The Metal and mining industry of Australia is a significant contributor to the development of the economy of the country. The metals and mining sector has been dependent on the Australian equity market in order to access capital, which can be deployed in capital-intensive mineral projects. At the time of writing on 29th August 2019 (AEST 2: 42 PM), the S&P/ASX 300 Metals and Mining Industry index is trading at 4,228.4, with a rise of 0.29% over the previous close.

Letâs have a look at 4 Metals and Mining Stocks with their recent updates:

Independence Group NL

Independence Group NL (ASX: IGO) is into mining and processing of nickel, copper and cobalt at the Nova Operations. Recently, the company announced that it has ceased to become a substantial holder in Arrow Minerals Limited, which became effective on 26th August 2019. In other updates, Independence Group NL and its related entities have made a change to their substantial holding in Prodigy Gold NL with the current voting power of 8.48% as compared to the previous voting power of 10.25%, effective from 29th August 2019.

A look at the financial performance of FY19

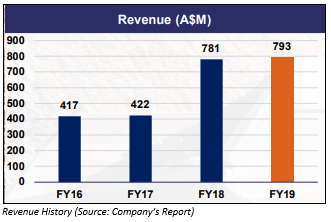

The company stated that the FY19 had been a record year, wherein it posted total revenue and other income amounting to A$793 million, an increase of 2% over the prior year and reported underlying EBITDA of A$341 million with an EBITDA margin of 43%. The net cash from the operating activities stood at A$372 million with underlying free cash flow amounting to A$278 million. Adding to that, the company reported the net profit after tax of A$76 million, reflecting a rise of 44% in comparison to FY18.

Dividend

The Board of the company has declared a final dividend amounting to A$0.08 per share, franked to 97%, for FY19, which takes the total dividend payments for the full-year 2019 to A$0.10 per share and amounts to returning a record amount of A$59 million to its shareholders.

Moving to stock performance, the stock of Independence Group NL last traded at A$5.310 per share with a rise of 1.53% in the trading session of 29th August 2019. In the time frame of three months and six months, it witnessed a rise of 10.81% and 7.17% respectively. When it comes to a time period of one month, IGO provided a return of -5.60%

OZ Minerals Limited

OZ Minerals Limited (ASX: OZL) is engaged in mining and processing of ore, which contains gold, silver and copper. The company is also involved in the sale of the concentrate as well as exploration and development activities of mining projects. Recently, OZL through a release dated 28th August 2019, provided an update about the Pre-feasibility Study at West Musgrave Project. It added that the study had evaluated a potential 10 million tonne per annum copper-nickel open pit mine.

An Eye on Half Yearly Results

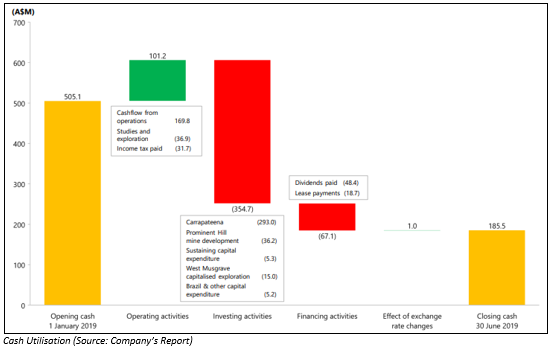

In 1H FY19, the company reported copper and gold production of 52,534 tonnes and 58,757 ounces, respectively from Prominent Hill. The company reported a Net profit after tax amounting to $44 million in 1H FY19, which demonstrates the timing of shipment as well as an increased growth in investments. The company posted Revenue and Underlying EBITDA amounting to $419.2 million, and $162.5 million, respectively. The earnings per share of the company stood at 13.6 cents per share and the cash balance of the company stood at $185.5 million in 1H FY19.

Dividend

The Board of Directors of OZ Minerals Limited has declared a fully franked interim dividend amounting to 8 cents per share.

Moving to the stock performance, the stock of OZ Minerals Limited last traded at A$8.990 per share with a fall of 4.666% in the trading session of 29th August 2019. In the time frame of one month and six months, it witnessed a fall of -8.27% and -8.45%, respectively. When it comes to the time period of three months, OZL provided a return of 1.29%.

