Has March 2020 alone seemed like a year? Yes! To us too, with the prolonged COVID-19 fear engulfing us all alike and demonstrating possibilities that seem to have practically awakened right out of a Black Mirror episode. It sure has been a rough tide for homo sapiens, with them being self-isolated, practising social distancing and adhering to quarantine measures.

With depleting economies, waning businesses, global trade disruptions and deteriorating health worldwide, the globe has not been in such a challenging situation, at least in a very long time.

But as humans have been blessed with a gift that lacks in any other creation of our world- the mind, our strategic thinking capacity and the capability to put out thoughts into actions, there have been signs that we will be able to pull ourselves out of this crisis.

We say this because things have seemed to be getting better at the back of wise decisions being taken by governments and regulatory authorities to help us get back on track in our regular lifestyles. The global equity/share market, for instance, which surpassed massive sell-offs in the past few weeks kick started the current week on a terrific note, which clearly demonstrates that investors and people are steadily gaining back their lost confidence.

We will graze upon these factors, but foremost, let’s get some market updates from across the world. To start with, one should note that rebounds are common (and welcoming, this time!) in the share markets. And this turn around has finally happened, read on to know why we say this.

Global Share Market Rebound- It’s Finally Happening!

Call it a silver lining or the much-desired ray of hope, share markets across the globe kick started this week with a bang, mostly at the back of stimulus packages being announced by governments, the unprecedented measures inculcated in countries helping to curb the virus spread, ongoing rapid testing for COVID-19, vaccine development news and better-than-expected manufacturing activity (in China)-

- The S&P 500 Index rose by more than 17% relative to last week and S&P 500 futures traded up by nearly 0.35% on30 March 2020

- Nasdaq 100 advanced nearly 4%, and Nasdaq 100 futures rose by almost 0.55% on Monday

- As at 5.10 PM GMT-4, the Dow Jones Industrial Average was trading up by 3.19% at 22,327.48 on 30 March 2020

- In Asia, South Korea's Kospi gained close to 2%, Japan’s Nikkei 225 added another 0.7%, Australia's S&P/ASX 200 up by 1.4%, Hong Kong's Hang Seng Index as well as China's Shanghai Composite were up by 1.5% and 0.6%, respectively

- More recently, on 31 March 2020 at 2.20 PM AEDT, the S&P/ASX 200 was trading up by 0.01% at 5182

ALSO READ- Tales Inducing ASX Gains Amidst Coronavirus Crisis

What’s Propelling Share Market Rebound?

With these figures in green, you would be eager to understand the events that have taken place to hit the investor sentiment right during the ongoing crisis time. Let’s walk you through the same, briefly-

- In the US, companies like Abbott Laboratories and Johnson & Johnson recently announced a five-minute Covid-19 test and vaccine candidate for the virus, respectively, that majorly set the stock rally. Also, the dollar rose.

- China’s central bank, the People’s Bank of China, loweredshort-term funding rates and injected cash into its financial system (launched RMB300 billion worth of special central bank lending, RMB500 billion quotas of central bank lending, central bank discounts to render support for epidemic containment and the renewal of work and manufacture).

- Australia announced a job-support program wherein the Morrison Government would offer a historic wage subsidy to approximately 6 million workers who are bound to obtain a flat payment (before tax) of $1,500 every two weeks, via their employer.

- Financial stimulus packages are continually being announced by governments from across the world to curb the COVID-19 consequences. For instance, US$2 trillion, $66 billion and ~US$2.1 billion has been announced by the US, Australia and India, respectively.

- In Singapore, the Monetary Authority of Singapore has set the Singapore dollar's rate of appreciation at zero per cent (at the exchange rate policy band), as a policy easing measure.

GOOD READ- How solid financial systems with support from Banks can help in recovery of Pandemic-hit Economies

Recent Share Market Turmoil

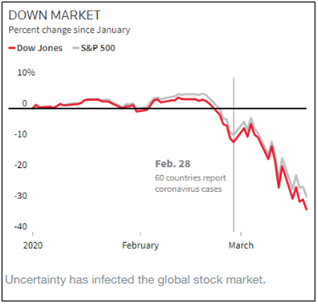

Undoubtedly, the global stock market has experienced some of its highest drops ever as a result of COVID-19. For instance, for the Dow Jones Industrial Average, 12 March and 16 March 2020 were the largest one-day drops, right after 1987!

The reaction to COVID-19 has erupted with fretting volatility, mainly because traders have panic-sold due to fear. Consequently, according to the World Economic Forum, the market-wide circuit-breakers (that primarily try to thwart panic-trading) have been sparked four times, in March 2020 alone. Do you know what this means? Trading halted four times this month! What’s worrisome is this equation- Falling markets = Rising Volatility.

The graph belowshows how the market drop due to uncertainty around the global coronavirus pandemic has been historic (figure for Dow Jones & S&P 500)-

(Source: weforum.org)

GOOD READ-COVID 19 Intensifying- Bleak & Bright Side, US Stock Worries Persist

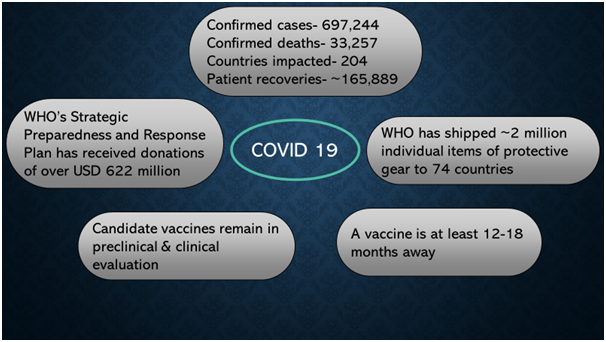

COVID 19 Updates

As witnessed, the world, a united global family currently, is doing all it can to fight the novel coronavirus. Below are few latest figures pertaining to the virus, sourced from the WHO and JHU CSSE dashboard-

WHO’s Director-General Tedros Adhanom Ghebreyesus stated in his recent media briefing-

Let’s pray for the world to soon be a better place, businesses to propel, trade relations to be up and running and stock markets to soar at greater heights.

Meanwhile, PLEASE READ- Ways to Boost Your Immune System to Combat COVID-19