Gold prices have shown recovery from the lower end of the bullish flag pattern, and the prices are now moving up to test the upper range. There has been a lot of noise around the change in fundamentals of gold; however, the continuous addition of gold by central banks and global gold-backed ETFs is separating gold from all the noises and gold is standing tall against all of it.

To Know More, Do Read: Is the Emergence of Volatile Patterns in RSG and SAR a Warning Sign for Gold Bulls OR Does Gold Still Stand Strong?

Table of Contents

- Recovery in Gold Spot

- Australia Gold Scenario

-

ASX-Listed Gold Miners

- Vango Mining Limited

- Gold Road Resources Limited

- Alliance Resources Limited

Recovery in Gold Spot

Gold spot prices took a U-turn from the level of USD 1,459.15 per ounce (Dayâs low on 1 October 2019) to the level of USD 1,519.60 per ounce (Dayâs high on 3 October 2019) before oscillating around the level the new base price of USD 1,500 per ounce.

While gold prices sailed low, many ASX-listed gold miners demonstrated bearish patterns; however, with gold prices again trading above the new psychological level of USD 1,500 per ounce many ASX-listed gold miners are accelerating to utilise the moneyness of their exchange options.

To Know More, Do Read: ASX-Listed Junior Gold Miners Consider Moneyness of Exchange Options; Progress Across Projects

Junior gold miners listed on ASX are progressing rapidly to take a leap with high gold prices. While Bellevue Gold Limited (ASX: BGL) discovered high-grades gold nuggets at the Deacon & Mavis discovery, another ASX-listed junior gold miner- Vango Mining Limited (ASX: VAN) is targeting high-grade gold resources at its Marymia Gold Project in Western Australia.

Also Read: Bellevueâs Gold Nuggets To Polish The Stock Shine Of the ASX-Listed Junior Gold Miner?

Australia Gold Scenario

Australia, which produced 315 tonnes of gold in 2018 is the second-largest gold producer in the world. The 315 tonnes produced by the country in 2018 accounted for 9 per cent of the total world mine production.

The Australian Department of Industry, Innovation and Science (or DIIS) anticipated the total gold export volume to mark the level of 370 tonnes in 2020-21 amid high progress across the gold projects in Western Australian- the golden hub of Australia.

Also Read: A Glimpse Over ASX-Listed Top Performing Mining Stocks

Several ASX-listed gold miners such as Evolution Mining Limited (ASX: EVN), Cygnus Gold Limited (ASX: CY5), etc., operate in Western Australia, and the DIIS anticipates a record production in the region over the coming years.

To know More, Do Read: Gold Industry Outlook And Popular ASX Names- EVN, DCN, RMS, CY5, RSG, NCM And SAR

ASX-Listed Gold Miners

Vango Mining Limited (ASX: VAN)

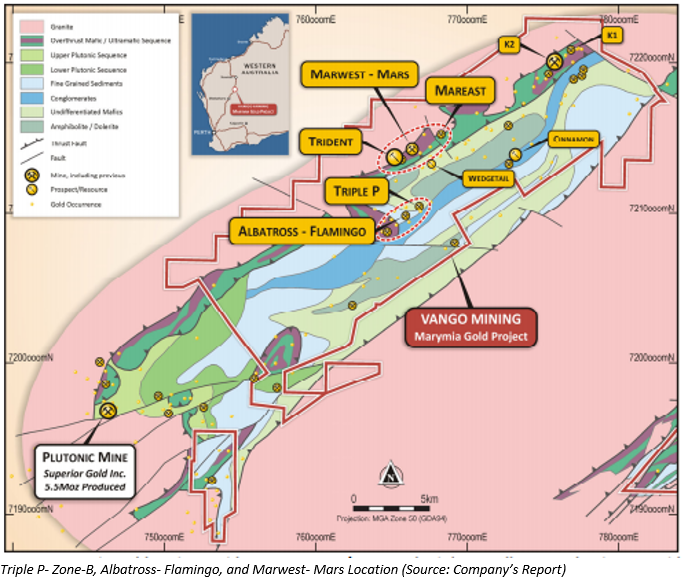

VAN started the next phase of drilling for resource definition at the Marymia Gold Project. The drilling at the current phase would test significant high-grade targets, which include Triple P? Zone?B, Albatross- Flamingo, and Marwest? Mars.

