Gold prices are again nearing towards the record high in Australia with Australian dollar-denominated gold spot trading around A$2,211.57 (as on 14 August 2019 01:30 PM AEST), while the record-high intact at A$2268.64. The strong fundamentals are backing the gold prices with demand from central banks and global gold-backed ETFs fanning the prices higher and higher.

The high gold prices have now hit the sentiments of many physical gold consumers such as Jewellery makers, which in turn, is exerting pressure on gold demand; however, the demand for gold as an investment asset class is resembling the time of financial crisis, with demand from central banks reaching their previous peaks.

The gold miners are taking advantage of the gold shine and their stocks are appreciating in value; however, the industry experts are now suggesting the miners, not to get engaged in aggressive merger and acquisition amidst the soaring gold prices, as industry experts believe and anticipate that in the prevailing environment, the miners could enter an expensive deal.

The suggestion from the industry experts came amidst the recent acquisition by Resolute Mining Limited (ASX: RSG) of Toro Gold. The company is increasing its exposure in the African gold sites and post a bumper performance from its Syama operations in the June 2019 quarter, RSG set its target on the Mako Gold Mine in Senegal.

The company entered into a binding agreement with Toro Gold to acquire the Mako Gold Mine in Senegal for a consideration of US$274 million.

UBS- an asset manager and investment banker, was offering RSG shares (block trade) on 13 August 2019. The block trade which was anticipated by the market to be on behalf of shareholders whose shares came out of escrow and the shares were offered at A$1.79 per share.

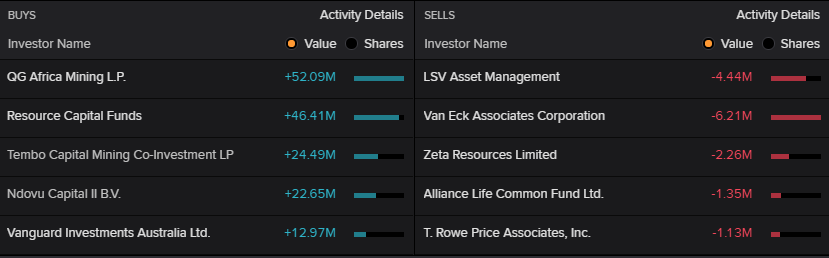

While, few shareholders are selling their shares, the recent ownership activity of RSG showing strong capital demand for the companyâs shares.

Filling Over the Past Six Months (Source: Thomson Reuters)

Filling Over the Past Six Months (Source: Thomson Reuters)

RSG Strengthen Hedge Book Further:

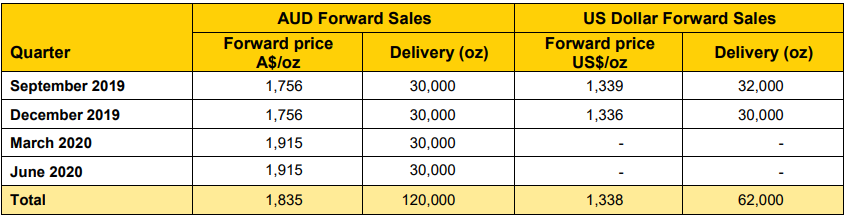

During the June 2019 quarter, RSG strongly hedged its gold sales above its budgeted gold price in order to secure the sales from high volatility in the gold market and to maximise its revenue to safeguard the balance sheet of the company.

RSG had hedged 30,000 ounces of gold at an average price of A$1,943 per ounce, and further hedged 30,000 ounces at an average price of US$1,337 per ounce. The forward sales of the company previously remained as below:

RSG Hedge Book till 30 June 2019 (Source: Companyâs Quarterly Report)

RSG Hedge Book till 30 June 2019 (Source: Companyâs Quarterly Report)

In the status quo, the company further boosted the hedge book and added a further forward sale of 30,000 ounces at an average price of US$1,519 per ounce for the scheduled monthly deliveries of 5,000 ounces between January 2020 to June 2020.

The new hedge added by the company aimed at securing the high prices of gold in the market and convert it into the revenue for the African operations. The hedge added by the company now secures income for its Syama and the Mako Gold Mine.

As on 8 August 2019, RSG total gold hedge book consists of 190,000 ounces (3% of RGSâs ore reserves) in monthly deliveries out to June 2020.

Barrick Kalgoorlie Superpit and the Australian Investors:

While the Australian Gold miner RSG is securing overseas gold exposure and achieving sales, the international behemoth- Barrick Gold is signalling a departure from the Australian gold exposure, which under the prevailing gold rush could attract competitive bidding.

Barrick Gold declared 50 per cent stake sale in Kalgoorlieâs superpit as the company has expressed its displeasure from the performance of the superpit, which is operated by another mammoth- Newmont Gold Corporation.

The boss of Barrick Gold- Mark Bristow in a discussion over the June 2019 quarter expressed displeasure over the superpit and mentioned that Kalgoorlie is the only asset which could be performing better in the companyâs asset portfolio.

Mark Bristow further mentioned that Kalgoorlie remains a valuable asset; however, considering the fact that the company does not operate the project, Barrick Gold is moving down the road to sell its 50 per cent stake in the project as the company does not want to remain a passive investor in its own asset.

The market is now speculating over many cash abundant Australian gold miners such as Northern Star (ASX: NST) and Newcrest Mining (ASX: NCM) to bid for Kalgoorlie along with many other potential buyers.

Barrick Gold (50 per cent) Posts Strong Numbers for the Superpit:

Barrick Gold has posted strong numbers for the Kalgoorlie superpit for the year 2019, as per the company the production from Kalgoorlie attributable to Barrack Gold should remain in the range of 260,000-280,000 ounces in 2019, with a cash cost of US$740 to US$790 and all-in sustaining cost of US$1,010 to US$1,050 per ounce.

During the June 2019 quarter, the production from Kalgoorlie superpit remained at 57,000 ounces, which in turn, underpinned the growth of 4 per cent as compared to the previous corresponding quarter production of 55,000 ounces.

The total cash cost from the Kalgoorlie marked a decline of 3 per cent, and the total cash cost stood at US$864 per ounce in the June 2019 quarter, as compared to the total cash cost of US$870 per ounce in the previous corresponding quarter.

However, the all-in sustaining cost (or AISC) witnessed a slight increase of 2 per cent, and the AISC for the June 2019 quarter stood at US$1,204 as compared to US$1,185 per ounce in the previous corresponding quarter.

In 2018, the operations produced 314,000 ounces of gold with an AISC of US$857 per ounce. The estimated Proven and Probable Reserve of the prospect stands at 3.65 million ounces, while the Measured and Indicated Resources stand at 1.5 million ounces.

Barrick Gold mentioned in its June 2019 report that the higher production at the superpit was mainly due to the processing of higher grade and tonnes, which in turn, indemnified the lower recovery at the mine.

In a nutshell, Barrick Gold is moving down the road to sell its stake at the Kalgoorlie superpit; however, the industry experts are suggesting miners avoid any aggressive merger or acquisition, as it might lead the miners toward expensive valuation amid higher gold prices.

However, the market participants predict NST and NCM along with other potential Australian gold miners to emerge as the potential buyers of the Barrick Goldâs interest in the Kalgoorlie superpit.

While Barrick Gold stake sale and the potential buyers are under the investorsâ scrutiny, the ASX-listed Resolute Mining and many other gold miners are actively looking to increase their gold resources and are strengthening their hedge book to avoid market volatility.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.