Summary

- E-commerce companies are largely benefitting from the shifting consumer preference to online shopping, especially during the situation created by social distancing amid the spread of COVID-19.

- Businesses are transitioning to online offering and closing stores to preserve capital and reach out to the targeted customer base.

- Global omni-channel retailer, City Chic Collective derives two-third of its total sales via multiple websites in Australasia and the US; Nursery retailer and one-stop shop for baby products, Baby Bunting group achieved total sales growth of 13.2% and comparable store sales growth of 8.1% between 30 December 2019 and 17 May 2020.

- Clearpay, part of Afterpay, crossed 1 million active shoppers using the service in the UK, while retail giant, Kogan.com settled institutional placement for higher financial flexibility.

- Goodman Group, an integrated property group, recorded improved portfolio fundamentals and development activity, supported by customer demand in the online, logistics, food, consumer goods and digital economy.

Past two decades have seen an internet boom, propelling the emergence of online retail. The world is moving online, and the e-commerce industry is increasingly disrupting the traditional retail landscape. Particularly, in the ongoing crisis caused by the coronavirus pandemic (COVID-19), Australians have been resorting to buy all kinds of products, especially essential goods and services, online from the comfort of their homes due to social distancing restrictions in place.

E-commerce companies with an established online presence have particularly benefitted from these developments reporting record revenues. However, the period has been challenging for companies with no online buying options.

The surge in online buying has encouraged various companies to take their business online and match up with the trend to reach out a broader consumer base. The COVID-19 situation seems unresolved, globally, and such businesses are demonstrating the importance of going digital in these times.

Must Read: How is the buying pattern changing during the COVID-19 pandemic?

Today, online businesses are catering to personalised expectations of shoppers and playing a crucial role in ensuring the best possible experience for both businesses and consumers, enabling them to have a mutually rewarding engagement.

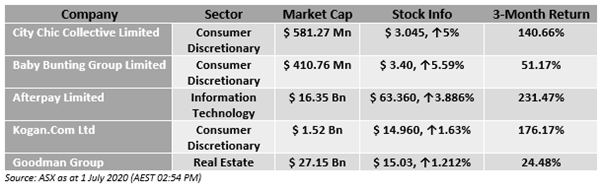

The following ASX-listed companies have delivered an exemplary performance and demonstrated resilience during the global pandemic.

City Chic Collective Limited (ASX: CCX)

City Chic is a global omni-channel retailer, specialising in provision of plus-size women’s apparel, footwear and accessories via customer-led brands, offered through 92 physical stores in Australia and New Zealand, as well as multiple websites in Australasia and the US. The group also has wholesale partnerships with US retailers and a wholesale business with European and UK partners including ASOS and Zalando.

City Chic has been well equipped to sail through the turbulent landscape in the past few months, owing to its more variable cost structure than most traditional retailers. The group derives two-third of its total sales via multiple websites.

Having implemented various measures concerning COVID-19 and coping with store closures, the group remains strongly positioned financially with a good cash position and a significant headroom in its $ 35 million debt facility (Expiration Date: February 2023), according to a late-March CCX update.

Baby Bunting Group Limited (ASX: BBN)

A nursery retailer and one-stop-baby shop for products like prams, car seats, cots, nursery furniture, high-chairs, change tables, and portable cots, Baby Bunting Group has also responded well to COVID-19 with health and safety measures in stores and operations, encouraging cashless transactions.

The teams at Baby Bunting have worked remotely and relentlessly to serve the consumers, as there are around 6,000 babies born in Australia every week.

As a result, Baby Bunting has been able to manage and continuously deliver total sales growth of 13.2% (10.3% on a year-to-date basis) between 30 December 2019 and 17 May 2020. Comparable store sales growth for the period was noted at 8.1% (3.4% year-to-date) amidst a challenging operating landscape. It is noteworthy that the group’s online sales constitute 17.3% of the total sales (14.3% on a year-to-date basis), representing growth of around 66% on the prior corresponding period (pcp).

