The below-mentioned stocks have come with their FY19 results today i.e., 20th August 2019. All three stocks have witnessed growth in their revenues and earnings during FY19. Letâs take a look at the financial performances of these stocks.

Ingenia Communities Group (ASX:INA)

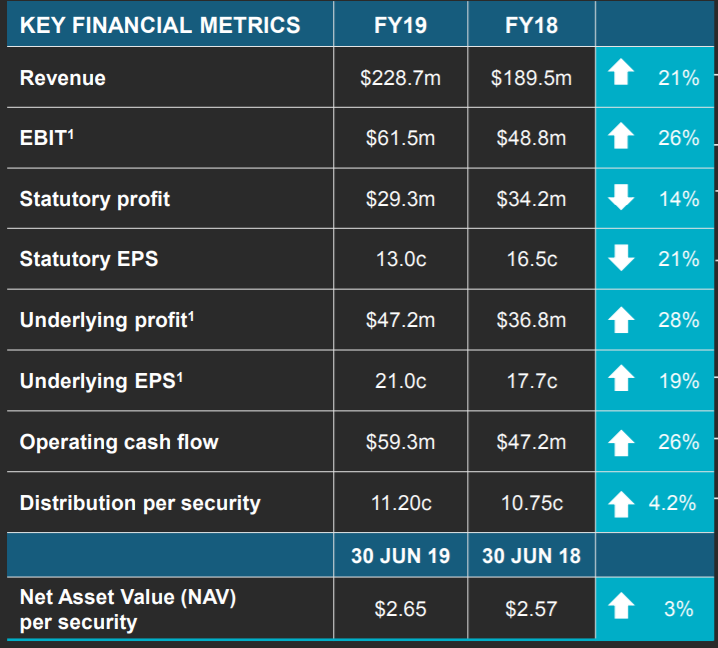

Australian property group, Ingenia Communities Group (ASX: INA) has unveiled its FY19 results today. For FY19, the company has reported total revenue of $228.7 million, up 21% on the previous corresponding period (pcp). The company has reported a record EBIT of $61.5 million, up 26% on pcp with Underlying EPS of 21 cents, which is 19% higher than pcp. The growth in the EPS was driven by strong asset performance and increased settlements. The companyâs gross operating income grew by 27% to $24.08 million in FY19 as compared to FY18.

Key Financial for FY19 (Source: Company Reports)

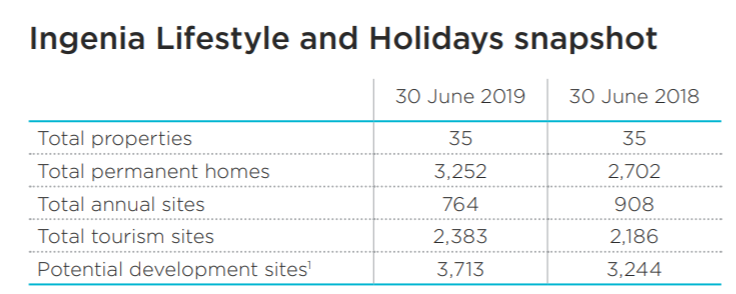

During the year, the company sold 336 turnkey homes and grew Lifestyle and Holidays rental income from permanent, annual and tourism clients to $67.7 million. Driven by the increase in settlements and rental income, the operating cash flow increased by 26% to $59.3 million in FY19.

The company has declared a final distribution of 5.80 cents per stapled security with a payment date of 26th September 2019.

In FY2020, the company is focussed on improving the performance of existing assets to drive growth in rental returns. In FY2020, the company expects its EBIT growth to be in between 10-15%, and underlying EPS growth to be in the range of 5-10% on last year. The distribution per security in FY19 is 11.20 cents, up 4.2% on pcp.

While releasing the FY19 results, the companyâs CEO, Simon Owen assured that the company is delivering on a number of initiatives to build out its rental base and create capital efficiency across the Group. These include acquiring established and new communities, the acquisition of a funds management business that provides co-investment opportunities, the creation of a development Joint Venture with Sun Communities, Inc. (NYSE:SUI), and growing new home settlements.

Ingenia Lifestyle and Holidays snapshot (Source: Company Reports)

Stock Performance: In the last six months, the companyâs stock has provided a return of 9.84% as on 19th August 2019. On year to date (YTD) basis, the companyâs stock has gained 15.33%. The stock has a 52 weeks high price of $3.735 and 52 weeks low price of $2.780 with an average volume of ~496,159. The stock is trading at a PE multiple of 24.200x and an annual dividend yield of 3.19%. At market close on 20 August 2019, INAâs stock was trading at a price of $3.570, up by 3.179% with a market capitalisation of circa $817.86 million.

