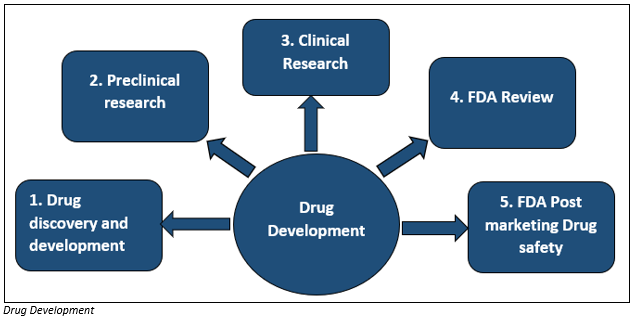

Drug development is an extensive process and includes drug discovery & development, pre-clinical and clinical research and FDA approvals, including Post-Market Drug Safety Monitoring.

The first and the most essential step of drug development is drug discovery which includes designing a new product to prevent and reverse the effect of the disease condition. The researchers conduct many tests to find out the beneficial effect of the molecule against various diseases. After the identification of the compound, the experiments are conducted to gather pharmacokinetic (absorption, distribution, metabolism and excretion) information of the molecule. Besides, other information such as the mechanism of action, side effects, dosage, route of administration are also collected from the tests.

Before the drug molecule is tested in humans in vivo and in vitro study is performed to evaluate any possible toxicity from the drug. After evaluating drug safety, the molecule is tested in humans under clinical research.

In Australia, clinical trials are subject to many regulatory controls for ensuring the safety of participants and Therapeutic Goods Administration (TGA) regulates the use of therapeutic goods supplied in clinical trials in Australia under the therapeutic goods legislation. The researchers and clinical trial sponsors must be conscious about the requirements to manufacture, supply, import and export therapeutic goods in Australia.

In the article, we would be discussing 3 ASX listed health care stocks that are engaged in drug development and have a strong product pipeline.

Let us discuss- NEU, BIT, RGS

Neuren Pharmaceuticals Limited (ASX:NEU)

An ASX listed health care company Neuren Pharmaceuticals Limited (ASX:NEU) is into the development of innovative therapies for devastating neurodevelopmental disorders which are characterised by impaired signalling and connections between brain cells.

NNZ-2591 patent granted in Europe-

In an ASX update on 3 December 2019 the company announced that the European Patent Office (EPO) has released a notice of the grant of a new patent which is for NNZ-2591 for the treatment of neurodevelopmental disorders. The new patent is entitled âNeuroprotective bicyclic compounds and methods for their use in treating autism spectrum disorders and neurodevelopmental disordersâ and after the issued it will expire in July 2034.

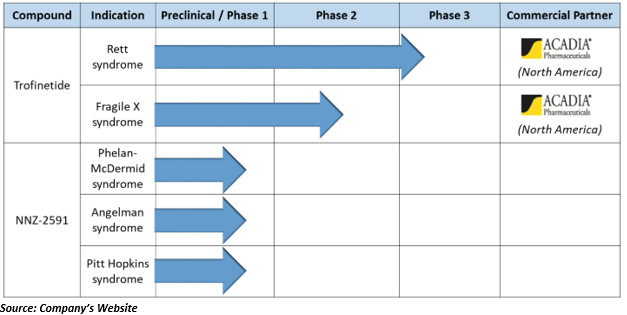

After the positive outcomes in the mouse models, the company has received an Orphan Drug designation for NNZ-2591 for the treatment of Pitt Hopkins, Phelan-McDermid, and Angelman syndromes. Currently, the company is into development and non-clinical studies which are required prior to submitting an Investigational New Drug Application to the Food and Drug Administration (FDA), and in 2020 it would start clinical trials.

Want to know more about NNZ-2591? Click here

The company has a well-planned product pipeline and Trofinetide (NNZ-2566) the lead compound of Neuren Trofinetide (NNZ-2566) is licensed to ACADIA Pharmaceuticals.

Phase 3 trial of trofinetide in Rett syndrome-

The company unveiled that its ACADIA Pharmaceuticals (North American licensee of Neuren) has started the phase 3 trial of trofinetide in Rett syndrome in the US. Rett syndrome program of Neuren has received a grant of Orphan Drug and Fast Track designation from the US FDA.

The expense of phase 3 trial as well as all other developmental costs are wholly funded by ACADIA, and Neuren has complete access to all the information to use for commercialisation purpose outside North America without any cost.

Intellectual property information-

Neuren has strong Intellectual property, and all the patents are owned by the company without any royaltiesâ payables.

- A patent issued in the United States and Europe for Trofinetide composition of matter and expires in 2022.

- A patent on Trofinetide for Rett and Fragile X syndromes is issued in the United States and expires in 2032.

- A patent issued in the US, Europe and Japan for NNZ-2591 composition of matter, expires in 2024.

- A patent issued for NNZ-2591 for neurodevelopmental disorders in the United States and Japan and it is pending in Europe. The patent expires in 2034.

- Another patent is issued in Europe, Japan and Australia on Trofinetide for autism spectrum disorders and this patent expires in 2032.

