Investors achieve dual benefits of owning and earning profits through investment in dividend stocks. The investment in dividend stocks carries the advantage of providing returns while keeping the ownership of the stocks for capital gains.

Moreover, the dividend gained from such stocks can be reinvested back in the stock, to increase the number of stocks held, through Dividend Reinvestment Plans rolled out by companies.

Let us now look at few dividend stocks listed on the ASX.

Harvey Norman Holdings Limited (ASX: HVN)

Harvey Norman Holdings Limited (ASX: HVN) is an Australian company whose primary activities include retail, franchise, digital enterprise and property. The company owns three brands, namely Harvey Norman, Harvey Domayne and Joyce Mayne, which provide the franchises to autonomous business owners. Further, the company offers a variety of products to Australian customers through market leadership and pioneering technology in major product classes.

As per the companyâs annual report, the franchisee aggregated sales revenue was $5.66 billion for FY19 (ended June 2019). In addition to this, HVN earned net profit before tax of $574.56 million in FY19, up by 8.4% as compared to FY18. The company achieved profit after tax of $402.32 million for FY19, which was 7.2% higher than FY18.

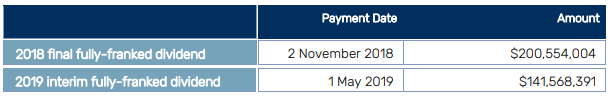

The company paid a total dividend of $342.12 million in FY19, an increase of $74.79 million when compared to the payment of $267.34 million as the FY18 dividend. The increase in the dividend payment during FY19 was driven by the higher final dividend payment in the month of December 2018.

The company directors have suggested a fully franked final dividend of 21.0 cents per share, scheduled for payment on 1st November 2019.

Previous Final Dividend Payment Schedule (Source: Company Reports)

At the market close on 09th October 2019, the company's stock was trading at a price of $ 4.400 with a market capitalisation of approximately $5.3 billion. The stock has a 52 weeks high price of $4.667 and a 52 weeks low price of $2.925 with an average volume of ~3,828,156. In the past six months, the companyâs stock has increased by 17.98%. The companyâs annual dividend yield is 7.35%.

JB HI-FI Limited (ASX: JBH)

JB HI-FI Limited (ASX: JBH) is an Australia based company, also operating in New Zealand and specialising in consumer goods. The company operates through three segments, namely JB HI-FI Australia, JB HI-FI New Zealand and The Good Guys. JBH deals in a wide variety of consumer goods including electronics, mobile devices, games and consoles, music and audio systems. The company also has a wholly owned subsidiary, named JB HI-FI Solutions, which provides technology solutions in addition to professional advice and maintenance services.

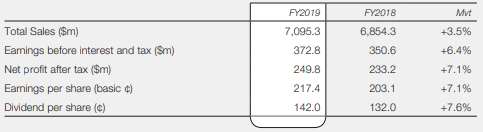

According to the companyâs FY19 annual report, the total dividend, fully franked, for FY19 ended 30 June 2019 amounted to 142 cents per share, which increased by 7.6% as compared to 132 cents per share paid during FY18. Moreover, the companyâs earnings per share (EPS) also grew by 7.1% year-on-year to 217.4 cents per share in FY19 from 203.1 cents per share in the same period a year ago.

Financial Performance (Source: Company Reports)

The companyâs net profit after tax for FY19 was $249.8 million, representing an increase of 7.1% from the previous corresponding period. Also, the total dividend for the financial year of 142 cents per share represented a payout ratio of ~65% of net profit after tax.

At the market close on 09th October 2019, the JBH stock settled at a price of $34.760 with a daily volume of ~ 930,708 and a market capitalisation of approximately $4.06 billion. The stock has a 52 weeks high price of $35.595 and a 52 weeks low price of $20.300. In the past six months, the stock delivered a return of 43.01%. The companyâs annual dividend yield stands at 4.02%.

Macquarie Group Limited (ASX: MQG)

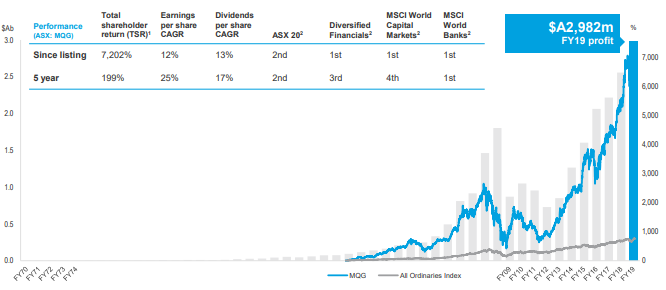

Macquarie Group Limited (ASX: MQG) is a financial services blue-chip group that delivers personal banking and wealth management services, risk and capital solutions, business banking products and services; and personalised investment solutions, among others. According to the companyâs recent announcement, MQG completed share purchase plan (SPP) with over 53,000 applications received from eligible shareholders for raising $679 million.

According to the company reports, its profit for FY19 was reported at a record figure of $2,982 million. Additionally, its dividend, 45% franked, for the total year stood at $5.75, up from $5.25 in FY18. Annual payout ratio for FY19 stood at 66%.

Profitability of MQG (Source: Company Reports)

At the market close on 09 October 2019, the company's stock settled at a price of $125.410 with a daily volume of ~ 892,170 and a market capitalisation of approximately $44.86 billion. The stock has a 52 weeks high price of $136.840 and a 52 weeks low price of $103.300. In the past six months, the stock delivered a negative return of 3.84%. The companyâs annual dividend yield stands at 4.54%.

National Australia Bank Limited (ASX:NAB)

National Australia Bank Limited (ASX: NAB) is Australiaâs largest bank with almost 160 years of experience in the banking sector. The bank provides services to small, medium and large businesses with 9,000,000 customers and presence in more than 900 locations in Australia, New Zealand as well as globally.

The company recently announced a distribution rate of 4.0519% per annum for NAB Capital Notes 2. Based on 91 days in the distribution period starting on and including 8th October 2019 to (but excluding) 7 January 2020, the distribution rate is equal to a cash amount distribution of $1.0102 per NAB Capital Notes 2, fully franked, which is to be paid on 7 January 2020.

On 09th October 2019, the NAB stock closed the dayâs trading at a price of $ 28.060, with a daily volume of ~4.6 million and a market capitalisation of approximately $ 80.98 billion. The stock has a 52 weeks high price of $ 30.000 and a 52 weeks low price of $ 22.520. In the past six months, the stock has delivered a return of 13.72%. The companyâs annual dividend yield is 6.48%.

Westpac Banking Corporation (ASX:WBC)

Westpac Banking Corporation (ASX: WBC) is a company operating in the financial sector of Australia, providing financial and banking services to customers across the globe. The company operates through its three units, namely Westpac Institutional Bank (WIB), Westpac New Zealand and BT Financial Group (BTFG).

Recently, the company announced a distribution rate of 4.0845% per annum on each Westpac Capital Note 4 (WCN 4) for the distribution period of 91 days. The cash distribution amount stands at $ 1.0183, fully franked, for each note, scheduled for payment on 30 December 2019.

On 09th October 2019, the WBC stock closed the dayâs trading at a price of $ 28.430 with a daily volume of ~5.2 million and a market capitalisation of approximately $100.09 billion. The stock has a 52 weeks high price of $ 30.050 and a 52 weeks low price of $23.300. In the past six months, the stock has delivered a return of 10.82%. The companyâs annual dividend yield stands at 6.56%.

For more information on Dividend stocks, please read here.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.