

On 6 September 2019, S&P Dow Jones Indices announced a quarterly rebalance of the S&P/ASX Indices, effective from 23 September 2019. Ingenia Communities Group would be added to S&P/ASX All Australian 200, effective at the open on 23 September 2019.

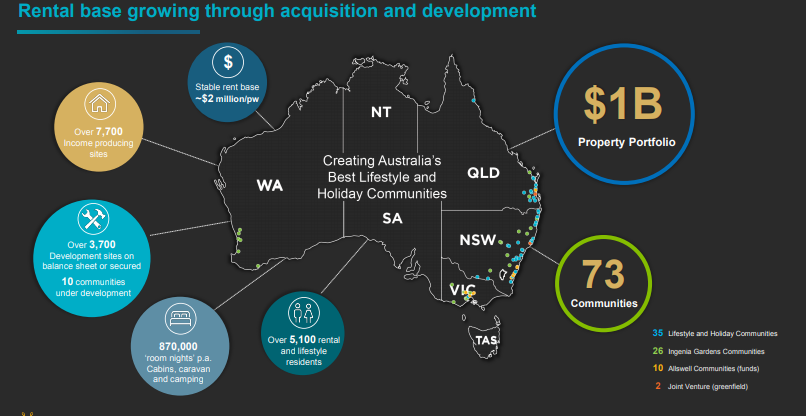

FY2019 Property Portfolio

On 20 August 2019, the company updated the market with its property portfolio for FY2019. The investment property portfolio consists of 67 per cent of Lifestyle and Holidays (development), 18 per cent in Ingenia Gardens (Rental) and 15 per cent of Lifestyle and Holidays (Rental). By location, in terms of value, the companyâs property portfolio includes 53 per cent in New South Wales, 35 per cent in Queensland, 8 per cent in Victoria and 4 per cent in Western Australia.

FY2019 Highlights

For FY2019, the company reported

- Record EBIT of $61.5 million, surging by 26 per cent when compared to the previous corresponding year.

- Revenue increased by 21 per cent to $228.7 million.

- Underlying EPS of 21 cents, up by 19 per cent year-on-year.

- Ten projects of the company were under development with two starting in FY2020.

- Strong operating cash flow increased by 26 per cent to $59.3 million.

- Rental revenue up 10 per cent year-on-year to $68.1 million.

Business Overview (Source: Companyâs Report)

The company has also announced a dividend of $0.058 on fully paid ordinary/ units stapled securities, payable on 26 September 2019.

Stock Performance

On 11 September 2019 (AEST 12:39 PM), the stock of INA was trading at $3.900, down 1.015 per cent from its previous close. The company has ~236.37 million shares outstanding and a market cap of $931.32 million. The stock has generated a return of 32.66 per cent in the last six months, while its YTD return stands at 31.33 per cent.

Independence Group NL

Independence Group NL (ASX: IGO), headquartered in Australia, is an ASX listed exploration and mining company that owns a 100 per cent stake in NOVA (nickel â cobalt â copper) operation and a 30 per cent interest in Tropicana Operation.

Ordinary Sharesâ Issue

On 3 September 2019, the company issued 1,916 ordinary fully paid shares owing to 50% vesting of 2018 Series Service Rights pursuant to Employee Incentive Plan approved at the annual general meeting in November 2016.

Meanwhile, on 2 September 2019, the company issued 278,059 ordinary fully paid shares due to 50% vesting of 2017 and 2018 Series Service Rights pursuant to Employee Incentive Plan that was given a go ahead at the annual general meeting in November 2016.

Change in Interest

On 29 August 2019, the company made an announcement regarding a change in the interest of substantial holder (Prodigy Gold NL) from a voting power of 10.25 per cent to 8.48 per cent. Additionally, the company ceased to be a substantial holder in Arrow Minerals Limited.

