In this article, we discuss five stocks that have been increasingly showing positive movement in the last five days. Majority of the stocks under discussion are from the Financials sector, comprising of banks and investment managers. However, Treasury Wine belongs to the Consumer Staples sector.

Letâs discuss these stocks:

CYBG PLC (ASX: CYB)

UK-based CYBG PLC is a comprehensive banking group with several brands in the market. Last month, the bank had disclosed an increase in legacy Payment Protection Insurance (PPI) cost.

Legacy PPI Costs

In the Q3 Update, the group had highlighted an increase in the information requests, but it was early to determine the estimated impact. Therefore, the company had updated the market in September.

In September, the group had notified on the increasing PPI cost estimates, as the deadline approached. Although the estimated provisional cost impact was based on historical assumptions and conversion rate. Provisional legacy PPI cost estimates were in the range of £300 million and £450 million.

It was said that the group is working to process the significant number of information requests, and more accurate numbers would be provided at its full-year results on 28 November 2019.

Return to Profitability

In the half-year results ended 31 March 2019, the group was making profit, following a loss incurred in the previous corresponding period. The group had depicted profitability despite experiencing cost associated with the acquisition and integration.

Evidently, the statutory NPAT of the group stood at £29 million for the half-year period compared to a statutory net loss after tax of £76 million in the previous corresponding period. The statutory NPAT also improved on sequential terms, as the group had suffered a statutory net loss after tax of £69 million to the six months ended 30 September 2018.

On 17 October 2019, CYB was trading at $2.55, up by 1.19% (at AEST 1:24 PM). In the last five days, the stock has given 28.24 percent return.

Pinnacle Investment Management Group Limited (ASX: PNI)

Performance Rights

Recently, the companyâs directors had collectively acquired 2,680 shares, and the company has issued 2,680 shares as a result of exercising performance rights, according to the exchange filings dated 15 October 2019.

AGM & Presentation at Macquarie Securities

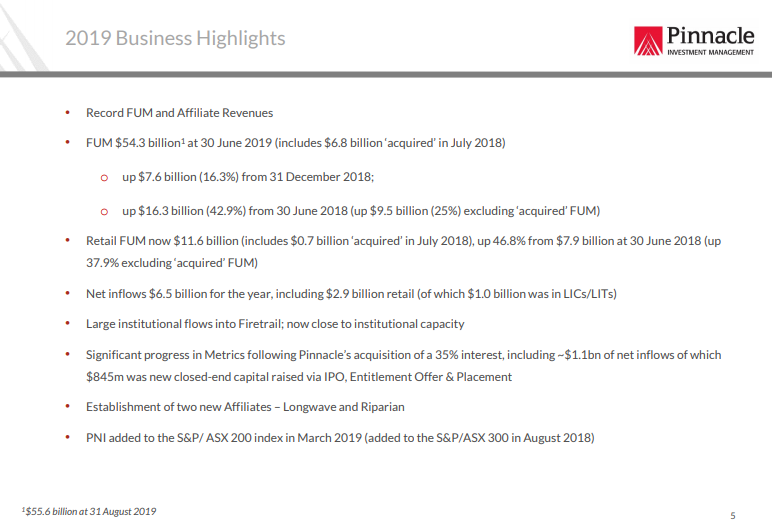

Late in September, the company had reported convening its Annual General Meeting on 31 October 2019. Around mid-September, the company presented at Macquarie Securities. Accordingly, the company had highlighted its achievement in the recent past.

It was noted that the funds under management stood at $55.6 billion as at 31 August 2019 compared to $54.3 billion at 30 June 2019. Among the indices, the S&P/ASX 300 index was down 0.1% in the two months period to 31 August, and the MSCI World Index was down 2.4% in the same period.

FY 2019 Highlights (Source: PNI Presentation at Macquarie Securities)

The company successfully closed the entitlement & shortfall offer for Plato Income Maximiser (ASX: PL8), raising $144 million in the process. In late August 2019, the company launched two Pinnacle aShares Active ETFs.

The launch of ETFs included a new concept in Australia with The Dynamic Cash Fund (ASX:Z3RO) â a zero management ETF. The Global Dynamic Cash Fund (ASX:SAVE) was launched for a consistent monthly income.

On 17 October 2019, PNI last traded at $4.65, up by 4.9% relative to the last close. In the past five days, the stock is up by 3.75%.

Challenger Limited (ASX: CGF)

Challenger Limited has disclosed the first-quarter results (September 2019) on 16 October 2019. The headline numbers included an increase of 3% in the AUM and strong results in the life segment supported by Japanese annuity and other life sales.

Mr Richard Howes, CEO & MD, stated that the results depicted the progress made by Challenger in diversifying its product base across life & fund management verticals. He said that the institutional investors are preferring guaranteed income products amid a low rate environment.