Also, READ: Online fashion retailer City Chic and Baby Bunting braving the corona storm

Afterpay Limited (ASX: APT)

Afterpay provides innovative payment solutions, including buy now, pay later (BNPL) to customers, making purchasing experience a memorable and convenient one for a global customer base in Australia, New Zealand, and the United States.

On 23 June 2020, Clearpay, part of Afterpay Limited Group, announced that over 1 million active shoppers are using the service in the United Kingdom (UK). At the same time, customer purchasing frequency in the UK is outpacing the US when it was at the same stage of lifecycle. Besides, Clearpay has a strong pipeline of leading merchants offering the payment platform in the UK.

Even for the March quarter 2020, Afterpay, on 14 April, reported a strong business performance with overall underlying sales of $ 7.3 billion year-to-date, increasing by an outstanding 105% compared to pcp, which has been in line with the Company’s H1 FY20 guidance. It is noteworthy that March turned out to be the company’s third largest underlying sales month on record amid the market turbulence, behind the seasonally higher months of November and December.

Kogan.com Ltd (ASX: KGN)

Australia-based retail giant, Kogan.com operates as a holding company for retail and services businesses- Kogan Retail, Kogan Marketplace, Kogan Mobile, Kogan Internet, Kogan Insurance, Kogan Travel, Kogan Internet, Kogan Insurance, and others. The company is well-known for price leadership through digital efficiency.

During mid-June 2020, the company settled its underwritten $ 100 million institutional placement at an offer price of $ 11.45 per new share, strongly supported by existing shareholders and new investors. The funds raised have been planned to be utilised for enhancing financial flexibility to act quickly on any future value accretive opportunities that may arise.

In addition, the company announced offer of new shares under a ~$ 15 million Share Purchase Plan (non-underwritten), at 7.00pm (Melbourne time) on 9 June 2020 (Record Date), to allow eligible shareholders with the opportunity to apply for up to $ 30,000 worth of new shares at the placement price.

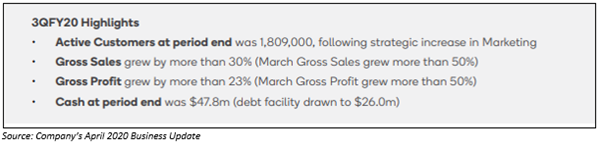

Kogan.com is known for a disciplined approach to capital deployment with a proven track record of delivering operating leverage. For the first and apparently challenging March Quarter 2020, Kogan.com achieved a 30% growth in gross sales and ~ 23% growth in gross profit.

Interesting Read: A look at Kogan.com Share Price: A rich list e-tailer

Goodman Group (ASX: GMG)

Goodman Group, an integrated property group with operations across New Zealand, Australia, Europe, Asia, North America, Brazil and the UK, has ~ $ 55.1 billion of total assets under management (AUM) as at 31 March 2020.

The group, in its Q3 FY20 operational update, informed that amid a challenging global environment due to COVID-19, customer demand in the online, logistics, food, consumer goods and digital economy, has largely supported portfolio fundamentals and development activity. As a result, there has been higher demand for both temporary and permanent space from customers in the food, consumer goods and logistics sectors, particularly related to e-commerce operators as well as those switching to online business.

Key Highlights for the nine months to March 2020:

- 3.0% like-for-like NPI growth in GMG’s managed partnerships.

- Over 97.5% occupancy across the group and Partnerships.

- $ 4.8 billion of development work in progress with 76% undertaken in Partnerships.

- $2.5 billion of development commencements for the nine months ended 31 March 2020.

The group remains in a strong position and reaffirmed its forecast FY20 operating earnings per security of 57.3 cents, up 11% on FY19.

Market participants are quite optimistic about the future of e-commerce industry, which is as vibrant as ever, as consumers are hooked on to their mobile phones, tablets and laptops. Some key factors driving the shift from physical stores to online shopping can be convenience, price comparison ability, shopping availability 24/7, greater variety and options, as well as free shipping. From groceries to electronics to apparel, e-commerce has changed the face of shopping.

Must Read: Guide to Portfolio Strategies and Investment Avenues to Wade Through COVID-19 Crisis