Tassal group Limited (ASX:TGR)

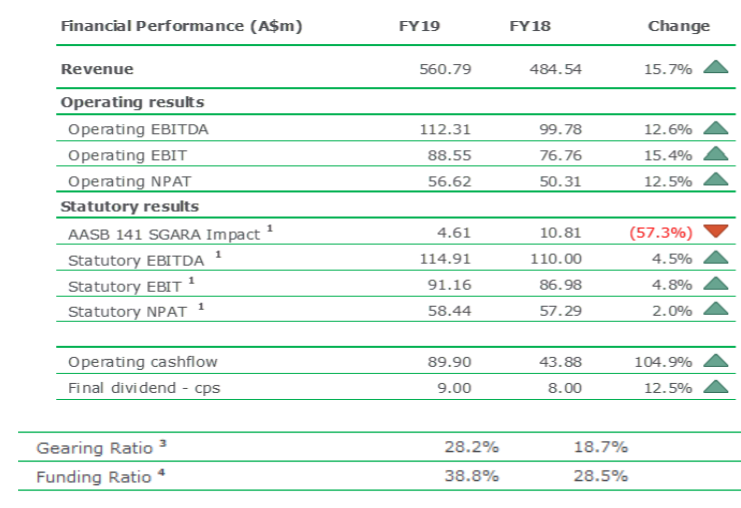

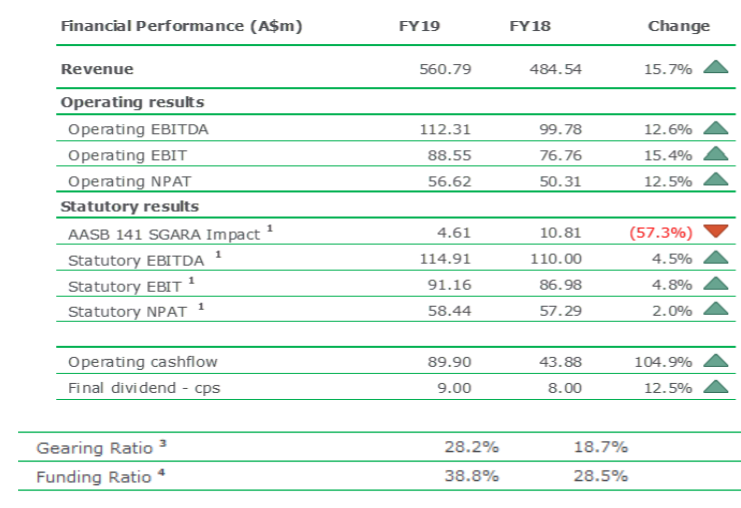

Seafood company, Tassal Group Limited (ASX: TGR) has reported record full year results for FY19 with operating NPAT growth of 12.5% and operating cashflow growth of 104.9% during the period. The companyâs revenue grew by 15.7% to $560.8 million in FY19 while its operating EBITDA increased by 12.6% to $112.3 million.

The FY19 results are highlighting the strength of Tassalâs platform to generate continued, sustainable growth in shareholder returns. During the year, the company witnessed strong growth in its salmon biomass and sales driven by investments in capacity and supporting infrastructure.

FY19 Results Snapshot (Source: Company Reports)

The company is committed to growing the prawn business with a focus on accelerating near?term earnings as well as securing the capacity necessary to support long?term growth in profitability. In FY2020, the company will continue to invest in state?of?the?art technology that supports a more efficient business.

In order to fund the accelerated prawn growth strategy, the company has today announced a ~$108 million capital raising. In addition to this, the company will also be undertaking a Share Purchase Plan (SPP) to raise up to an additional $25 million.

In the next two years, the company intends to invest around $85 million on the Proserpine expansion and Smart Farm initiatives to increase the pace of prawn production.

The company has declared a final dividend of 9.0 cents per share, taking the total dividend for FY19 to 18.0 cps (25% franked). The final dividend has a record date of 11 September 2019 and payment date of 30 September 2019.

Stock Performance: In the last six months, the companyâs stock has provided a negative return of 2.68% as on 19th August 2019. On year to date (YTD) basis, the companyâs stock has gained 7.76%. The stock is trading at a PE multiple of 13.390x and an annual dividend yield of 3.6%.

At market close on 20 August 2019, TFRâs stock was trading at a price of $4.720 with a market capitalisation of circa $842.28 million.

Aspen Group (ASX:APZ)

Aspen Group (ASX:APZ) is a property group which is involved in providing quality accommodations at reasonable prices.

In FY19, Aspenâs portfolio increased by 20% to $128 million, mainly through the acquisition of Highway 1 Tourist Park in Adelaide, and the addition of newly manufactured housing product at the companyâs Four Lanterns Estate in Sydney.

In FY19, the accommodation revenue of the company increased by 27% to $22.29 million mainly due to the acquisition of Highway 1 Tourist Park, and full year contributions from Darwin FreeSpirit Resort (DFR) and Koala Shores. Due to the acquisition of DFR, operating margin reduced slightly to 47%.

In FY19 the company reported underlying earnings per security (EPS) of 5.15 cents, which was up 8% on FY18. The Underlying EBITDA in FY19 was $5.89 million up 16% on FY18.

FY19 Results Snapshot (Source: Company Reports)

At the end of FY19, the company had total assets of $141.73 million, gross debt of $24.50 million and net asset value of $108.77 million. As at 30 June 2019, the company had a gearing of only 13.3%.

The company has reaffirmed its earnings and distribution guidance for FY20 at 6.75-7.00 cents and 6.00 cents per security, respectively.

Following the release of FY19 results, the companyâs stock witnessed a slight growth of 0.455% during the intraday trade as on 20 August 2019.

Stock Performance: In the last six months, the companyâs stock has provided a return of 17.65% as on 19th August 2019. On year to date (YTD) basis, the companyâs stock has gained 14.58%. The stock has a 52 weeks high price of $1.105 and 52 weeks low price of $0.910 with an average volume of ~65,164. The stock is trading at a PE multiple of 50.230x and an annual dividend yield of 4.55%. At market close on 20 August 2019, APZâs stock was trading at a price of $1.105 with a market capitalisation of circa $104.81 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.