Stock performance- The companyâs stock last traded at $2.240 down by 3.03% from its last close (as on 6 December 2019). Its stock has 52 weeks high price of $2.700- and 52-weeks low price of $0.980. Neurenâs stock has delivered a positive return of 50.98% and 89.34% on year to date basis and in the last six months, respectively.

Biotron Limited (ASX:BIT)

An ASX listed health care player, Biotron Limited (ASX:BIT) is into research & development (R&D) and commercialisation of pharmaceutical drugs which targets the significant viral diseases having an unmet medical need.

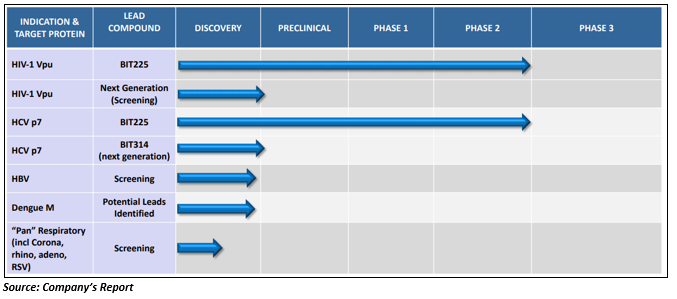

BIT225, Biotronâs lead compound is under phase 2 clinical development for HIV-1 treatment and has a promising pre-clinical program for Hepatitis B (HBV). Besides, Biotron has a strong pre-clinical pipeline with a notable portfolio of pharmaceutical compounds-

Clinical & non-clinical programs-

The lead compound of Biotron- BIT225 is under the clinical development to treat Hepatitis C virus (HCV) infections and HIV-1 and has completed seven clinical trials. The compound has been administered in 55 healthy human volunteers, and 94 HIV-1 or HCV infected subjects.

Besides BIT225 development, the company also has a portfolio for non-clinical (pre-clinical) antiviral programs for the development of the pharmaceutical compounds to target various significant well-known and emerging viral infections such as Dengue, Zika and Influenza virus.

According to one recent update on ASX on 3 December 2019, the company announced that it would be presenting the clinical trial data at the Conference on Retroviral and Opportunistic Infections (CROI) which is to be held in Boston, the United States in March 2020. This conference is the preeminent international HIV-1 conference which brings together translational, top basic and clinical researchers from the world who would share the recent studies and developments in the constant battle against HIV/AIDS.

Stock performance- On 6 December 2019, the companyâs stock last traded at $0.059 down by 1.667% from its last close. Biotronâs stock has delivered a negative return of 46.96% on the YTD basis and a negative return of 4.69% in the last six months.

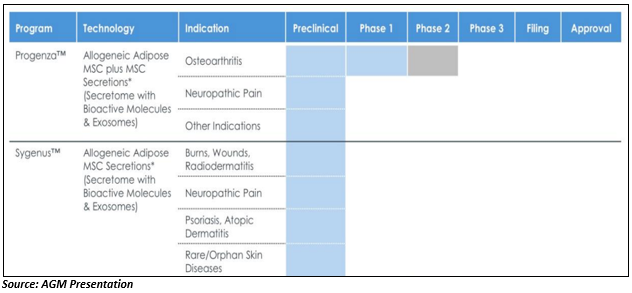

An Australian exchange listed health care company Regeneus Ltd (ASX:RGS) is a clinical-stage regenerative medicine company, which is into the development of new cellular therapies which target significant unmet medical needs. The key therapeutic areas of the company are osteoarthritis, cancer and skin conditioning & wound healing. The product pipeline of Regeneus is supported by proprietary stem cell technologies with two core stem cell platforms Progenza and Sygenus.

Progenza, stem cell platform, uses mesenchymal stem cells (MSCs) for the reduction of inflammation and healing of diseased tissue. It targets neuropathic pain and osteoarthritis (OA). Progenza has completed phase 1 clinical trial for osteoarthritis and has entered in phase 2 trial.

Sygenus stem cell platform uses bioactive molecules which are secreted by mesenchymal stem cells (MSCs) for the reduction of pain, inflammation, healing and repair. Sygenus heals neuropathic pain, nociceptive pain and oral conditions and it is under pre-clinical stage.

The company released its annual general meeting (AGM) presentation on ASX, highlighting the overview of the company with upcoming milestones that are as follows-

- The company would sign a deal for commercialisation of Progenza in Japan.

- Regeneus would continue to execute revised company strategy and streamline operations. The company would focus on new strategic direction in Progenza pain market and appointments of new board in the financial year 2019 would accelerate growth strategy at the global level in the financial year 2020.

- Progenza OA is expected to launch in Japan in 2023.

- For technology licensing the company expects some new scientific partnership model.

- Regeneus would continue its synergies from cost-containment initiatives.

Stock performance- On 6 December 2019, RGSâ ended the trading session at $0.095, moving up by 5.556 percent from its previous close, with a market cap of $25 million. RGS stock has delivered a negative return of 50.23% and 12.30% on year to date basis and in the last six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.