United Nations General Assembly caught the worldâs attention last night with global leaders squabbling at each other. Crude oil prices responded substantially overnight to the comments of worldâs premiers, which hampered the ASX-listed energy stocks.

Also Read: Understanding Crude Oil Dynamics Through The Web Of Global Influencers

Tug of War at The U.N. General Assembly

The United Nations General Assembly witnessed an array of exchanged comments between the United States, Iran, and China. The United States President Donald Trump mentioned that the Iran sanctions could further take strength if Iran does not change its stance to curb its nuclear activities.

The statement from the United States President was initially anticipated to fan the crude oil prices; however, the willingness of Iranian premier- Hassan Rouhani to re-enter the 2016 Tehran Nuclear Deal with minor addition exerted pressure on the crude oil prices in the international market.

The Iranian President Hassan Rouhani said that he is willing to discuss small changes, additions or amendments to the nuclear deal if sanctions were taken away, which in turn, induced pessimism among the oil buyers, and the oil market forces shifted towards the short sellers.

The comments from the Iranian President coupled with previous indication from the United States to ease the Iran oil curb over some prerequisite, raised speculation in the oil market, and apart from that, the additional pressure from the supporting countries such as France and Germany on Iran to ink a nuclear pact further fuelled the speculative sell.

The United States and China

Another event at the United Nations General Assembly which influenced the crude oil prices was the sharp criticism of Chinaâs trade policies by the President of the United States. Mr Trump criticised Chinaâs trade policies and concluded that the United States would not accept âbad negotiationsâ in the U.S-China trade talks.

The heated comments from the United States dampened the market sentiments over the global oil demand, further propelling the speculative sell, and the Brent crude oil future plunged by over 3.50 per cent from its dayâs high of US$64.60 a barrel on 24 September 2019.

How Strong are the fundaments for short sellers?

The exports and imports of oil in the United States increased for the week ended 13 September 2019 amidst the Aramco attack.

Read Here: Aramco Fire Fuelled ASX Energy Stocks; United States SPR to Rebalance the Supply Chain?

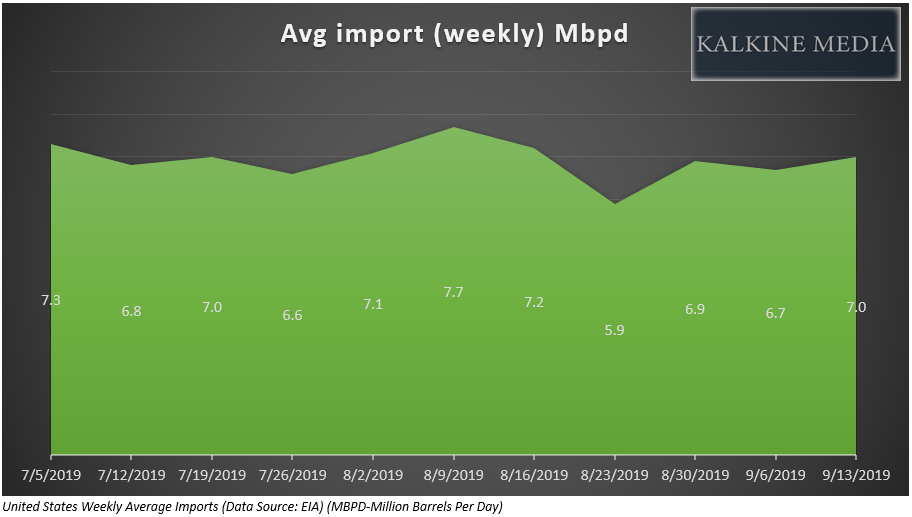

The average imports in the United States inched up slightly for the week ended 13 September 2019 to 7.0 million barrels a day against the previous corresponding period average imports of 6.7 million barrels a day.

Likewise, the net exports per day witnessed an increase to stand at 5,550 thousand barrels a day against the previous corresponding period net exports of 3,295 thousand barrels a day.

Despite the higher exports, the United States commercial crude oil inventory witnessed an increase of 1.1 million barrels to stand at 417.1 million barrels (as on 13 September 2019) without a change in strategic petroleum reserve, which stood at 644.8 million barrels (as on 13 September 2019), unchanged from the previous week.

The resultant no net change in the strategic petroleum reserve along with an increase in commercial crude oil inventory coupled with higher exports indicate ample oil supply and lower consumption in the United States (as production remained unchanged at 12,400 thousand barrels a day). Which, in turn, favours the short sellers fundamentally.

However, the heightened geopolitical tensions in the Middle East possess a serious risk for the short sellers in the oil market, and investors should run event impact studies before taking a short position in the market.

What Could Disrupt the bearish view?

- Saudi Arabiaâs largest export facility- Ras Tanura holds only over 6 days of inventory and loadings of over 3 million barrels a day.

- The exports infrastructure of the United States is maxed out, and if the interruption continues for an extended period, the strategic petroleum reserve of the United States could only offset the supply reduction over the short-term.

- The oil tankers in the United States are out of position for timely deliveries to the global market, which, in turn, could hamper the adequate current supply.

The ASX-listed oil and gas explorers reacted sharply to the fall in oil prices on 25 September 2019 and traded in a red zone.

ASX-Listed Oil & Gas Explorers (Prices as on 25 September 2019)

Senex Energy Limited (ASX: SXY)

Senex witnessed a large gap-down opening of almost 3.80 per cent on ASX today, and the stock started the session at A$0.385 against its previous close of A$0.395 (Dayâs close on 24 September 2019). Post witnessing a large gap-down, the stock plunged during the dayâs session to close at A$0.365 down by almost 7.60 per cent against its previous close.

Also Read: Global LNG Supply Glut Prompts ASX-Listed Oil & Gas Explorers To Play The Volume Game

Beach Energy Limited (ASX: BPT)

BPT took a jab during the session today, and post-opening at A$2.610, down by almost 3 per cent from its previous close, the stock plunged to mark a low of A$2.520, and the stock ended the dayâs session at A$2.540, down by approx. 5.576 per cent from the previous close of A$2.690.

Carnarvon Petroleum Limited (ASX: CVN)

CVN followed the same trajectory of its peer group to mark a low of A$0.395, down by 3.66 per cent against its previous close of A$0.410.

Also Read: EIA Forecast Brings More Shock Waves For ASX-listed Oil & Gas Explorers

Many other ASX energy players followed suit and plunged on ASX during the dayâs session.

S&P/ASX 200 Energy (Sector) index dropped by 1.65 per cent to closed the dayâs trade at 10,777.5.

Read Here: S&P/ASX 200 Energy Recovers as New Saudi Oil Minister Sticks to the Production Curb

To wrap up, the ample supply of crude oil in the international market coupled with changes of an ease-down by the United States on Iran export ban, and low international demand exerted pressure on crude oil prices and raised speculative selling in the market.

However, the Strategic Petroleum Reserve of the United States could only keep the production normal over the short-run, which, in turn, holds a substantial risk (considering the high volatility) for the short-sellers.

But for now, the plunge in crude oil prices amid high short-selling exerted pressure on the stock prices of the ASX-listed oil & gas explorers, and they ended the dayâs session in the red.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.