CYBG PLC, is an English bank with registered office in Leeds, England. The stock of the company is dual listed - on the London Stock Exchange and ASX. Clydesdale Bank, Yorkshire Bank, Virgin Money & B are the brands associated with the group â CYBG PLC. In Australia, CYB is a component of several indices in Australia, including S&P/ASX 200 Financials (Sector), S&P/ASX 100, S&P/ASX 200, S&P/ASX Mid-Cap 50 and a few more.

New Group (Source: IFR 2019 - Investor Presentation, May 2019)

New Group (Source: IFR 2019 - Investor Presentation, May 2019)

Clydesdale Bank was established in 1838 and is focused on supporting communities and industries in Scotland. Yorkshire Bank was established in 1859, has a strong personal consumer base, and is also focused on business banking across the UK. Virgin Money is the latest addition to the group, and it provides services including savings, investments, pensions, insurance, credit cards, mortgages. B is the digital banking arm of the group with an innovative application packed with smart tech solutions.

Trading Update

At the end of the trading session, on ASX, CYBâs stock was at A$3.1, down by 13.408% from the previous close. Also, on 30 July 2019, the group released the third quarter update for the 9 months period ended 30 June 2019. Accordingly, it was asserted that the results are consistent with the expectations of the Board, and the integration of Virgin Money has been progressing on good terms.

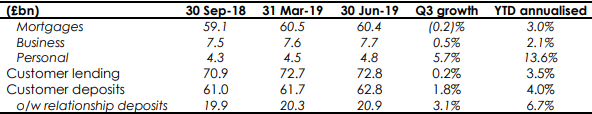

Admittedly, the group suffered a reduction in mortgage book during the quarter by 0.2% to £60.4 billion, which was due to lower new business volumes and higher redemption during the period, which was in line with the groupâs strategy. Also, the lending grew by 0.5% to £7.7 billion in Q3 due to subdued fresh business volumes. Besides, the personal lending improved by 5.7% to clock £4.8 billion in Q3, which was driven by strong credit card growth. Further, 1.8% growth was achieved in the customer deposits, driven by business and personal segment of the business.

It was reported that the nine months annualised NIM stood at 168bps in Q3 period, depicting a fall of 3bps from the half - year 2019 report, due to the re-financing of the large volume mortgages redemptions in Q3. Besides, the group expects the FY19 NIM to be at the lower end of 165-170bps guidance. Concurrently, the integration continues to progress, approximately £45 million of annual cost synergies were delivered, and the group has been consistently moving forward for the completion of FSMA Part VII.

Business Growth (Source: Companyâs Announcement, July 2019)

As per the update, the mortgages saw a small fall in balances during the Q3 period, which was in line with optimisation strategy, while the quarter depicted better margins despite lower volumes than the Q2, and large volume redemptions have contributed in significant numbers to lower the balances. Also, the business segment did not perform as expected due time consuming completion of larger facilities in slower market, and the growth was for 0.5%.

Besides, the unsecured lending depicted a strong quarter, driven by credit card, personal loans and the digital platform, customer optimisation added to the strong lending. Further, the group attracted further £0.6 billion in the deposits, which were driven by the improvement in business current accounts and linked saving balances.

It was reported that the Investments & Pensions JV with Aberdeen Standard Investments was being anticipated to conclude on 31 July 2019, and the group had completed necessary regulatory approvals and conclusion of contractual negotiation. Besides, the group anticipates a gain on sale of approximately £35 million through the divestment of ~50% interest in Virgin Money Unit Trust Managers Limited.

The group has reported that the integration process is ongoing, and it is consistent for achieving the completion of FSMA Part VII process in October this year. Further, the re-branding, remaining integration plans are moving forward in line with schedule communicated at the Capital Markets Day. CYBG has been undertaking the target to save approximately £200 million in net costs by FY22, as previously stated approximately £45 million has been achieved during the quarter, and it remains in line to achieve an underlying cost of <£950 million in FY19. Besides, the company had incurred an additional £65 million in restructuring, acquisition accounting charges, which were consistent with guidance.

As per the update, the annualised net cost of risk of 21bps during the first nine months depicts that the asset quality remains resilient. Also, the CET1 ratio of the group stood at 14.6% as on 30 June 2019, slightly up with lower asset growth in Q3. Besides, PRA had directed to maintain Pillar 2A CET requirement at 3% from 3.6% in a firm-specific capital requirement update. Further, the groupâs fully loaded CRD IV minimum CET capital requirement was reduced by 60bps at 11%, and the groupâs CET1 operating level of approximately 13% was reaffirmed.

Reportedly, the group has been impacted along with the industry wide developments regarding PPI complaints, and it expects to provide an update on the final costs by 29 August. Also, the costs incurred in PPI were in line with assumed provisions.

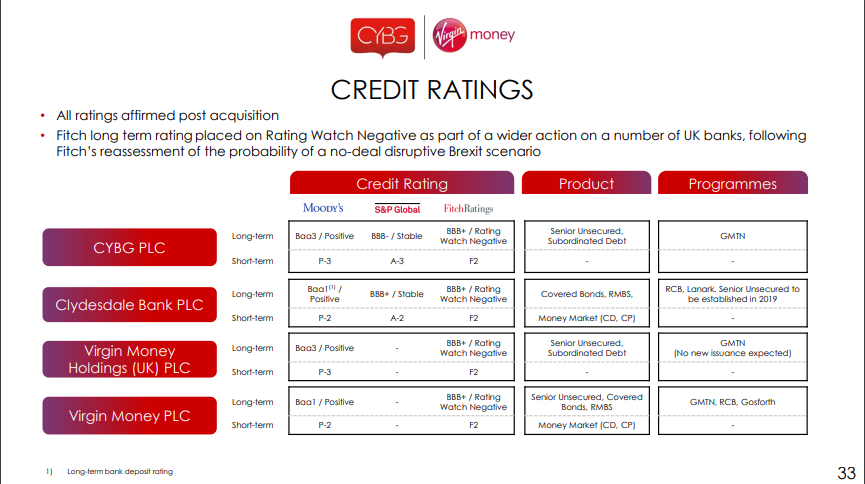

Credit Ratings (Source: IFR 2019 - Investor Presentation, May 2019)

Credit Ratings (Source: IFR 2019 - Investor Presentation, May 2019)

The performance of CYBâs stock, over the past one- year period has been of negative 39.93% return. Besides, it has recorded a return of +1.42% and +9.82% over the past one month and year-to-date period, respectively. The market capitalisation of the stock was A$5.13 billion, with ~1.43 billion shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.