Life Business

According to the release, the total life net flows for the quarter were $766 million, resulting in sequential life book growth of 3% of opening FY20 liabilities for the quarter. Total life sales of $1,778 million were up 89% or $839 million, on sequential terms, driven by favourable results from Japanese annuity sales and others.

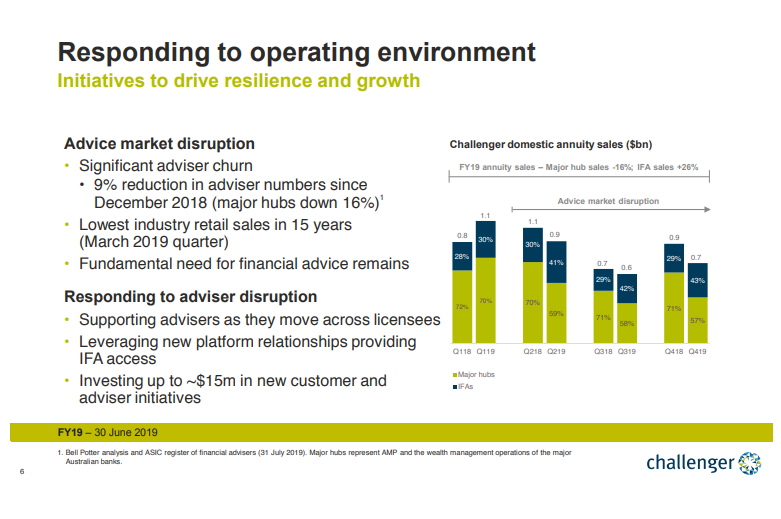

In Australia, the annuity sales were tracking $78 million lower or down 11% over the previous quarter, attributing to sector-wide disruptions caused by Royal Commission. Fixed-term sales increased by 18%, while lifetime sales decreased by 62%, on sequential terms.

Market Disruption (Source: CGFâs FY 2019 Presentation)

Further, the life segmentâs investment assets were $1.9 billion, an increase of $0.7 billion for the quarter at 30 September 2019, representing quarterly net book growth and changes in retained earnings.

Funds Management

Reportedly, the company had $81 billion in funds under management, depicting an increase of $1.9 billion or 2% for the quarter over the previous quarter, benefiting from net inflows and favourable investment market.

On 17 October 2019. CGF was trading at $7.53, up by 4.729% (at AEST 1:53 PM). In the past five days, the stock provided 5.43% return.

Pendal Group Limited (ASX: PDL)

Recently, Pendal Group had disclosed funds under management (FUM) for the quarter ended 30 September 2019. In September quarter, favourable currency movements and markets added $1.2 billion in FUM.

It was reported that the FUM for the quarter was down 1% or $0.9 billion at $100.4 billion. The positive global equity market and lower Australian dollar had helped to maintain the level of FUM. The company recorded outflows of $2.3 billion, majorly in the OEICs and Westpac book, and the inflows into the US pooled funds were -$0.5 billion.

Australia

Reportedly, the Australian outflows in the Westpac book were -$0.8 billion, primarily consisting of cash & Australian equities. Wholesale flows were positive in Australian equities, fixed income & cash strategies.

JOHCM

Reportedly, outflows in the segment were led by OEICs ~-$1.6 billion mainly in European and the UK region. There were positive inflows in the US pooled funds (+0.5 billion) led by the International Select and Global Emerging Market Opportunities strategies.

On 17 October 2019, PDL was trading at $7.25, down by 1.226% (at AEST 2:01 PM). In the past five days, the stock has generated return of 6.53%.

Treasury Wine Estates Limited (ASX: TWE)

On 16 October 2019, TWE had held its 2019 Annual General Meeting, and the voting for all of the resolutions depicted majority votes in favour of the resolutions.

Chairman Address

Paul Rayner â Chairman of TWE

In his address, Mr Rayner said that the company delivered another year of high-quality financial results, depicting the commitment of the management towards the strategies. The positive movement has continued amid challenges and macroeconomic landscape.

The company is focusing on premiumisation, existing competitive advantages, engaging customer partnerships, and execution capabilities of the global team. He said that the companyâs Luxury and Masstige portfolio of brands had depicted an attractive contribution along with all regions.

Further, the strategic initiatives like the route-to-market model were taken by the company in the United States, and it is optimising route-to-market model in Asia. Consistent with the previous year, the diverse portfolio of brands of the company continues to drive growth & recognition.

On 17 October 2019, TWE was trading at $18.94, up by 0.106% (at AEST 2:04 PM). In the past five days, the stock has provided return of 6.17%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_01_09_2025_07_01_12_631371.jpg)