Australia is going through its most profound economic contraction on record, first in almost 30 years even though it has flattened the coronavirus curve and has relaxed lockdown restrictions to restart its economy.

Number of coronavirus cases in the country grew from 100 in March to more than 7,000 on 22 May 2020, with 6,479 recovered, as per the WHO data. Australia closed borders and announced strict mobility and social distancing practices to contain the virus spread, forcing many businesses to shut down and declare massive layoffs.

To save the economy from the economic fallout of coronavirus, the Federal Government has announced fiscal stimulus packages worth $194 billion over the next 4 years. These measures have been rolled out to support households and businesses that are financially affected, and include wage subsidy package, JobKeeper Payment of $130 billion to give financial aid to firms, so that they retain their employees.

The Central Bank of Australia, RBA has slashed interest rates to a record low of 0.25%, set a yield target of 0.25% on 3-year government bond and introduced an unlimited quantitative easing program to facilitate smooth credit flow and functioning of the financial market.

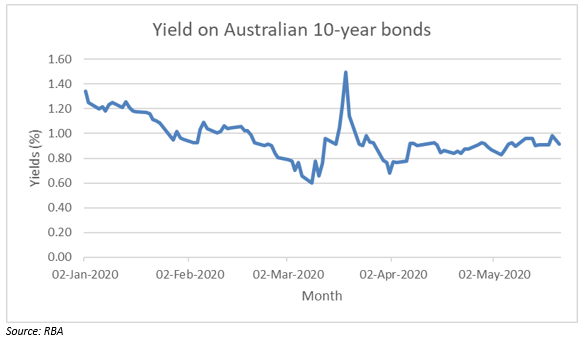

Falling Bond Yields

Investors are cautious and remain firm that economic recovery after coronavirus will be slow and gloomy, keeping domestic and global bond yields low. However, some experts believe that immense interference by central banks is keeping bond yields from rising. US and UK 10-year bond yields have fallen from 1.9% and 0.81% on 1 January to a massive low of 0.64% and 0.16% on 22 May 2020, respectively.

In Australia, 10-year government bond yields have fallen from 1.35% at the beginning of the year to a substantial 0.92% on 21 May 2020.

Investors are of the view that once the virus is contained, central banks will keep the bond yields low, which would result in lower borrowing costs for households and increased credit flow in the economy. This will further help in strengthening the economic recovery.

Fitch Downgrades Australia Outlook

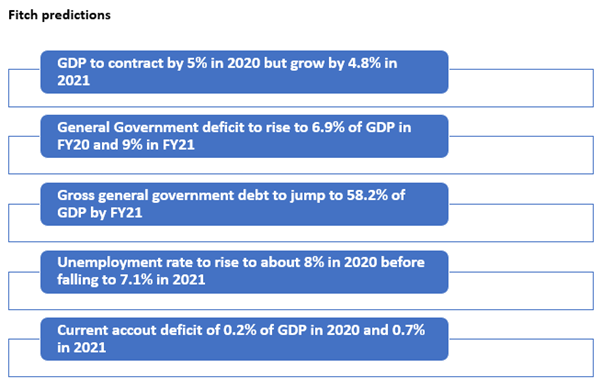

Fitch downgraded its outlook on Australia's AAA credit rating from stable to negative, referring to massive setback to public finances and economy, as a result of the coronavirus pandemic. The rating agency stated that a downgrade is on the cards if a sufficient fiscal consolidation strategy is not formulated post coronavirus or during financial and economic distress. Fitch cited downside risks due to uncertainties on the spread of coronavirus domestically and on the global level.

Fitch has projected an economic contraction of 5% in 2020, ending 28 years of consecutive economic growth, stating that government spending in response to health and financial emergency will result in large fiscal deficits.

S&P Ratings had also downgraded the economic outlook of Australia's AAA credit rating from stable to negative on 8 April, due to weakening of the debt position of government owing to roll out of large fiscal packages amid COVID-19. It also warned that if the economic fallout from coronavirus is more severe or prolonged than expected, the AAA rating can be downgraded within the next 2 years.

The government measures taken to curb the spread of coronavirus have been successful effectively, but they have significantly hampered household consumption while reducing business sentiment and investment. An effective policy framework with strong net migration has strengthened the record of consistent and stable economic growth for 28 years.

Ratings on Australian Banks Unchanged

The revision in Australia's rating outlook to negative has not affected ratings of Australian banks. Fitch lowered the ratings of 4 largest banks of Australia from AA- to A+ on 7 April due to anticipation of a significant economic blow during the first half of 2020, as a result of measures taken to halt the spread of coronavirus.

The rating agency's banking system indicator scored an 'A' for Australia's banking system, reflecting that the banks are well placed to manage the ill effects of coronavirus. However, Fitch anticipates worsening of bank asset quality and earnings due to low-interest rates and weak performance of the economy.

ALSO READ: Safeguarding banks amid coronavirus pandemic

Sufficient buffers, sound prudential regulations and bolstering of underwriting standards have helped in making the balance sheets of the banks resilient. Near-term pressures are limited due to RBA's liquidity supervision and support actions supporting funding and liquidity. Fitch believes that the exposure of Australia to any external financing risks from a sharp shift in capital flows is limited even though the country's net foreign debt is among the highest in 'AAA' category at 57.9% of the GDP in 2019.

The rating agency anticipates economic recovery to begin in H2FY20 gradually, as domestic restrictions ease. However, with border controls still intact, international tourism and student service exports are likely to remain restrained. Also, Australia's exports could be significantly impacted if China fails to recover. There are also potential risks to the economy due to international and bilateral trade tensions with China.

Brewing tensions between China and Australia: What could be at risk? Must Read

There are still significant downside risks due to prevalent uncertainties around the virus spread in Australia and around the world. Any resurgence in virus cases in Australia can again lead to the imposition of lockdown restrictions domestically along with worsening of the global outlook than what is predicted at present.

According to Fitch, there is an increasing need to put general government debt/GDP on a downward course in the medium term. If there is no fiscal consolidation strategy after coronavirus, the decline in housing prices or any worsening of the labour market can lead to a rating downgrade.