Marking a robust beginning of the week, the Australian benchmark index, S&P/ASX 200 closed the day’s trade 7 per cent higher at 5181.4 points on 30th March 2020, observing its biggest percentage increase in the last 40 years.

The massive gains in the equity market coincided with the federal government’s new $130 billion job keeper package for preserving jobs amidst the coronavirus crisis, which includes an allowance of $1,500 per fortnight per employee.

The gains in the benchmark index were backed by the outperforming healthcare sector, which ended the trading session 10.25 per cent higher, supported by rises in Ansell Limited (ASX:ANN), CSL Limited (ASX:CSL) and Ramsay Health Care Limited (ASX:RHC). Market analysts and brokers also seem to be optimistic about other stocks trading on the ASX, including G.U.D. Holdings Limited (ASX:GUD) and United Malt Group Limited (ASX:UMG), which closed the day’s trade 4.6 per cent and 15.1 per cent higher, respectively.

Several positive stories grabbed investors’ attention on 30th March 2020, stimulating gains in the Australian share market. Let’s discuss three such tales that helped turn market sentiment upbeat amidst coronavirus crisis:

Nine Announced Cost Initiatives in Response to COVID-19

Media and entertainment player, Nine Entertainment Co. Holdings Limited (ASX:NEC) has recently released its trading update and cost initiatives in response to the ongoing COVID-19 situation. The Company notified that audiences across all its platforms are demonstrating robust growth in comparison to the levels recorded in late-February – early March 2020.

The Company has observed linear audience growth on core News and Current Affairs content - A Current Affair (+13 per cent), Nine News (+30 per cent) and the Today Show (+26 per cent). The Company added that both 9Now and Stan are witnessing speedy growth in active users/subscribers and usage.

Nine’s Cost Initiatives

Nine informed that it is targeted at major short and long-term cost initiatives throughout all of its businesses, in addition to advancing part of the $100 million, 3-year linear cost out declared with its interim results in February.

To recall, the Company announced a statutory EBITDA of $251 million, a statutory revenue of $1.2 billion and statutory Net Profit After Tax of $114 million in its interim results for the half-year period ended 31st December 2019.

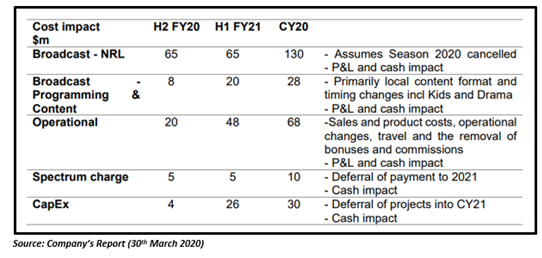

The Company has now revealed the first set of its cost initiatives based on the continuing global financial crisis, highlighted in the table below:

The Company seems to be in a decent capital position, with its recently finalised refinancing of corporate debt facilities. The new facilities include one year working capital facility of $80 million and three and four-year revolving cash advance facilities of $545 million. The Company retains cash and undrawn debt of about $300m as on 30th March 2020.

NEC closed the trading session 11.7 per cent higher on 30th March 2020, at $1.050.

Ansell Affirmed its FY20 EPS Guidance - US112¢ to US122¢

Healthcare player, Ansell Limited (ASX:ANN) has recently reiterated its FY20 EPS guidance to between US112¢ and US122¢. Moreover, the Company highlighted that it expects to provide its FY21 guidance in August as usual despite the unprecedented uncertainties and implications of coronavirus pandemic.

The Company added that it is observing a very robust demand for its AlphaTec® hand and body protection products, certified and tested to established standards for protection from infective agents. The Company is also experiencing huge demand for many of its TouchNTuff® & Microflex® single use examination gloves and for Encore® and Gammex® surgical gloves.

However, the Company also mentioned that this increased demand can be offset by falling demand for certain industrial products due to export restrictions within the European Union, temporary lockdowns, restrictions levied to curb COVID-19 spread and weak economic growth outlook.

To mitigate the impact of coronavirus pandemic and maximise output, the Company is taking the following steps:

- entry screening (travel history, temperature)

- sanitation of surfaces

- social distancing

- working closely with government authorities to produce protective goods

- making selective investments in new capacity

- leveraging unaffected manufacturing locations.

The Company informed that its balance sheet stays strong with about $515 million of committed undrawn bank facilities and cash as at 29 February 2020. The Company has no considerable debt maturities in the next one year and continues to deliver positive operating cash flow.

ANN’s stock surged by 25 per cent on 30th March 2020, ending the trading session at $29.030.

Genex Signed Binding Energy Storage Services Agreement with EnergyAustralia

Marking a substantial step towards attaining financial close of the Kidston Hydro Project, power generation development firm, Genex Power Limited (ASX:GNX) has signed a binding Energy Storage Services Agreement with the Australian energy company, EnergyAustralia Pty Ltd. With this agreement, the Company has completed its offtake arrangements for K2-Hydro or the 250MW Kidston Pumped Storage Hydro Project.

The agreement is signed for a term of up to thirty years, comprising an initial term of ten years and two options to extend for an additional ten years each. The Company will offer the complete operational dispatch rights for Kidston Hydro Project’s plant to EnergyAustralia against a fixed yearly rental payment under the agreement.

The Company is also deeply involved with other stakeholders of the project, including the Northern Australia Infrastructure Facility (NAIF) to finalise the restructuring of the project financing based on the terms of the agreement. Subject to approving suitable terms with the Queensland Government and NAIF, the Company is now seeking to reach financial close on K2-Hydro in Q3 2020.

Following the release of the announcement, GNX’s share price improved remarkably by ~70.4 per cent, closing the trading session at $0.150 on 30th March 2020.