The drilling would include 35 reverse circulation holes for a total of about 5,300m and would be conducted in two stages with stage 1 aimed at extending and defining the Triple P? Zone?B, Albatross- Flamingo, and Marwest? Mars and stage 2 aimed at detailed resource definition.

The company would test Triple P ? Zone B high?grade resource target with twelve holes to define and extend the potential significant gold discoveries at depth and along the strike to the north. The previous intersection received by the company from the mine-mafic hosted Triple P ? Zone B are as below:

- The drill hole identified as VPPPRC0005 intersected in 4m @ 9.48 g/t of gold from 177m, which further includes g 1m @ 25.0 g/t of gold.

- The drill hole identified as PMDD0002intersected in 7m @ 15.7 g/t of gold from 144m, which further includes 3m @ 28.1 g/t of gold.

The company anticipates that the Triple P and Zone B are the same mineralised zone with a combined strike length of over 1km and is offset by a significant fault. VAN conducted an Induced Polarisation (or IP) geophysics, which suggested a strong anomaly indicative of high?grade gold associated sulphide mineralisation.

Vango intents to test the Albatross ? Flamingo target with eleven holes for a repeat of the mine-mafic hosted high-grade mineralisation around 1.5km to the west of the Triple P and Zone B.

The company would test the very high-grade Mars zone with six holes. The drilling would aim to extend the mineralisation post the stage 2 resource definition drilling.

Gold Road Resources Limited (ASX: GOR)

GOR and Gruyere Mining Company Pty Ltd- a member of global gold behemoth Gold Fields attained commercial production at the Gruyere Gold Mine, Western Australia, on September 2019.

The company achieved the commercial production ahead of schedule through the anticipated ramp-up period of 6 to 7 months post-commissioning the ball mill in early August 2019.

The pre-determined minimum total process plant throughput rate would be 70% of nameplate capacity, and the minimum average gold recovery of 85 per cent over the expected life of mine metallurgical recovery.

The company capitalised the cost incurred for developing and commissioning the Gruyere Project, including the process plant and associated infrastructure, to the balance sheet up to the point of commercial production.

Now that GOR has attained commercial production, the company would start reporting the all-in sustaining cost (or AISC) and other financial metrics.

The company expects the production from the Gruyere Project to reach the upper range of the CY2019 production guidance of 75,000 to 100,000 ounces (on a 100 per cent basis), as throughput rates and gold recoveries during ramp-up remained above expectations.

To Know More, Do Read: Newcrest Beats Industry Expectation; While GORâs Gruyere Leaps For 100,000 Shiny Ounces

GOR kept the AISC for the December 2019 quarter in the range of $1,050 to $1,150 per ounce, which is slightly higher than the forecasted life-of-mine average AISC of $1,025 per ounce.

Alliance Resources Limited (ASX: AGS)

AGS recently received the results of the aircore drilling at the Weednanna Gold Deposit which identified a suitable area for mine infrastructure.

The company drilled 190 aircore holes for 7,753 metres on the west side of the Weednanna Gold Deposit, and extended RAB and aircore traverses to test a 160-hectare area for the mine infrastructure, which was not considered a prospective for gold.

The anomalous assay results received by the company from the drilling program are as below:

The drill hole identified as 19WDAC025 returned 0.18 gram per tonne gold of 2m interval from 20m, and gold assay results do not indicate the potential for a gold deposit within the area tested, which in turn, confirm its suitability for the construction of mine infrastructure, which includes:

- A 1.34Mm3 capacity waste dump.

- A tailings storage facility to hold 1.75 million tonnes of dry tailings.

- A gold processing facility, and the site administration buildings.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.