FY2019 Highlights

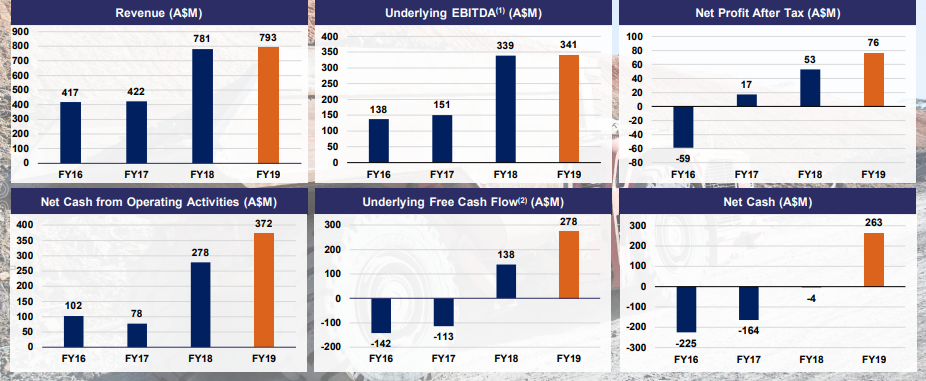

- Revenue increased to $793 million compared to the corresponding last year of $781 million.

- Underlying EBITDA increased to $341 million.

- NPAT reached $76 million from $53 million last year.

Financial Results Summary (Source: Companyâs Report)

IGO has declared a final dividend of 8 cps (97 per cent franked). The total dividend pay-out by the company for FY2019 stands at $59 million, which is equivalent to 10 cps.

Stock Performance

On 11 September 2019 (AEST 12:42 PM), the stock of IGO was trading at $6.550, up 1.708 per cent from its previous close. The company has ~590.8 million shares outstanding and a market cap of $3.8 billion. The stock has generated a return of 34.17 per cent in the last six months, while its YTD return stands at 77.41 per cent.

Medical Developments International Limited

Medical Developments International Limited (ASX:MVP) is a specialised healthcare company in Australia, which provides products related to asthma, pain management and resuscitation. The company is providing healthcare solutions since 1971.

Roadshow Presentation

On 5 September 2019, MVP released the Roadshow Presentation. A few highlights of the companyâs key achievements during FY2019 are as below.

- European sales grew by 401 per cent

- UK sales of the company went up by 68 per cent

- Regulatory approval in 27 countries in Europe

- The company has a total customer base of 1,058, which includes 400 new customers from the European region

- The company completed the Phase 1 Pharmacokinetic study in Europe

Below is a snapshot of the companyâs financial performance during the year.

Source: Companyâs Report

Stock Performance

On 11 September 2019 (AEST 12:43 PM), the stock of MVP was trading at $4.415, up 0.341 per cent from its previous close. The company has ~65.52 million shares outstanding and a market cap of $288.27 million. Its YTD return stands at 3.29 per cent.

Altium Limited

Altium Limited (ASX: ALU), listed on ASX in 1999, is an IT sector player that sells and develops PCB design software and high-powered tools for PCB designers.

September Updates

On 6 September 2019, the company announced that Wendy Stops, an ALU director, transferred few ALU stocks to a new personal holding from one personal holding. There has been no change in the total beneficial shareholding of Wendy stops. The total ordinary shares held by Wendy Stops stands at 45,000.

On 3 September 2019, ALU unveiled a new substantial holder in the company. Mitsubishi UFJ Financial Group, Inc. acquired 7,157,117 fully paid ordinary shares, translating into a 5.46 per cent voting power.

FY19 Highlights

- Revenue increased by 23% year-on-year to US$171.8 million.

- EBITDA margin increased to 36.5 per cent from 32.0 per cent last year.

- The company reported an EBITDA of US$62.72 million, up 40% year-on-year.

- EPS of the company grew by 41 per cent to US$0.4057.

- Operating cash flow surged by 42 per cent to US$69.1 million.

FY19 Highlights (Source: Companyâs Report)

Stock Performance

On 11 September 2019 (AEST 01:05 PM), the stock of ALU was trading at $35.980, down 2.042 per cent from its previous close. The company has ~130.97 million shares outstanding and a market cap of $4.81 billion. Its YTD return stands at 69.97 per cent, while six-month return is 12.15 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.