Platina Resources Limited

Platina Resources Limited (ASX:PGM) is engaged in exploring, developing and acquiring minerals interests and prospects for precious metals.

A look at Blue Moon Project Acquisition.

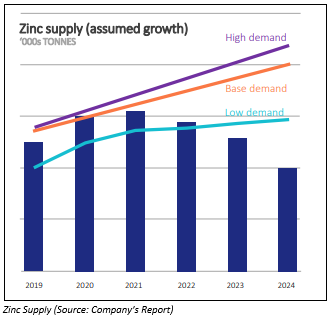

Recently, the company has released Blue Moon Project presentation dated 29th August 2019, wherein it stated that the company leverages its core expertise as well as experience in advancing projects by way of drilling, feasibility and development. The company added that the new Blue Moon Project is a drill-ready, high-grade zinc-copper gold deposit with various resource expansion and development potential. The company is planning to acquire an interest equating to 70% in the Blue Moon Project by making expenses amounting to $CAD3.25 million in order to earn 50% over 18 months and $CAD3.75 million to acquire an additional 20% over an additional 18 months. The company further stated that the fundamentals of zinc are strong, and there are potential supply gaps and a low metal inventory, which support a robust price outlook.

Raising of Resources

In other updates, the company announced that it is planning to raise an amount of $1.25 million before costs from underwritten Shareholder Share Purchase Plan and proposed Placement with a view to raising to an additional amount of $1.25 million. However, The Share Purchase Plan of the company will enable shareholders to apply new shares in the company, which are valued between $500 and $15,000.

Utilisation of Funds

The funds will be primarily utilized for completion of the Blue Moon transaction. Further it will also be utilized to finance the exploration and drilling operations for the Blue Moon zinc project. The company reported a cash balance of A$ 2,447,000 in December 2019 quarter.

Moving to price performance, the stock of Platina Resources Limited last traded at A$0.036 per share with a fall of 16.279% in the trading session of 29th August 2019. In the time frame of three months and six months, it witnessed a fall of -14.00% and -35.82%. When it comes to the time period of one month, PGM provided a return of 7.50%

Metals Australia Ltd

Metals Australia Ltd (ASX: MLS) primarily operates into exploration of mineral deposits.

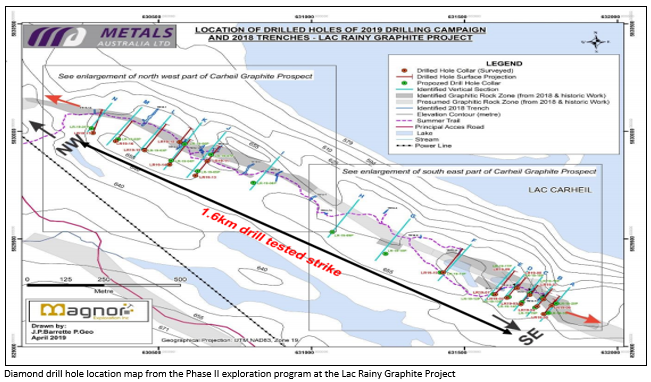

Assay Results from Lac Rainy Graphite Project

The company through a release dated 29th August 2019 announced High-Grade near-surface drilling Intersections at Lac Rainy Graphite Project. The company stated that it had received assay results for DDH LR19-05 and DDH LR19-06 holes. It further added that the drill hole has been identified as LR19-05, which intersected four zones of mineralization, which are resulting in a cumulative graphite mineralised interval of 70.95m, which include the following:

- 0m at an average grade of 8.24% Cg

- 45m at an average grade of 6.41% Cg

- 0m at an average grade of 9.66% Cg

- 5m at an average grade of 16.24% Cg

Another drill hole has been identified as LR19-06, which intersected three zones of graphite mineralisation resulting in a cumulative graphite mineralised interval of 38.36m

- 46m at an average grade of 5.79% Cg

- 40m at an average grade of 15.89% Cg

- 50m at an average grade of 14.64% Cg

As per the release dated 22nd August 2019, the company has announced that it has commenced Exploration Campaign at Manindi in order to evaluate the potential for Youanmi-Penny West style Gold Mineralisation.

Moving to price performance, the stock of Metals Australia Ltd last traded at A$0.002 per share in the trading session of 29th August 2019. In the time frame of six months, it has witnessed a fall of -16.67%.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.